- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

First Watch (FWRG): Margin Squeeze Challenges Bullish Narrative Despite 39% Projected Earnings Growth

Reviewed by Simply Wall St

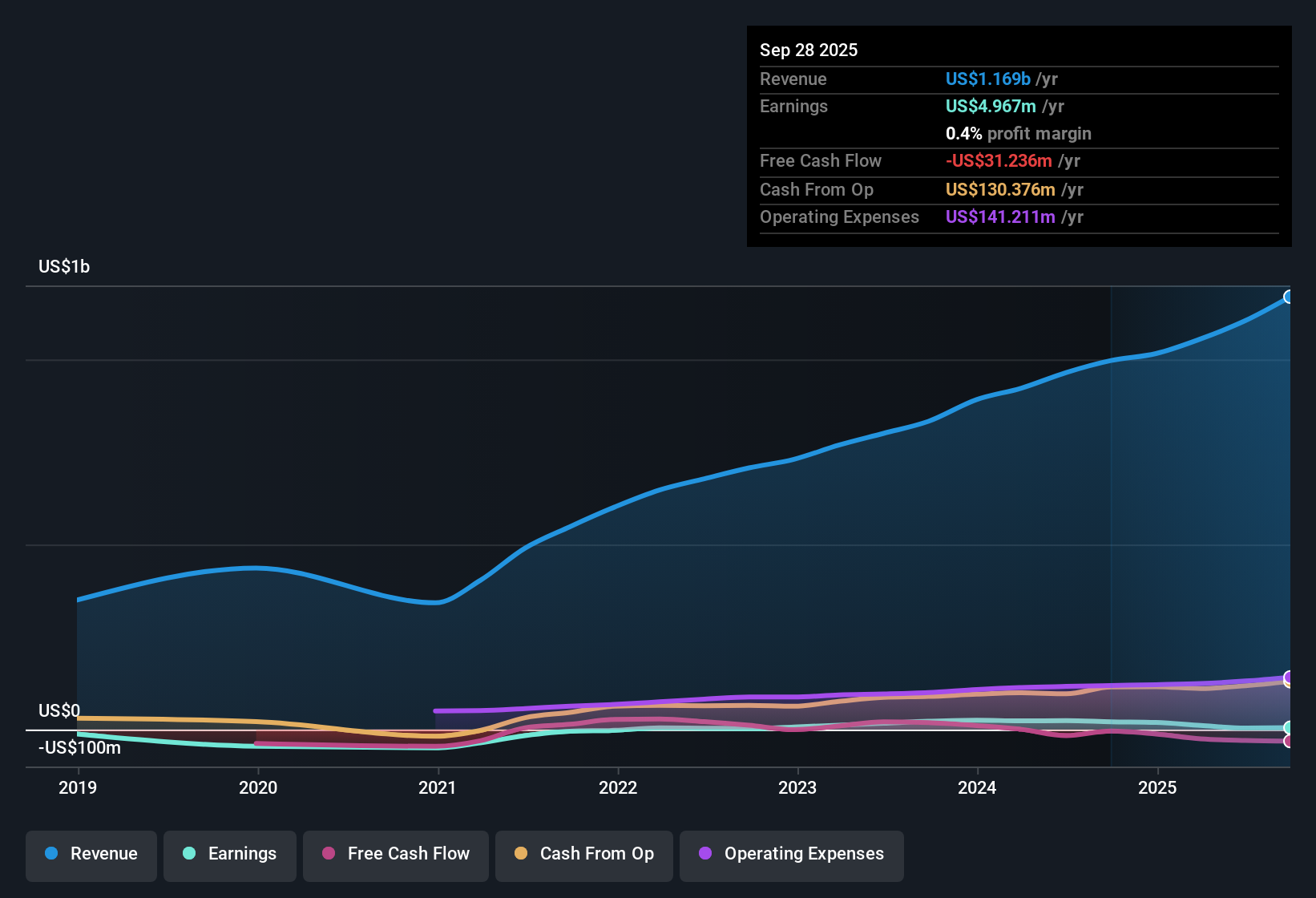

First Watch Restaurant Group (FWRG) reported a net profit margin of 0.4% this quarter, slipping from 2.1% last year as margins tightened. While a $2.5 million one-off loss weighed on trailing results and short-term earnings growth was negative, the company has turned profitable over the last five years with robust compound growth. Despite mixed financial signals, investors are taking note of optimistic forecasts, with earnings expected to climb 39.3% annually over the next three years, well ahead of the broader US market outlook.

See our full analysis for First Watch Restaurant Group.Next, we’ll see how these numbers hold up against the widely watched narratives. Sometimes the numbers confirm the story, and other times they flip it entirely.

See what the community is saying about First Watch Restaurant Group

Margin Squeeze Persists at 0.4%

- Profit margins held at just 0.4% for the latest period, hampered by a $2.5 million one-off loss and rising operating expenses, rather than showing any rebound toward last year’s 2.1%.

- Consensus narrative notes ongoing margin pressure from recent 8.1% input cost inflation and 3.9% labor cost inflation, warning that sustained margin compression could limit earnings growth even as revenue rises.

- Bears argue that higher G&A spending, heavier marketing outlays, and a daytime-only schedule create added risk, particularly as per-location profit opportunity is capped relative to peers offering dinner.

- Analysts' consensus view points to the need for improved operating leverage or new sources of margin growth to support the ambitious 39.3% annual forward earnings forecast.

- To see where Wall Street thinks margins will land and how risk factors shape the outlook, check out the full Narrative for First Watch Restaurant Group. 📊 Read the full First Watch Restaurant Group Consensus Narrative.

Top-Line Expansion Outpaces Market

- Revenue is forecast to grow at 12.6% annually over the next three years, outstripping the US market average of 10.5%, while share count is only set to rise by 0.75% per year.

- Consensus narrative highlights that rapid expansion in Sun Belt and suburban locations, together with menu innovation and a young, growing customer base, heavily supports the bullish case for above-average sales and market share gains.

- What’s surprising is that analysts expect First Watch to maintain double-digit revenue growth even as overall consumer trends for restaurants remain mixed.

- This projected growth is underpinned by investments in digital ordering and off-premises capabilities, which could broaden the addressable market beyond in-restaurant dining.

Valuation Gap Versus Peers and DCF

- Shares trade at a price-to-sales ratio of 0.9x, below peer and industry averages, but the $17.60 stock price stands well above the company's DCF fair value of $7.17 and sits 21% below the consensus analyst target of $22.27.

- The consensus narrative says the current discount to peer multiples and analyst target pricing creates room for re-rating, so long as profit margins recover and growth holds up.

- Bulls find reassurance that shares are trading below Wall Street's $22.27 target, but bears caution that soft underlying profitability makes valuation more exposed if growth falters.

- Critics highlight that sustaining lofty growth expectations is essential to close the gap to both peer multiples and intrinsic fair value estimates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Watch Restaurant Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? It only takes a few minutes to craft your own narrative and share how you see the story. Do it your way

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite impressive sales growth, First Watch’s tight margins and inconsistent earnings leave it vulnerable if growth slows or cost pressures persist.

If you want to focus on consistent performers, use stable growth stocks screener (2077 results) to find companies delivering steady revenue and profit expansion regardless of the economic climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives