- United States

- /

- Consumer Services

- /

- NasdaqGS:FTDR

The Bull Case For Frontdoor (FTDR) Could Change Following Raised Guidance and Share Buyback Completion – Learn Why

Reviewed by Sasha Jovanovic

- Frontdoor, Inc. recently reported strong third quarter results with increased sales and net income, raised its full-year revenue guidance to between US$2.08 billion and US$2.09 billion, and announced the completion of a major share buyback program totaling US$256 million.

- Jason Bailey was named as the company's new CFO after over 15 years at Frontdoor and ServiceMaster, with the outgoing CFO, Jessica Ross, supporting a smooth leadership transition through the end of 2025.

- We'll examine how Frontdoor's robust quarterly earnings and enhanced guidance influence its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Frontdoor Investment Narrative Recap

Frontdoor’s appeal for shareholders hinges on confidence in its ability to grow and retain its core home warranty membership, convert technology investments into lower service costs, and successfully integrate recent acquisitions. The positive third quarter results and higher revenue guidance primarily reinforce the importance of organic and acquired membership trends, but do not materially alter the immediate catalyst of member growth or the primary risk of potential ongoing declines in overall membership amid real estate market pressure.

Among the latest announcements, the completion of Frontdoor’s US$256 million share buyback is most relevant for this context, as it signals management’s focus on delivering value to shareholders in the face of modest expected top-line growth. While the repurchase supports per-share metrics in the near term, it does not directly offset the longer-term risk if declining membership trends persist or intensify as highlighted in recent projections.

On the other hand, investors should be aware of the implications if renewed competitive pressures in direct-to-consumer channels force sustained discounting and ...

Read the full narrative on Frontdoor (it's free!)

Frontdoor's outlook anticipates $2.4 billion in revenue and $279.0 million in earnings by 2028. This reflects a 7.2% annual revenue growth rate and a $22 million increase in earnings from $257.0 million today.

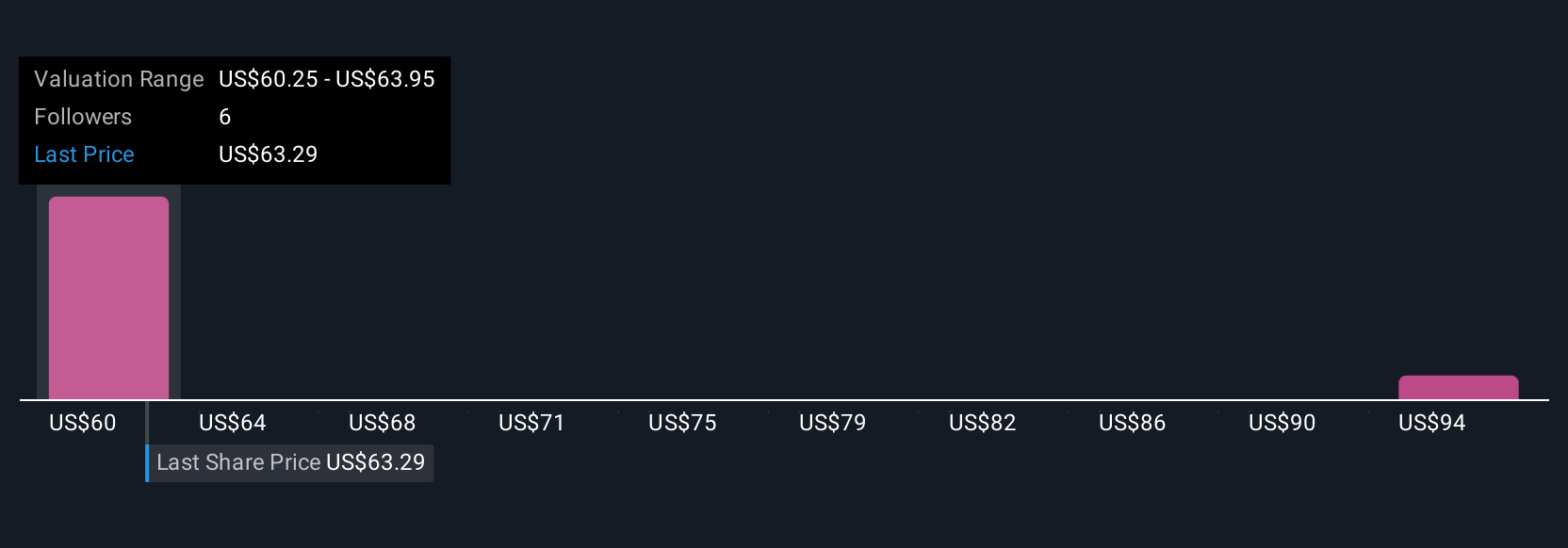

Uncover how Frontdoor's forecasts yield a $60.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Frontdoor, ranging from US$60.25 to US$105.95 per share. With uncertainty around sustained member growth as a recurring theme, you can see how differing expectations create a wide range of viewpoints worth exploring.

Explore 2 other fair value estimates on Frontdoor - why the stock might be worth over 2x more than the current price!

Build Your Own Frontdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Frontdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontdoor's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTDR

Frontdoor

Provides home and new home structural warranties in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives