- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

The Bull Case For Duolingo (DUOL) Could Change Following AI-Powered Expansion Into New Subjects and Strong Revenue Growth

Reviewed by Sasha Jovanovic

- Duolingo recently reported a 41% increase in revenue and a 43% rise in paid subscribers for 2025, highlighting substantial business expansion driven by its AI-powered growth strategy.

- The company’s use of AI to broaden its course offerings beyond languages into subjects like math, chess, and music reflects both its evolving brand and the potential to reach new user segments.

- We’ll explore how the company’s AI-driven push into new educational subjects shapes its investment narrative and growth prospects.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Duolingo Investment Narrative Recap

To own Duolingo shares today, you need to believe in the company's ability to use AI innovation for expanding beyond language learning into broader educational markets, all while maintaining subscriber growth. The latest news of a 41% revenue surge and 43% growth in paid subscribers reinforces Duolingo’s AI-powered execution, but doesn't materially change the near-term catalyst of international user growth or the biggest risk of competitive pressure in AI-driven language learning.

The September 2025 Duocon update, which expanded Duolingo’s Chess course and improved its AI-powered Video Call feature, directly relates to this growth narrative by illustrating how new offerings and technology upgrades deepen user engagement, potentially supporting higher conversion rates and recurring revenue, essential near-term drivers for the business.

But while Duolingo is pushing the frontiers of digital education, investors should be aware of intensifying competition from major tech players, as...

Read the full narrative on Duolingo (it's free!)

Duolingo's narrative projects $1.7 billion in revenue and $368.7 million in earnings by 2028. This requires 23.7% yearly revenue growth and a $251.5 million increase in earnings from the current $117.2 million.

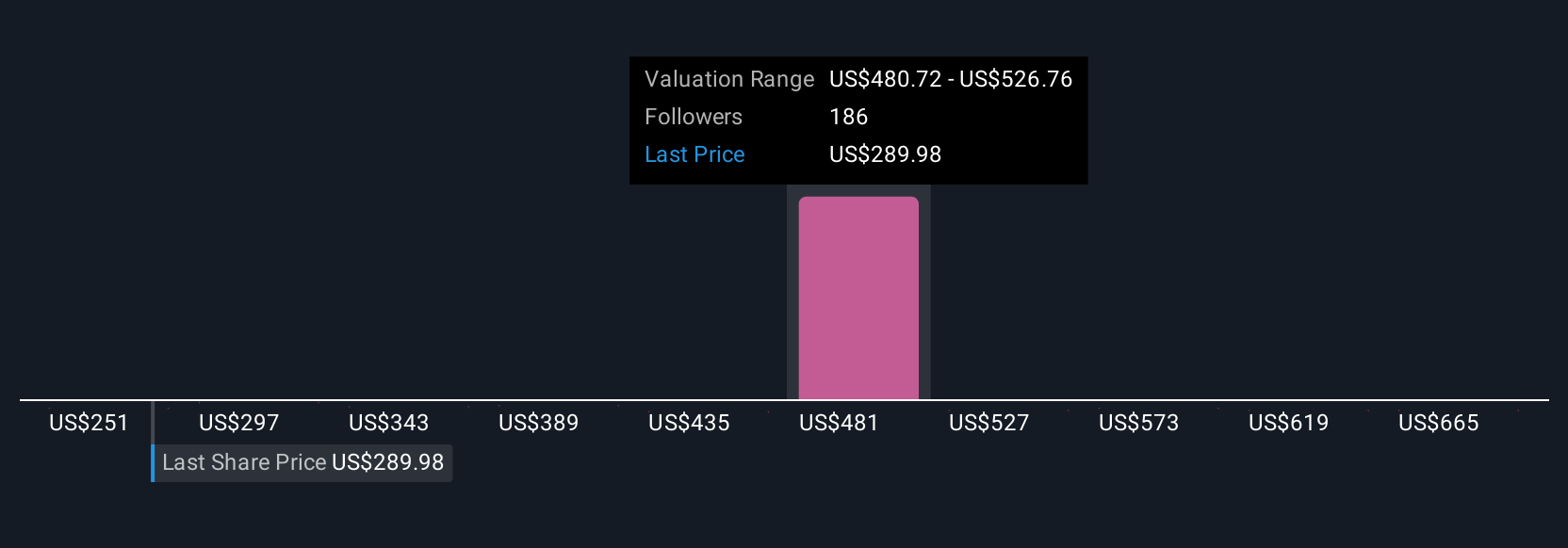

Uncover how Duolingo's forecasts yield a $449.24 fair value, a 39% upside to its current price.

Exploring Other Perspectives

You’ll find 30 distinct fair value estimates from the Simply Wall St Community, spanning US$191.95 to US$1,623.31 per share. With competitive threats rising as a result of rapid AI advancements, consider how different expectations about user growth or monetization could shape market outcomes.

Explore 30 other fair value estimates on Duolingo - why the stock might be worth over 5x more than the current price!

Build Your Own Duolingo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Duolingo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duolingo's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives