- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (DUOL): Assessing Valuation After Strong Revenue and Subscriber Growth Signals Momentum

Reviewed by Kshitija Bhandaru

Duolingo (DUOL) recently reported a 41% jump in revenue and a 43% increase in paid subscribers for 2025, highlighting its evolving business model and growing appeal with learners worldwide.

See our latest analysis for Duolingo.

Duolingo’s impressive revenue and subscriber growth is clearly turning heads, and despite a dip in the last quarter, the stock has maintained a strong upward trajectory with a 12.48% total shareholder return over the past year and an eye-catching 321.5% over three years. Given its expansion beyond language into new learning verticals and a profitable pivot to premium services, momentum appears to be gradually building again as the market digests its growth story.

If Duolingo’s evolution sparks your curiosity, now is a perfect time to expand your watchlist and uncover opportunities in fast growing stocks with high insider ownership

With Duolingo posting rapid growth and profits, yet trading at a notable discount to analyst targets, the big question is whether investors are overlooking its future upside or if the market has already priced it all in.

Price-to-Earnings of 126.7x: Is it justified?

At a price-to-earnings (P/E) ratio of 126.7x, Duolingo appears richly valued compared to its recent closing price of $324.02. This valuation places it at a notable premium relative to peers.

The P/E ratio measures how much investors are willing to pay today for a dollar of future earnings. For a fast-growing, profitable education technology company like Duolingo, the multiple reflects expectations for sustained high growth and profit expansion in the years ahead.

However, Duolingo’s P/E is more than seven times higher than the average for the US Consumer Services industry, which stands at 17.5x. Even when compared to an estimated fair P/E of 38.7x for Duolingo’s growth profile, the current market price implies a substantial growth premium that could be vulnerable if expectations shift.

Explore the SWS fair ratio for Duolingo

Result: Price-to-Earnings of 126.7x (OVERVALUED)

However, rapid valuation expansion could be at risk if subscriber growth slows or if competitive pressures increase in the fast-evolving edtech sector.

Find out about the key risks to this Duolingo narrative.

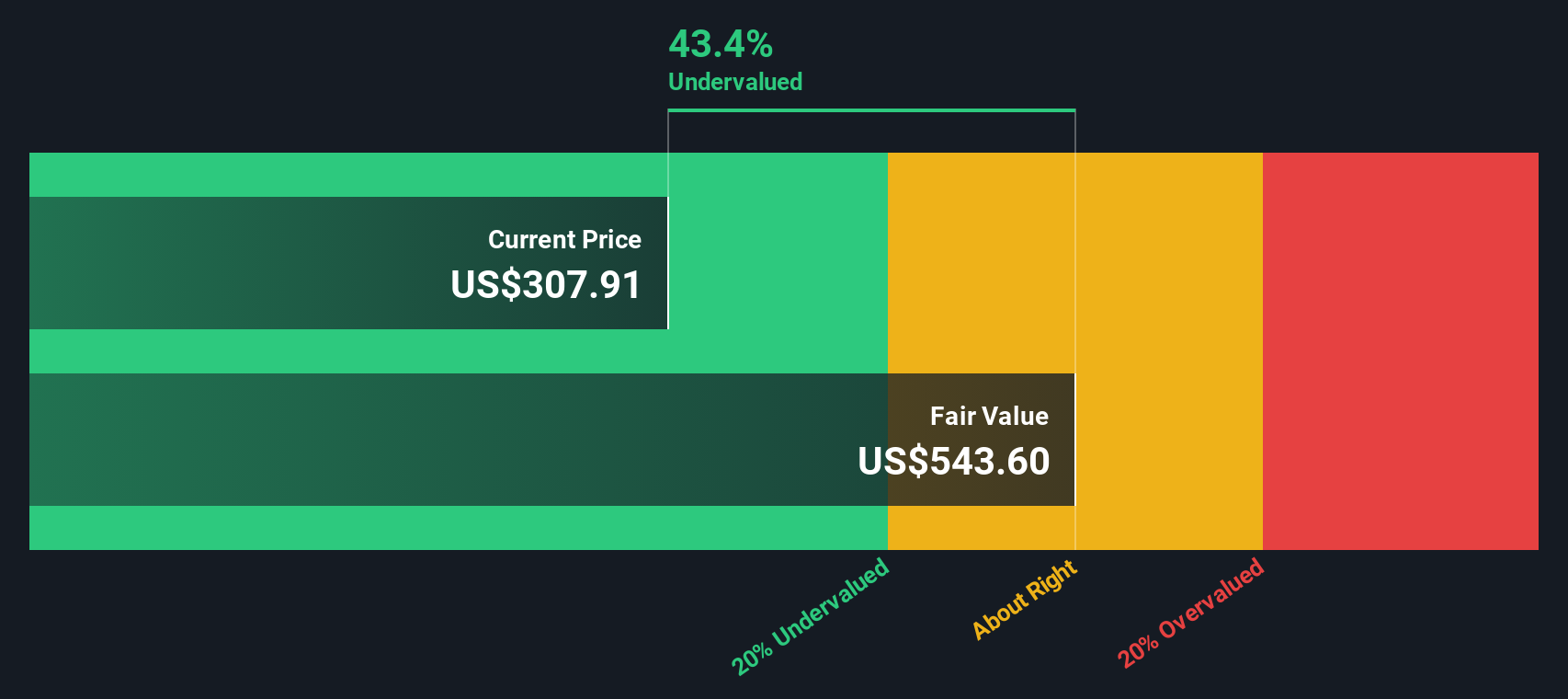

Another View: Discounted Cash Flow Suggests Undervaluation

While Duolingo's P/E ratio paints an expensive picture, our DCF model offers a different story. According to this approach, Duolingo shares are trading at a 32% discount to the estimated fair value of $479.53, which implies potential upside. Could the market be missing a longer-term opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duolingo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duolingo Narrative

If you'd rather form your own conclusions or delve deeper into the numbers, it's quick and easy to build your own take in just a few minutes with Do it your way.

A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities don’t wait, and investors who act now can stay one step ahead of changing trends. Make sure you’re not missing out on fresh angles and emerging winners in the market.

- Unlock high potential in established sectors with steady returns by getting started with these 100+ dividend stocks with yields > 3%.

- Catch waves of innovation in medicine and patient care by checking out these 100+ healthcare AI stocks, which is reshaping the future of healthcare.

- Ride the momentum of the digital transformation and see which cutting-edge companies stand out among these 100+ AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives