- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Could Domino's (DPZ) New Spicy Pizza and Celebrity Campaign Shape Its Menu Innovation Narrative?

Reviewed by Sasha Jovanovic

- Domino's Pizza recently launched its Spicy Chicken Bacon Ranch Pizza, featuring grilled chicken, ranch, smoked bacon, jalapenos, and Buffalo sauce, joining the company's lineup of 10 other Specialty Pizzas as of November 10, 2025.

- This new menu item is supported by a national TV campaign in partnership with actress Retta and a value-driven offer allowing customers to order any medium Specialty Pizza for US$9.99 each through the Mix and Match deal.

- We'll examine how the introduction of the Spicy Chicken Bacon Ranch Pizza and its high-profile marketing campaign could influence Domino's narrative of digital growth and menu innovation.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Domino's Pizza Investment Narrative Recap

To be a Domino's Pizza shareholder right now, you need to believe the company can keep growing digital sales and innovating its menu to stand out in a competitive, slow-growth pizza market. The launch of the Spicy Chicken Bacon Ranch Pizza, with its high-profile marketing and accessible price, may help support digital traffic and near-term transaction growth, but does not materially change the biggest catalyst: the continued expansion and success of Domino’s digital and delivery channels. Persistently flat industry demand and tough year-over-year comparisons from recent product wins remain real risks.

Of the latest company moves, the full national rollout on DoorDash is most relevant in this context. This partnership, along with last year’s Uber Eats integration, is a driving force in capturing consumers who expect convenient, tech-enabled ordering and fast delivery, key for supporting transaction volumes and helping mitigate pressure from stagnant pizza industry traffic.

By contrast, investors should also consider what happens if Domino’s faces even more challenging laps and category-wide demand softness as...

Read the full narrative on Domino's Pizza (it's free!)

Domino's Pizza's narrative projects $5.6 billion in revenue and $720.0 million in earnings by 2028. This requires 5.5% yearly revenue growth and a $122.9 million increase in earnings from $597.1 million today.

Uncover how Domino's Pizza's forecasts yield a $498.26 fair value, a 21% upside to its current price.

Exploring Other Perspectives

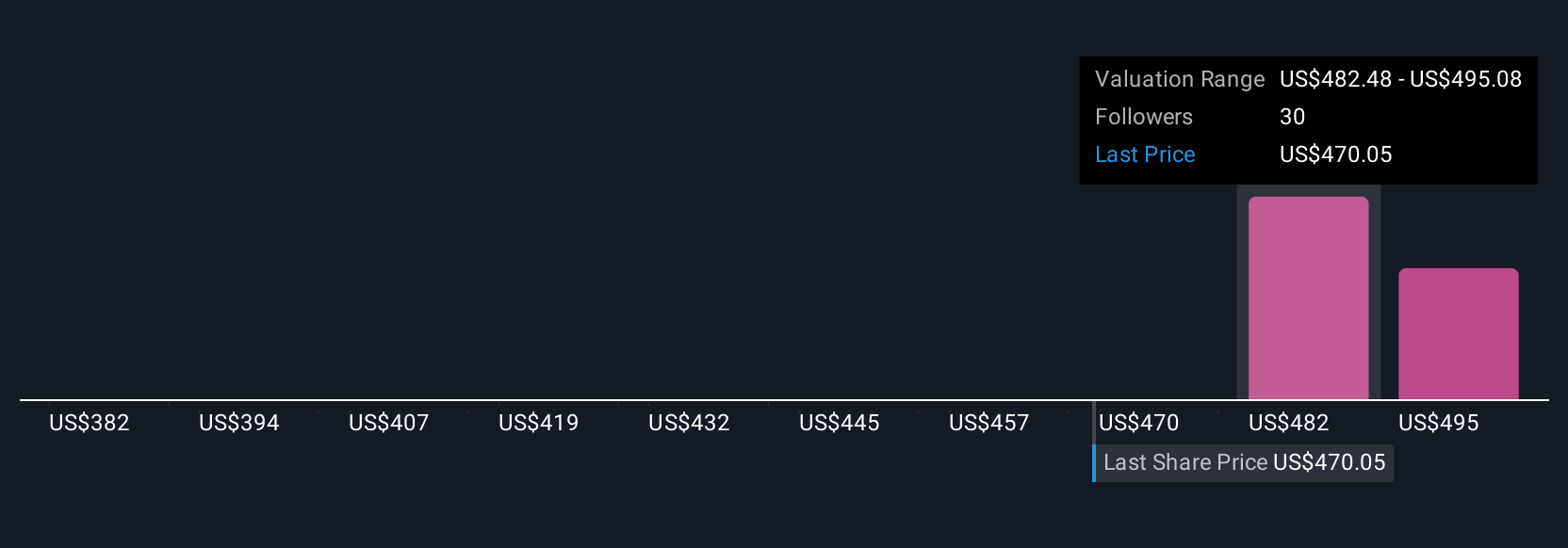

Retail investors in the Simply Wall St Community give Domino’s a fair value range from US$352 to US$498, with 3 distinct perspectives. Alongside this wide range, the risk of sustained flat growth in the pizza category could limit revenue, prompting deeper consideration of what might support or constrain future returns.

Explore 3 other fair value estimates on Domino's Pizza - why the stock might be worth as much as 21% more than the current price!

Build Your Own Domino's Pizza Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Domino's Pizza research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Domino's Pizza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Domino's Pizza's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives