- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Assessing Domino's Stock After Third-Party Delivery Partnership and Recent Price Moves

Reviewed by Bailey Pemberton

Thinking about what to do with Domino's Pizza stock? You are not alone. Investors have kept a close eye on Domino's lately, as the company has delivered a mix of steady long-term gains and short-term ups and downs. In the last week, Domino's edged up by 1.2%, rebounding from a quieter 30-day span down just 0.5%. The stock's year-to-date return sits at -3.0%, but those who have been in it for the long haul have enjoyed a 32.7% gain over three years and 16.0% over five years. Over the past year, Domino's managed a 3.1% positive return, showing the potential resilience of its business model through changing consumer trends and competitive headwinds.

Much of what has moved the stock recently comes down to evolving industry expectations, new partnerships, and expanding delivery options. Headlines like Domino's decision to integrate with third-party delivery apps, along with their focus on digital innovation, have injected new optimism into growth prospects and market reach. That has kept risk perceptions shifting, especially as the company looks for new ways to attract and retain customers in a crowded fast-food landscape.

But as tempting as those growth stories sound, a smart investor always asks: is Domino's Pizza stock undervalued or are shares already fully priced? According to our six-point valuation assessment, Domino's is not undervalued in any category right now, giving it a current valuation score of 0 out of 6. Next, we will break down exactly what those valuation checks cover and why there is one even better way to figure out what Domino's is truly worth.

Domino's Pizza scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Domino's Pizza Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. For Domino's Pizza, this approach helps gauge what the business might truly be worth, using hard cash flow projections as the foundation.

Currently, Domino's Pizza generates free cash flow of $622 million. Analysts provide estimates for the next five years, projecting solid growth that reaches $796 million in free cash flow by 2028. Beyond those years, longer-term projections are extrapolated, with expectations that Domino's could reach over $937 million in free cash flow by 2035. All these figures are reported in US Dollars.

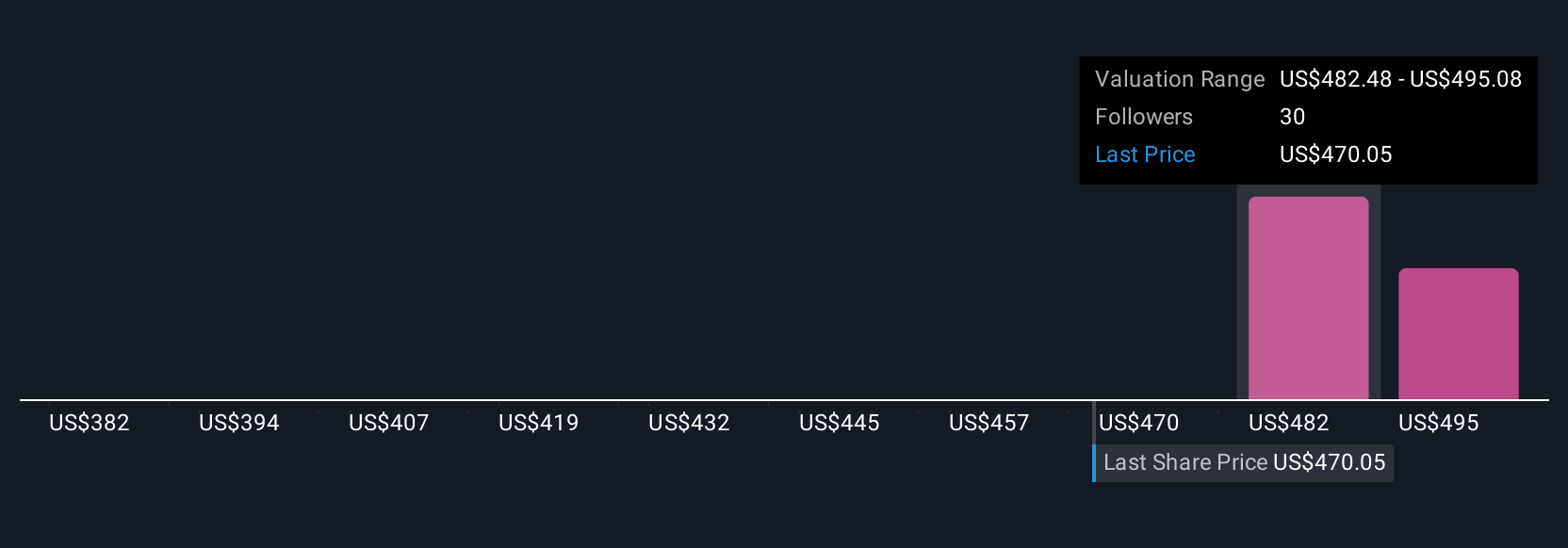

Based on the latest DCF analysis using a two-stage Free Cash Flow to Equity model, the intrinsic value of Domino's Pizza stock is estimated at $343.89 per share. However, the stock is trading at a 22.6% premium to this intrinsic value, suggesting that shares are currently overvalued according to this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Domino's Pizza may be overvalued by 22.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Domino's Pizza Price vs Earnings

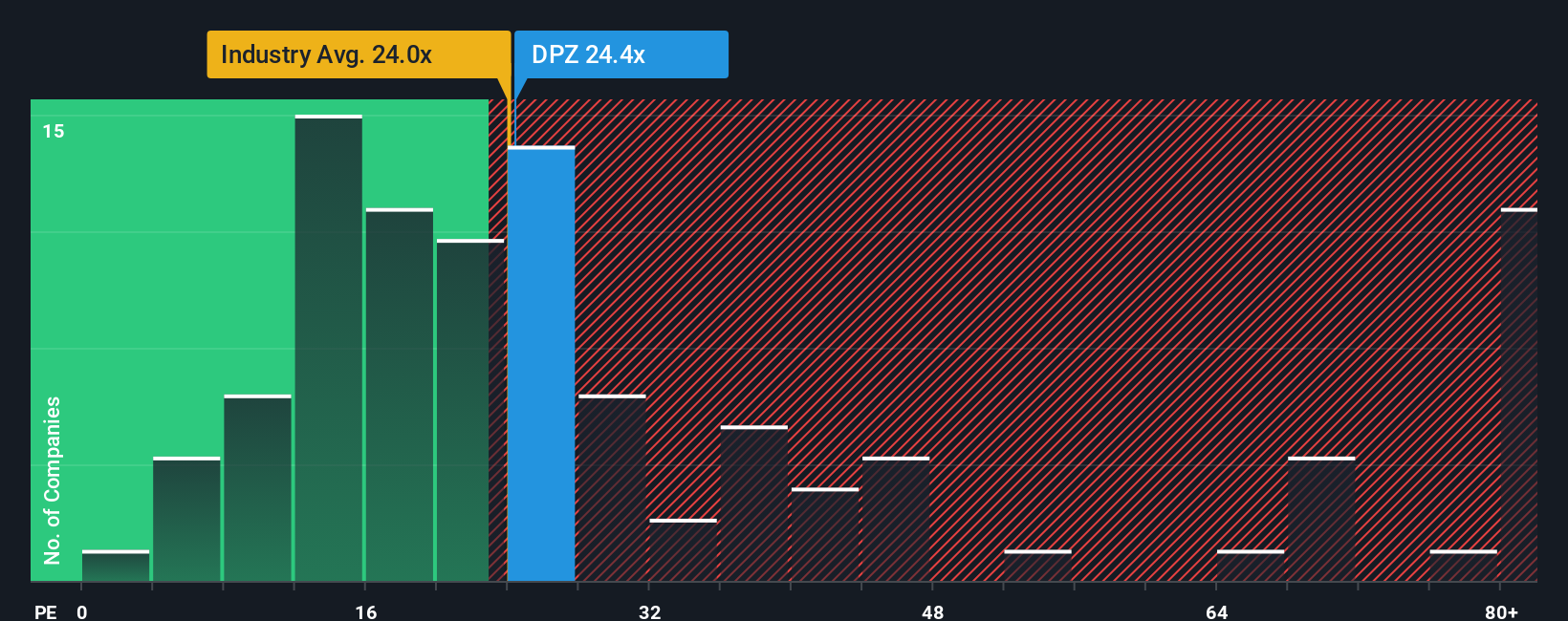

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Domino's Pizza. It reflects the relationship between a company's share price and its earnings per share. This makes it especially useful for evaluating established businesses with consistent profits, such as Domino's.

Generally, companies with higher expected growth or lower risk are assigned higher PE ratios. Those with slower growth or higher risk warrant lower multiples. Determining what is "normal" or "fair" depends on factors such as industry trends, competitive positioning, earnings stability, and the broader economic outlook.

Currently, Domino's Pizza trades at a PE ratio of 24.17x. This is slightly above both the peer average of 23.34x and the hospitality industry average of 23.93x, putting Domino's near the top of its competitive group in terms of valuation. However, Simply Wall St calculates a proprietary Fair Ratio for Domino's at 22.68x. This Fair Ratio is notable because it combines data on the company's growth, risk profile, profit margins, industry norms, and market capitalization. It provides a more tailored and accurate sense of what Domino's PE should be.

By comparing the current multiple of 24.17x to the Fair Ratio of 22.68x, Domino's Pizza appears slightly overvalued on this basis, but the gap is not dramatic. The Fair Ratio approach gives a fuller picture than just looking at industry or peer averages because it accounts for the most relevant drivers of Domino's potential and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Domino's Pizza Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your take on how a company's story might play out, connecting your beliefs and expectations about future revenue, profit margins, and fair value to the numbers behind the stock price. Instead of just relying on traditional valuations, Narratives link your personal perspective or thesis to a financial forecast and a fair value, turning the numbers into a living story that adapts as things change.

On Simply Wall St’s Community page, Narratives are accessible to anyone and are used by millions of investors to bring their own viewpoints into the investment process. Narratives help you decide when to buy or sell by automatically comparing your fair value (based on the story you believe in) against Domino’s current share price. When key news or earnings are released, Narratives update dynamically to reflect the latest data, keeping your view both current and actionable.

For example, some Domino’s investors see digital platforms and delivery partnerships fueling global expansion and set a bullish fair value of $594. Others focus on international growth challenges and cautious demand trends, setting a more conservative fair value closer to $340. Narratives let you quickly sense check your own view against these market perspectives and make smarter, personalized decisions with confidence.

Do you think there's more to the story for Domino's Pizza? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives