- United States

- /

- Hospitality

- /

- NasdaqGS:DNUT

Krispy Kreme (NASDAQ:DNUT) Is Paying Out A Dividend Of $0.035

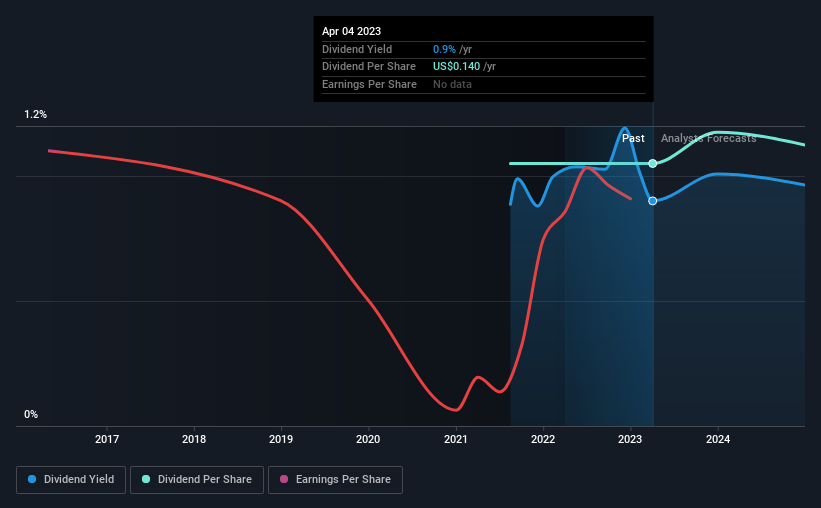

The board of Krispy Kreme, Inc. (NASDAQ:DNUT) has announced that it will pay a dividend on the 10th of May, with investors receiving $0.035 per share. This means the annual payment will be 0.9% of the current stock price, which is lower than the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Krispy Kreme's stock price has increased by 46% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Krispy Kreme

Krispy Kreme Might Find It Hard To Continue The Dividend

Even a low dividend yield can be attractive if it is sustained for years on end. Despite not being profitable, Krispy Kreme is paying out most of its free cash flow as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Analysts expect the EPS to grow by 72.5% over the next 12 months. This is the right direction to be moving, but it is not enough to achieve profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

Krispy Kreme Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. There hasn't been much of a change in the dividend over the last 2 years. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Company Could Face Some Challenges Growing The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Krispy Kreme has impressed us by growing EPS at 18% per year over the past five years. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Strong earnings growth means Krispy Kreme has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Earnings growth generally bodes well for the future value of company dividend payments. See if the 9 Krispy Kreme analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Is Krispy Kreme not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Krispy Kreme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DNUT

Krispy Kreme

Produces doughnuts in the United States, the United Kingdom, Ireland, Australia, New Zealand, Mexico, Canada, Japan, and internationally.

Low with questionable track record.