- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Will DraftKings’ (DKNG) New Markets and Spanish App Reveal Its Next Competitive Edge?

Reviewed by Sasha Jovanovic

- DraftKings Inc. recently expanded its U.S. footprint by launching its mobile sportsbook in Missouri and introducing a Spanish-language experience within its Sportsbook & Casino app for U.S. and Ontario customers whose devices are set to Spanish.

- This dual move not only extends DraftKings' market reach but also highlights a deeper push to cater to diverse and previously underserved customer segments.

- We'll explore how the Missouri entry and language expansion may influence DraftKings' investment narrative as it pursues market growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DraftKings Investment Narrative Recap

To be a DraftKings shareholder, you need to believe the legal sports betting and iGaming market can keep expanding, allowing the company to leverage its proprietary technology and product improvements to drive self-sustaining user growth and margin gains. The recent launches in Missouri and the Spanish-language app update expand addressable markets but do not materially affect the most immediate catalyst: new state legalization and user growth, nor do they directly ease the biggest risk from regulatory and tax pressures.

Among recent company announcements, the Missouri sportsbook launch stands out, as it directly aligns with DraftKings' efforts to grow by entering newly legal betting states. This move increases DraftKings’ geographic reach, potentially providing fresh momentum towards near-term revenue growth as legalization remains a core driver for expansion and improved market positioning.

By contrast, investors should keep in mind that regulatory and tax developments remain a significant risk to the business, including the possibility that...

Read the full narrative on DraftKings (it's free!)

DraftKings' outlook anticipates $9.5 billion in revenue and $1.3 billion in earnings by 2028. This implies a 20.5% annual revenue growth rate and an earnings increase of about $1.6 billion from current earnings of -$304.5 million.

Uncover how DraftKings' forecasts yield a $46.05 fair value, a 45% upside to its current price.

Exploring Other Perspectives

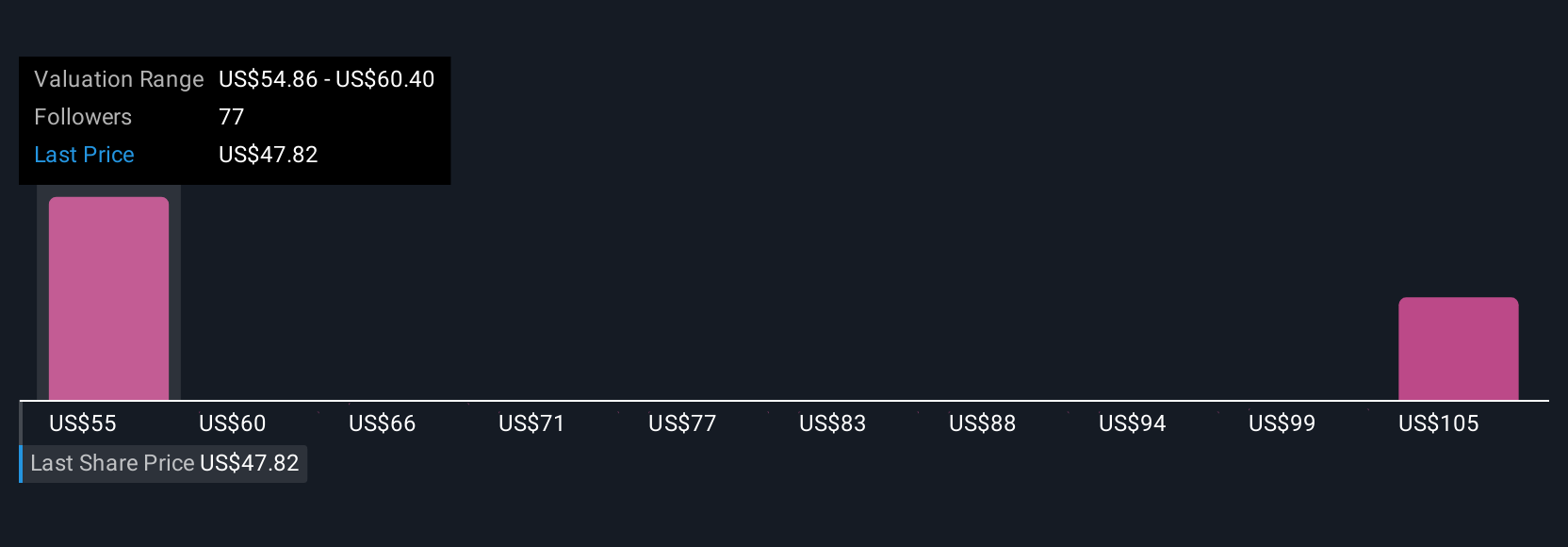

Seven contributors from the Simply Wall St Community valued DraftKings between US$40.89 and US$96.56 per share, showing a wide set of expectations. While some anticipate market growth, many remain focused on legal and tax uncertainties that could shape the company's future direction, see how other members view these challenges in their forecasts.

Explore 7 other fair value estimates on DraftKings - why the stock might be worth over 3x more than the current price!

Build Your Own DraftKings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DraftKings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DraftKings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DraftKings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success