- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Should DraftKings’ (DKNG) Entry Into Regulated Prediction Markets Spur Investor Action?

Reviewed by Sasha Jovanovic

- DraftKings announced the acquisition of Railbird Technologies, a Commodity Futures Trading Commission-licensed exchange, enabling the company to enter the regulated prediction markets sector with plans to launch a new mobile platform called DraftKings Predictions.

- This move positions DraftKings to diversify beyond sports betting into trading event contracts tied to outcomes in finance, culture, and entertainment, responding to growing competition from emerging prediction market operators.

- We'll explore how entering regulated prediction markets could reshape DraftKings' investment narrative and expand its addressable market.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

DraftKings Investment Narrative Recap

To own DraftKings stock, investors need confidence in the company’s ability to transition from a dominant online sports betting platform to a broader event-driven gaming and prediction markets business, while managing regulatory headwinds and competitive threats. The acquisition of Railbird Technologies expands DraftKings’ reach, but its impact on near-term catalysts, such as successful new state launches and sustained user growth, remains limited, as regulatory and tax risks still pose significant challenges to profitability and margin expansion.

Among recent announcements, DraftKings' direct mobile sports betting license in Missouri stands out. This independent approval represents an immediate catalyst for market expansion, especially as sports betting legalization continues to be a key driver, though competitive and regulatory uncertainty persist in other jurisdictions.

But on the risk side, investors should be keenly aware of how new tax hikes can sharply impact DraftKings’ profits and ...

Read the full narrative on DraftKings (it's free!)

DraftKings' narrative projects $9.5 billion revenue and $1.3 billion earnings by 2028. This requires a 20.5% yearly revenue growth and a $1.6 billion increase in earnings from -$304.5 million.

Uncover how DraftKings' forecasts yield a $51.20 fair value, a 48% upside to its current price.

Exploring Other Perspectives

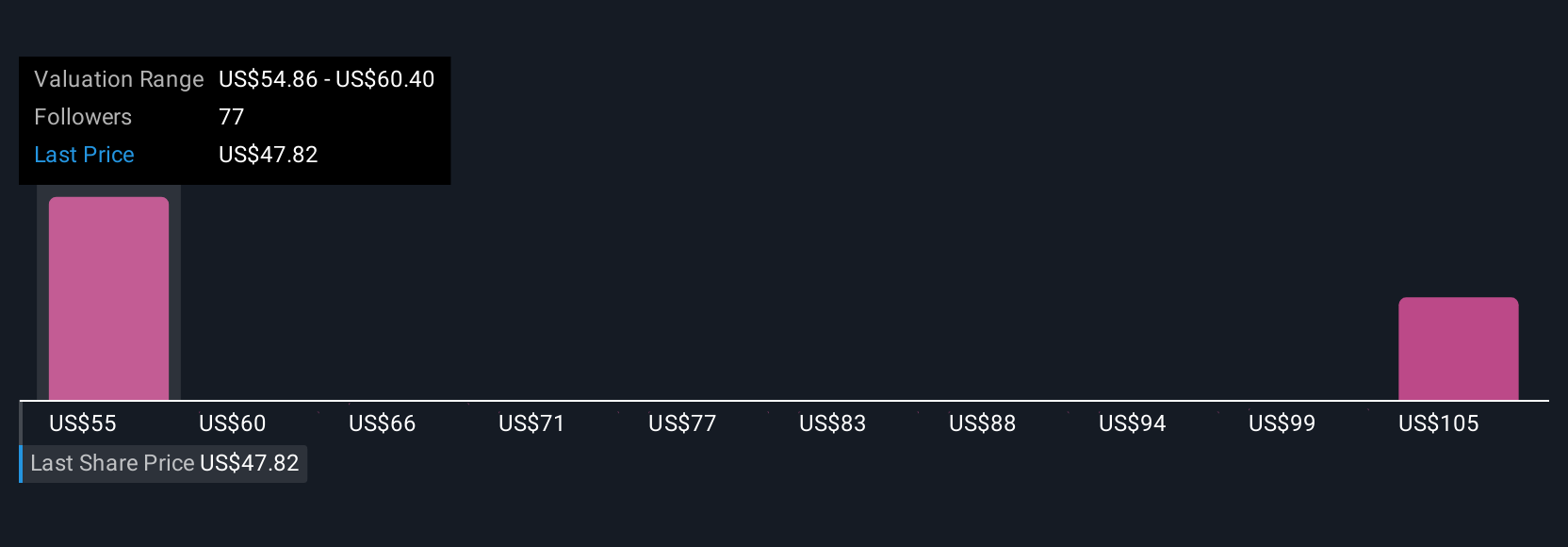

Six members of the Simply Wall St Community estimate DraftKings’ fair value between US$50.98 and US$104.56, with views spanning nearly US$54 per share. Continuous regulatory risk remains critical and can reshape both expectations and outcomes for the company’s growth. Explore several alternative viewpoints and see how your approach compares.

Explore 6 other fair value estimates on DraftKings - why the stock might be worth over 3x more than the current price!

Build Your Own DraftKings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DraftKings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DraftKings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DraftKings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives