- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH): Exploring Valuation as Autonomous Delivery Partnership with Waymo Rolls Out

Reviewed by Simply Wall St

DoorDash (DASH) has teamed up with Waymo to launch autonomous deliveries in Metro Phoenix. DashPass members in Los Angeles, San Francisco, and Phoenix are also receiving a new Waymo promotion. Testing has already started, and there are plans to expand operations later this year.

See our latest analysis for DoorDash.

DoorDash’s push into autonomous deliveries comes on the heels of a dynamic year, including its acquisition of Deliveroo and new robotics partnerships, that has fueled strong momentum. The stock’s 1-year total shareholder return clocks in at nearly 74%, and its three-year total return is a staggering 459%, underscoring both rapid recent growth and the long-term impact of its continual innovation.

If DoorDash’s latest moves have you curious, now’s a great time to broaden your scope and check out fast growing stocks with high insider ownership

Given these ambitious partnerships and robust financial growth, investors are left to wonder whether DoorDash is trading below its real value, or if the company’s rapid innovation pace has already been fully reflected in its stock price.

Most Popular Narrative: 11.8% Undervalued

With DoorDash’s last close at $265.37 and the most followed narrative assigning a fair value of $300.72, the gap signals upside potential if ambitious growth comes through. This sets a high bar for execution and fuels debate on whether momentum can outrun expectations.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This should diversify and accelerate topline revenue while supporting net margin expansion.

Think this price is bold? It rests on aggressive projected revenue and profit leaps, with margin assumptions that rival big tech. Want to see just how high these ambitions go? The complete narrative breaks down exactly what numbers the crowd is betting on.

Result: Fair Value of $300.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressure from rivals like Amazon and the challenge of integrating new acquisitions could disrupt DoorDash’s growth trajectory if these factors are not successfully managed.

Find out about the key risks to this DoorDash narrative.

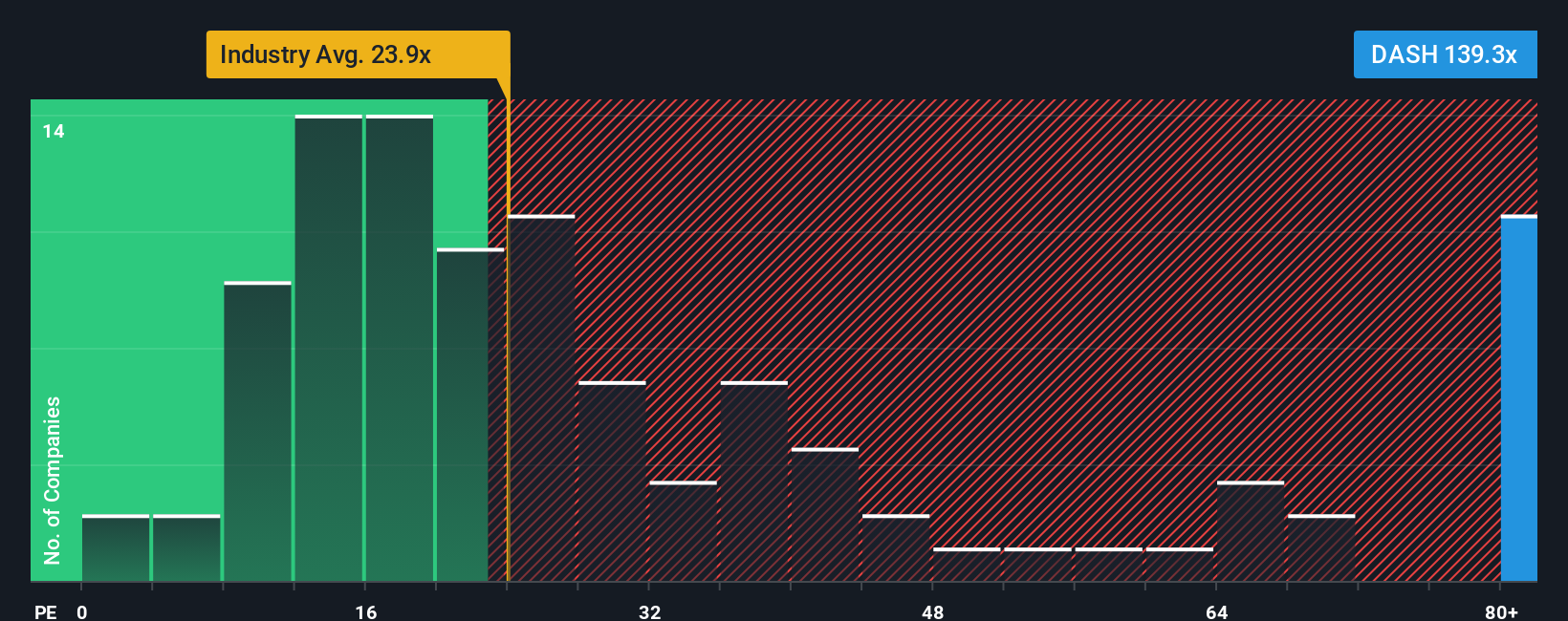

Another View: Multiples Tell a Different Story

While one valuation model points to DoorDash being undervalued, a quick look at its price-to-earnings ratio reveals a different angle. DoorDash trades at a lofty 145.2 times earnings, far higher than the US Hospitality industry average of 23.5 times and even the peer average of 31.9 times. The fair ratio suggests it could revert closer to 51.5 times over time, highlighting how much future growth is already built into today’s price. Is the current multiple a launchpad for sustained outperformance, or does it raise the risk that expectations have run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see things differently or want to dive into the data and map out your own story, you can test your view in just a few minutes. Do it your way

A great starting point for your DoorDash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for opportunities. Give yourself an edge by expanding your watchlist and tapping into trends reshaping the market before the crowd catches on.

- Spot the best values by targeting these 874 undervalued stocks based on cash flows poised for future growth based on strong cash flows and robust fundamentals.

- Tap into healthcare's evolution by checking out these 33 healthcare AI stocks changing patient care through artificial intelligence and advanced diagnostics.

- Benefit from dependable income streams by reviewing these 17 dividend stocks with yields > 3% offering yields above 3% to strengthen your portfolio's foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives