- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

Should Investors Rethink Caesars Entertainment After 26% Slide and Strategic Property Sales?

Reviewed by Bailey Pemberton

- Ever wondered if Caesars Entertainment is actually trading below its true value, or if its low price is just a mirage? This could be a turning point for opportunistic investors.

- The stock recently fell by 9.6% over the last week and is now down 26.3% in just the past month, reflecting shifting sentiment and raising questions about what the market might be missing.

- Some of these sharp moves came alongside headlines about strategic property sales and the company’s efforts to strengthen its balance sheet, keeping speculation swirling around its debt and future growth prospects. News of regulatory developments in the gaming sector has also sparked investor debate about Caesars’ position going forward.

- On our valuation checklist, Caesars Entertainment earns a 5 out of 6, indicating it appears undervalued by multiple key measures, but as we’ll see shortly, there is more than one way to size up a stock’s true worth.

Find out why Caesars Entertainment's -48.8% return over the last year is lagging behind its peers.

Approach 1: Caesars Entertainment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting those projections back to today’s value. This process helps estimate the value that investors should be willing to pay for the company right now, based on its capacity to generate cash in the years to come.

For Caesars Entertainment, the current Free Cash Flow (FCF) stands at $145.9 million. Analysts forecast that annual FCF will grow significantly, with projections from Simply Wall St indicating Free Cash Flow could reach over $1.6 billion by 2035. It is important to note that analyst estimates extend only five years, and figures beyond that are extrapolated to provide a long-term outlook.

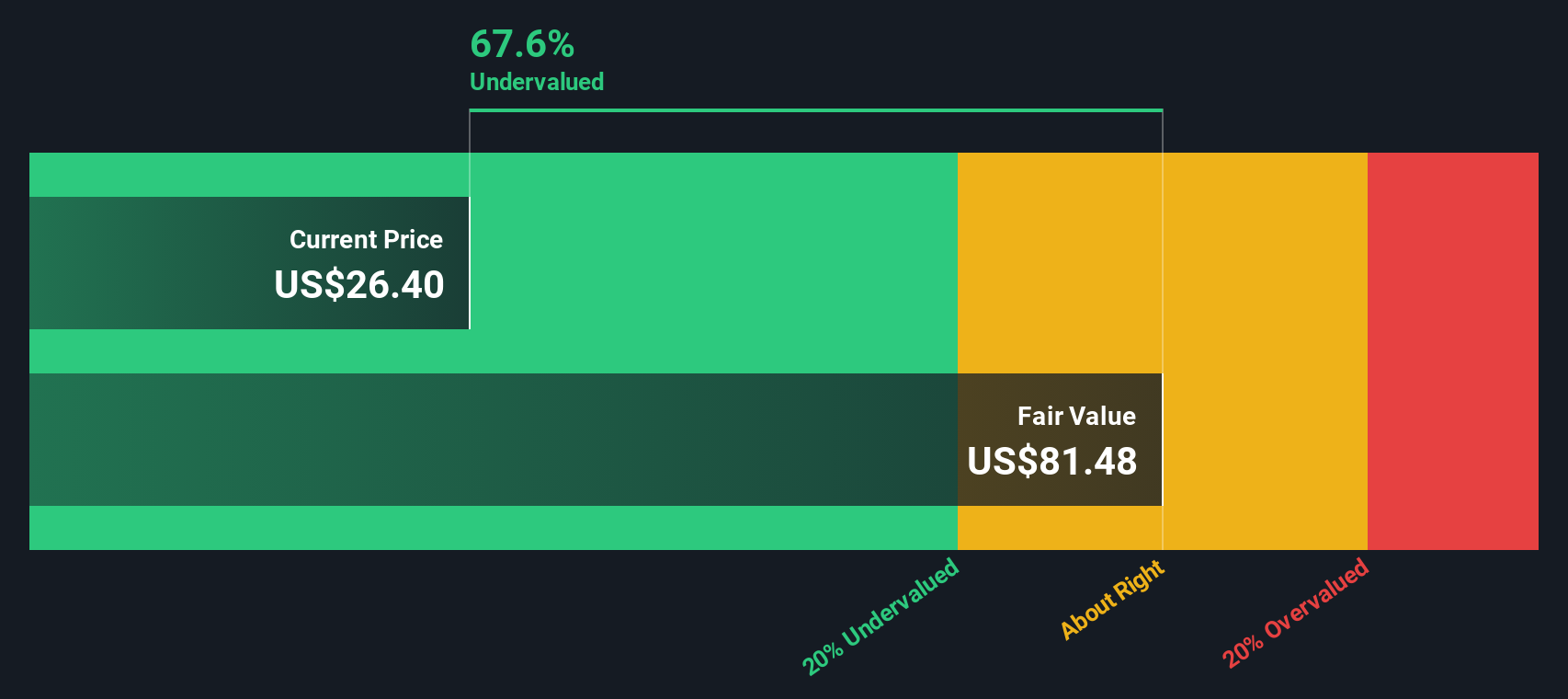

According to the DCF model, Caesars Entertainment has an estimated intrinsic value of $62.71 per share. Given the current share price, this suggests the stock trades at a 67.9% discount to its intrinsic value, indicating that the market is significantly undervaluing the company based on its projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Caesars Entertainment is undervalued by 67.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Caesars Entertainment Price vs Sales

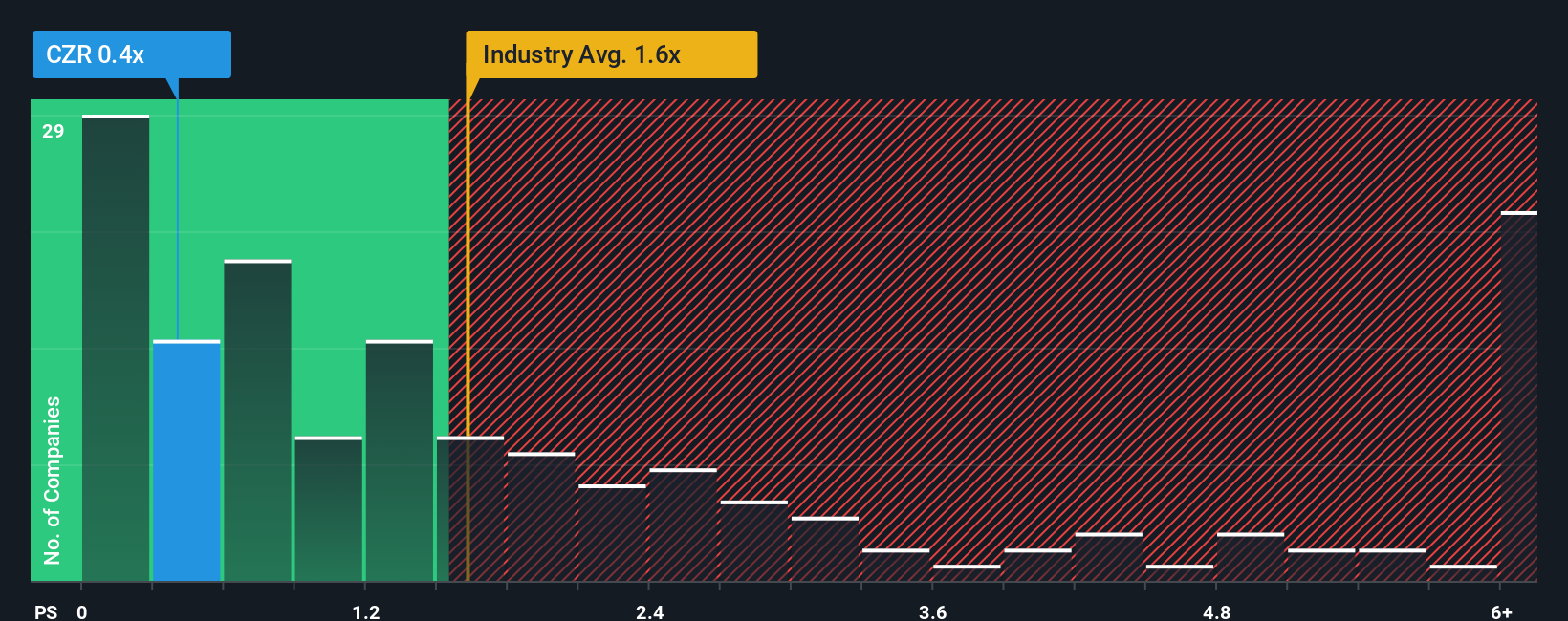

For companies in the hospitality industry like Caesars Entertainment, the Price-to-Sales (P/S) ratio is often a preferred valuation metric, especially when earnings can fluctuate due to investment cycles or business reinvestment. The P/S ratio allows us to compare the market value of the company against its revenue, making it a useful measure even in periods where profitability may not be consistent.

Growth expectations and risk levels heavily influence what investors perceive as a “normal” or “fair” multiple. Companies poised for higher sales growth or commanding less risk typically trade at higher P/S ratios. More mature or uncertain businesses might fetch lower multiples.

Currently, Caesars Entertainment trades at a P/S ratio of 0.36x, which is notably below both the industry average of 1.63x and the peer group average of 1.24x. While these comparisons provide a sense of how the market views Caesars relative to its rivals, they do not fully account for factors unique to the company.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Caesars is currently estimated at 1.31x. Unlike basic averages, this benchmark considers multiple factors at once, including Caesars' growth outlook, risk profile, profit margins, industry trends, and market capitalization. This results in a comprehensive and tailored valuation anchor.

With Caesars’ actual P/S multiple well below its Fair Ratio, the evidence points to an undervalued stock based on revenue multiples, even after accounting for company-specific risks and growth prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Caesars Entertainment Narrative

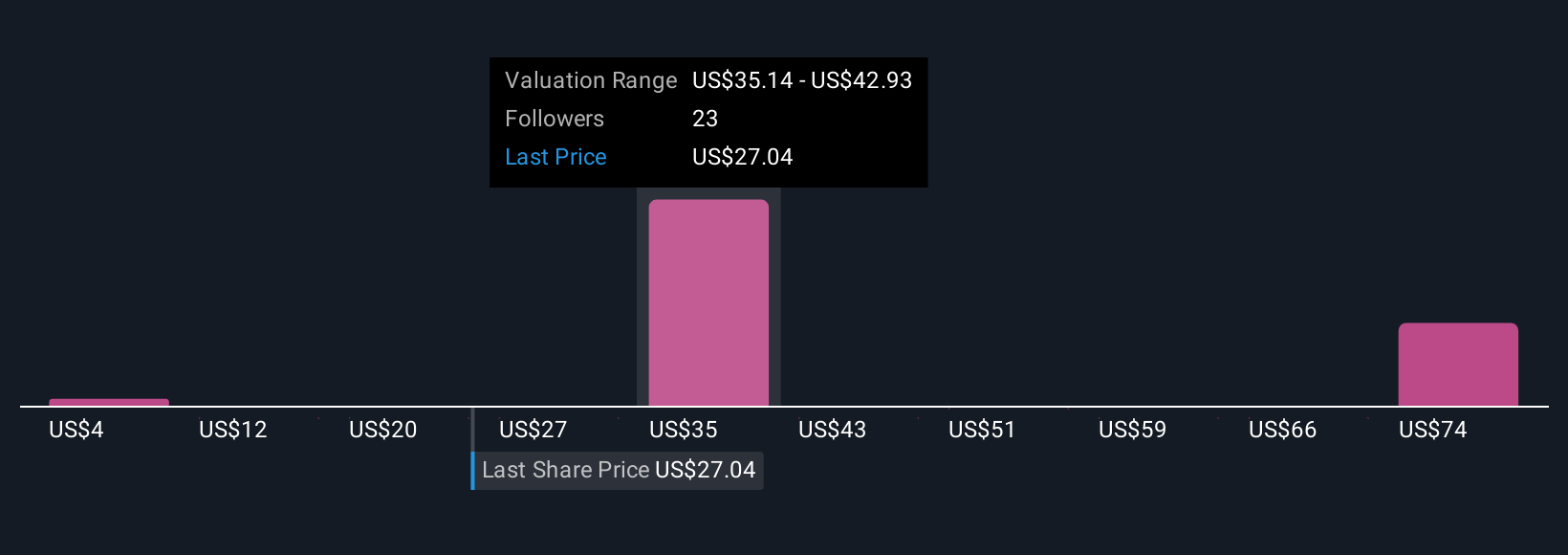

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an approach where you combine your view of Caesars Entertainment’s story with your financial forecast and see how this translates into a fair value for the stock.

A Narrative is your perspective made actionable: instead of simply relying on numbers, you connect the business's unique journey, market trends, and real-world developments to your estimates for future revenue, margins, and what you believe the shares are worth.

Narratives on Simply Wall St are interactive and easy to use inside the Community page, where millions of investors share, compare, and refine their investment stories in real time.

By anchoring your decision to a Narrative, you can clearly see whether your fair value differs from the current market price. This helps you decide when to buy or sell, and each Narrative is kept up to date as news, earnings, or market sentiment changes.

For example, one investor’s Narrative on Caesars might call for rapid digital growth and robust property upgrades, setting a bullish fair value around $61. Another, more cautious view might focus on debt burdens and leisure demand uncertainty, pinning fair value closer to $27. Narratives allow you to easily explore both perspectives and choose what fits your outlook.

Do you think there's more to the story for Caesars Entertainment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives