- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

Caesars Entertainment (CZR) Rises 5.2% After Missouri Sportsbook Launch and Digital Wallet Debut – Has the Growth Narrative Evolved?

Reviewed by Sasha Jovanovic

- Legal sports wagering has launched in Missouri, with Caesars Entertainment rolling out its Caesars Sportsbook mobile app statewide and introducing in-person betting at Harrah's Kansas City and Horseshoe St. Louis, alongside a series of customer-focused promotions and the debut of Universal Digital Wallet functionality.

- Missouri is the first state where Caesars Sportsbook has enabled Universal Digital Wallet on launch day, allowing seamless deposits and withdrawals across multiple states and enhancing cross-platform customer engagement.

- We'll explore how Caesars' Missouri digital rollout and integration of Universal Digital Wallet could influence its future cash flow and digital engagement strategy.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Caesars Entertainment Investment Narrative Recap

To be a shareholder in Caesars Entertainment, you need to believe in the company’s ability to successfully expand its digital gaming presence while navigating the challenges of traditional hospitality demand. The Missouri rollout of Caesars Sportsbook, with its Universal Digital Wallet integration, is a meaningful addition for the digital segment, but it doesn’t change the fact that the most important short-term catalyst remains customer acquisition cost control and digital profitability; meanwhile, debt management and unpredictable marketing spend remain the biggest risks, and this news does not materially alter those priorities. Of all recent company announcements, the introduction of the Caesars Sportsbook Universal Digital Wallet in Missouri stands out. This feature is especially relevant as it supports smoother user engagement and cross-state loyalty, potentially amplifying the company’s efforts to boost recurring revenue in the higher-margin digital business, an area closely watched as a driver of future cash flow. Yet caution is warranted, especially given the contrasting risk that persistently high marketing costs or margin pressure could quickly outweigh the digital growth opportunity investors should be aware of...

Read the full narrative on Caesars Entertainment (it's free!)

Caesars Entertainment's narrative projects $12.6 billion revenue and $540.9 million earnings by 2028. This requires 3.4% yearly revenue growth and a $735.9 million earnings increase from -$195.0 million.

Uncover how Caesars Entertainment's forecasts yield a $33.37 fair value, a 44% upside to its current price.

Exploring Other Perspectives

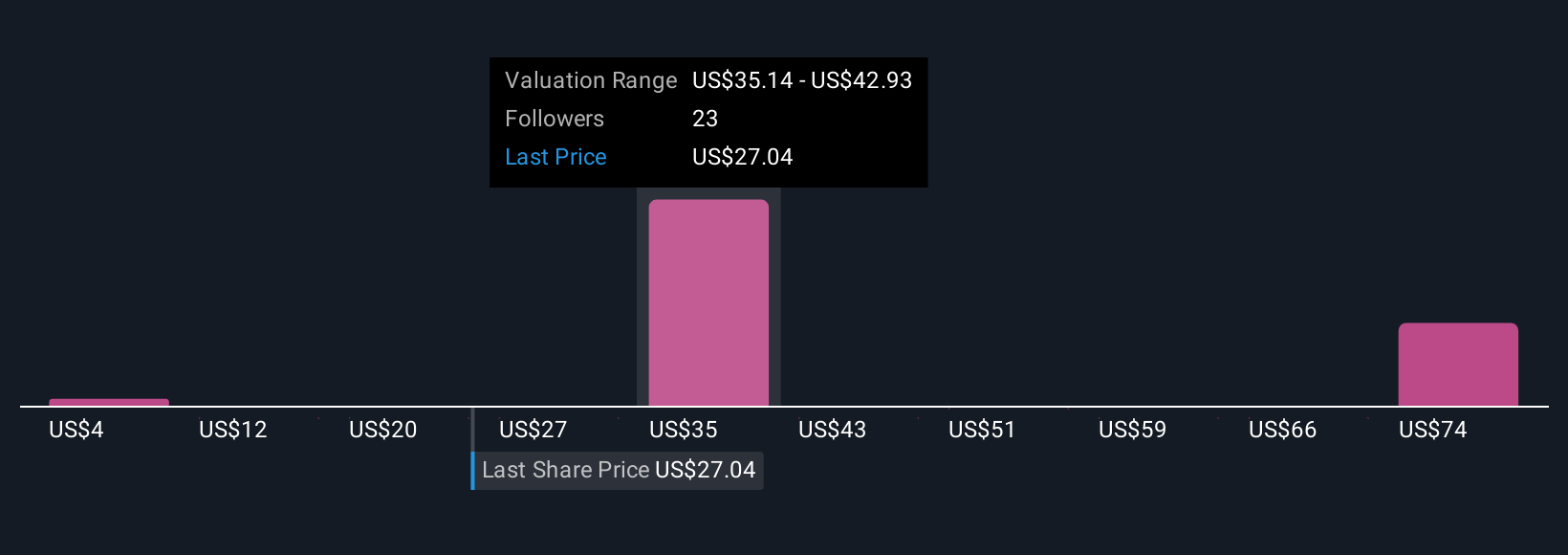

Five fair value estimates from the Simply Wall St Community range from US$4 to US$64.63, showing real disagreement on Caesars’ potential. While many participants focus on digital segment growth as a key catalyst, knowing where you stand on these widely different outlooks is essential.

Explore 5 other fair value estimates on Caesars Entertainment - why the stock might be worth over 2x more than the current price!

Build Your Own Caesars Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caesars Entertainment research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Caesars Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caesars Entertainment's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026