- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

A Fresh Look at Caesars Entertainment (CZR) Valuation as S&P 500 Exit Triggers Forced Index Selling

Reviewed by Simply Wall St

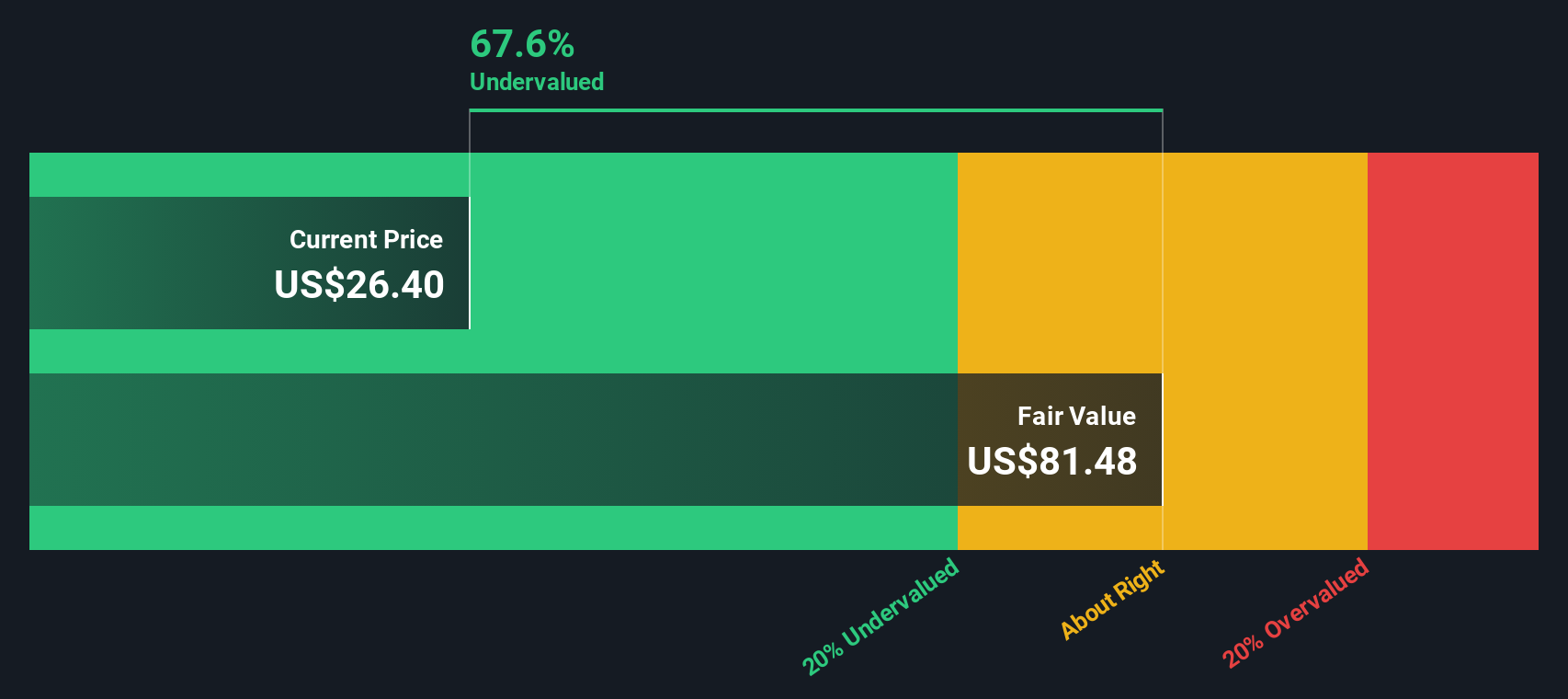

Most Popular Narrative: 37.5% Undervalued

Based on the most widely followed narrative, Caesars Entertainment is currently viewed as substantially undervalued compared to its calculated fair value, reflecting a significant discount by the market.

Strategic capital allocation into property renovations, new amenity rollouts (such as room remodels and high-return upgrades like Flamingo's pool experience), and slot machine enhancements are already showing positive returns and are expected to unlock additional property-level revenue and margin expansion over coming years.

How does a stock win analyst confidence despite market setbacks? This narrative’s secret sauce is a powerful mix of recurring digital revenue and bold property investments that could transform cash flow and profits. What ambitious financial milestones must Caesars reach for its share price to return to double digits? Dive in to uncover the surprising assumptions—according to analysts, this playbook might just raise your expectations.

Result: Fair Value of $41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent debt levels and shifting consumer preferences could challenge Caesars’ turnaround story if costly renovations or evolving demands reduce future earnings growth.

Find out about the key risks to this Caesars Entertainment narrative.Another View: The SWS DCF Model Perspective

Taking a different approach, the SWS DCF model also suggests that Caesars Entertainment is undervalued. This echoes the conclusion reached by market multiples. However, could both methods be missing something beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Caesars Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Caesars Entertainment Narrative

Not convinced by these takes or want to dig deeper on your own terms? You can craft your own story about Caesars in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Caesars Entertainment.

Ready for Your Next Winning Move?

Why stop at Caesars? Spot tomorrow’s opportunities with just a few clicks. Let Simply Wall Street’s powerful screener help you spot game-changing investments others might miss out on.

- Supercharge your growth strategy by targeting breakthrough companies in neural networks, automation, and generative tech with our handpicked selection of AI penny stocks.

- Snap up income opportunities now by finding shares that pay robust yields above 3 percent with direct access to dividend stocks with yields > 3%.

- Gain an edge by jumping on the most attractively priced opportunities based on in-depth cash flow analysis. All thanks to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success