- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Exploring 3 Undervalued Small Caps With Insider Buying To Enhance Your Portfolio

Reviewed by Simply Wall St

With global markets showing signs of recovery and hopes growing for a "soft landing" in the U.S. economy, small-cap stocks have seen renewed interest from investors. The S&P 600, which tracks small-cap companies, has also experienced gains amid this positive sentiment. In this context, identifying undervalued small-cap stocks with insider buying can be a strategic move to enhance your portfolio.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Essentra | 817.3x | 1.6x | 49.06% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 32.00% | ★★★★★☆ |

| Information Services | 24.0x | 2.1x | -66.79% | ★★★★☆☆ |

| CVS Group | 22.4x | 1.2x | 40.83% | ★★★★☆☆ |

| ADENTRA | 16.8x | 0.3x | 8.40% | ★★★☆☆☆ |

| Studsvik | 20.6x | 1.2x | 41.69% | ★★★☆☆☆ |

| Franchise Brands | 117.4x | 2.9x | 48.77% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -62.86% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -106.04% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

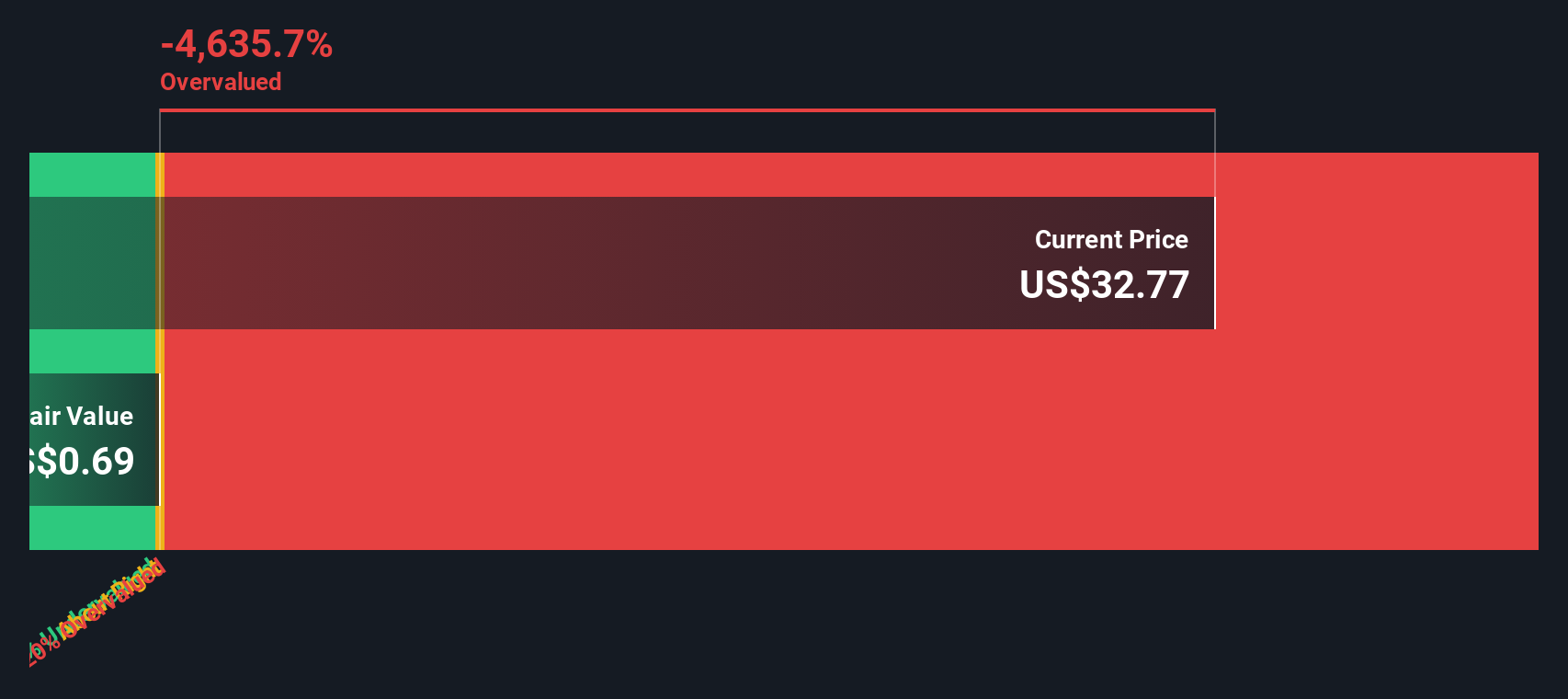

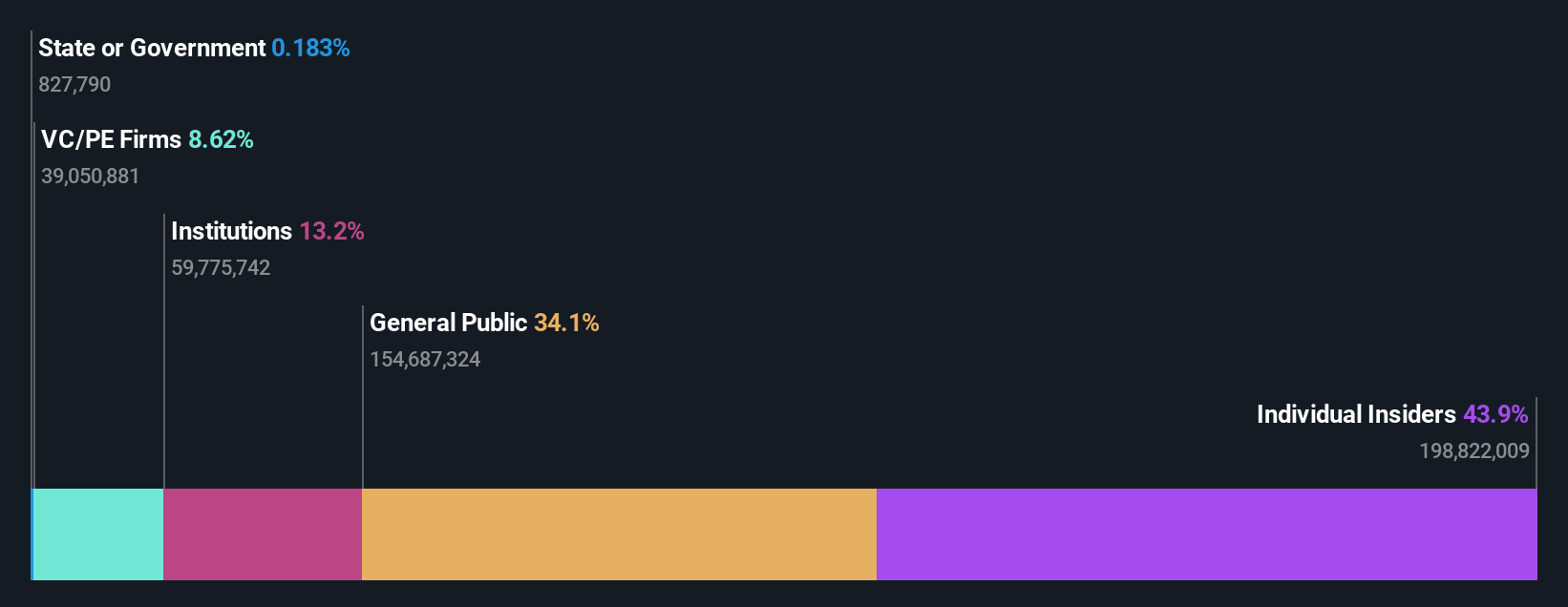

AtriCure (NasdaqGM:ATRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure specializes in developing and selling surgical and medical equipment, with a market cap of approximately $2.05 billion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, which reached $429.95 million as of the latest period. Its gross profit margin has been around 74.84%, with operating expenses largely driven by R&D and General & Administrative costs, totaling $356.58 million in the most recent quarter.

PE: -29.0x

AtriCure's recent regulatory approval in China for its AtriClip® device marks a significant milestone, potentially expanding its market presence. Despite reporting a net loss of US$8.01 million for Q2 2024, revenue grew to US$116.27 million from US$100.92 million year-over-year, indicating strong sales momentum. Insider confidence is evident with recent share purchases by executives between June and July 2024. The company expects full-year revenue to reach approximately US$456-461 million, reflecting an optimistic growth outlook despite past shareholder dilution and higher-risk funding sources.

- Dive into the specifics of AtriCure here with our thorough valuation report.

Review our historical performance report to gain insights into AtriCure's's past performance.

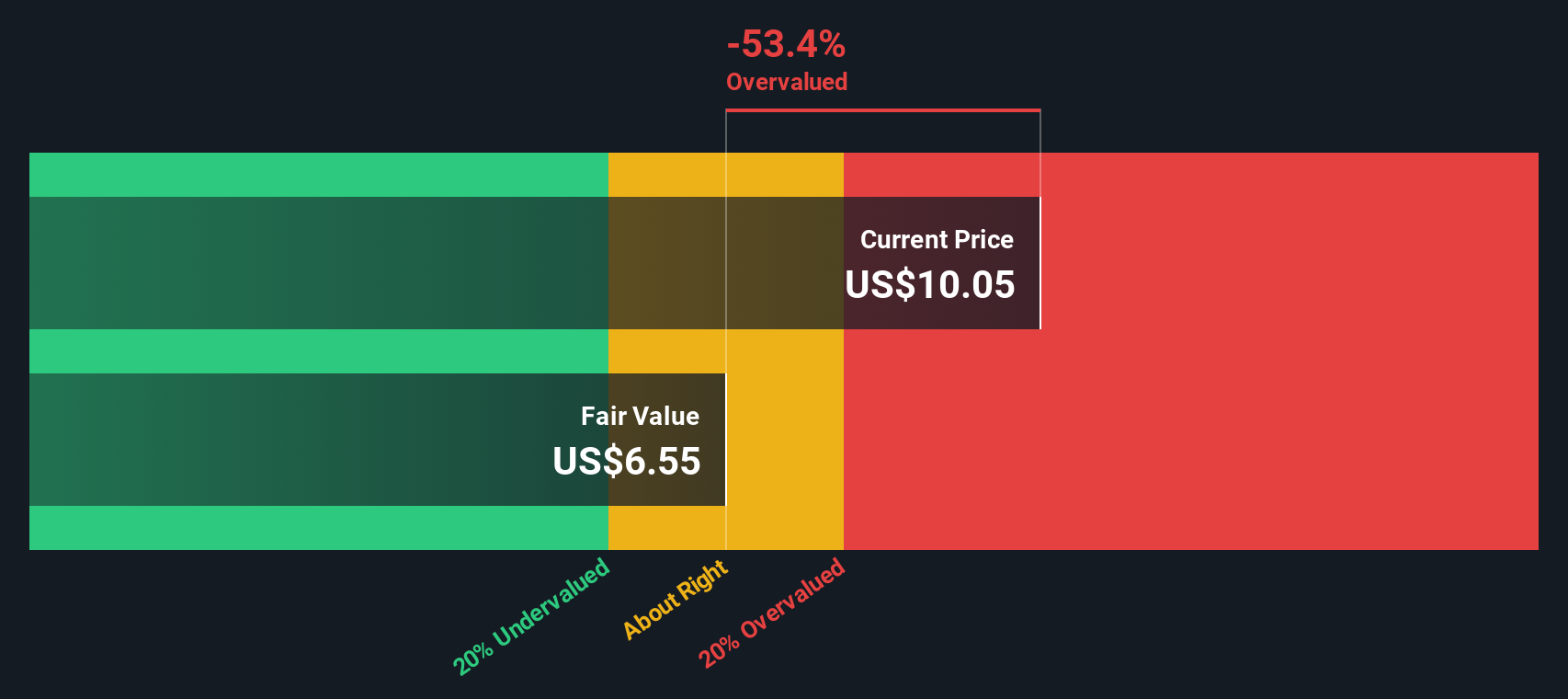

Bloomin' Brands (NasdaqGS:BLMN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bloomin' Brands operates a portfolio of casual dining restaurant chains, with a market cap of approximately $2.44 billion.

Operations: The company generates revenue primarily from its U.S. operations ($3.97 billion) and international markets ($615.57 million). For the period ending 2023-09-24, it reported a gross profit margin of 17.52% and a net income margin of 5.73%.

PE: 45.4x

Bloomin' Brands, a small cap stock, recently reported second-quarter revenue of US$1.12 billion and net income of US$28.4 million, down from the previous year. Despite lower profit margins and earnings guidance for 2024 being revised to US$0.25–US$0.45 per share, insider confidence remains strong with significant share purchases in recent months. The company maintains a quarterly dividend of US$0.24 per share and is included in multiple Russell indices, indicating potential value recognition in the market.

- Click to explore a detailed breakdown of our findings in Bloomin' Brands' valuation report.

Assess Bloomin' Brands' past performance with our detailed historical performance reports.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company involved in the manufacturing and marketing of generic drugs, with a market cap of ₹27.09 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceuticals segment, reaching ₹22.68 billion in the most recent period. The company has seen a gross profit margin of 53.39% and a net income margin of 14.72%.

PE: 29.9x

Marksans Pharma, a smaller pharmaceutical player, has seen significant insider confidence with notable share purchases in the last quarter. The company reported robust Q1 2025 earnings with sales of INR 5.9 billion and net income of INR 887.52 million, reflecting solid growth from the previous year. Additionally, Marksans is actively exploring M&A opportunities to expand its European market presence, indicating strategic ambitions beyond organic growth. Their focus on corporate governance and regular board meetings further underscores their commitment to sustainable expansion.

- Unlock comprehensive insights into our analysis of Marksans Pharma stock in this valuation report.

Examine Marksans Pharma's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Unlock our comprehensive list of 204 Undervalued Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives