- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Is There an Opportunity in Booking Holdings After Recent 5% Share Price Dip?

Reviewed by Bailey Pemberton

- Ever wondered if Booking Holdings is trading at a price that's truly fair, or if there's hidden value waiting to be discovered? You're not alone. A lot of investors are asking the same question right now.

- Despite a recent dip of 5.1% over the past month, the stock remains up 3.1% year-to-date and has posted a solid 7.7% return over the past year.

- Behind these moves, Booking Holdings has been in the spotlight thanks to ongoing travel demand and several major platform upgrades. Industry chatter has focused on how these developments might shape the company's competitive edge and future growth.

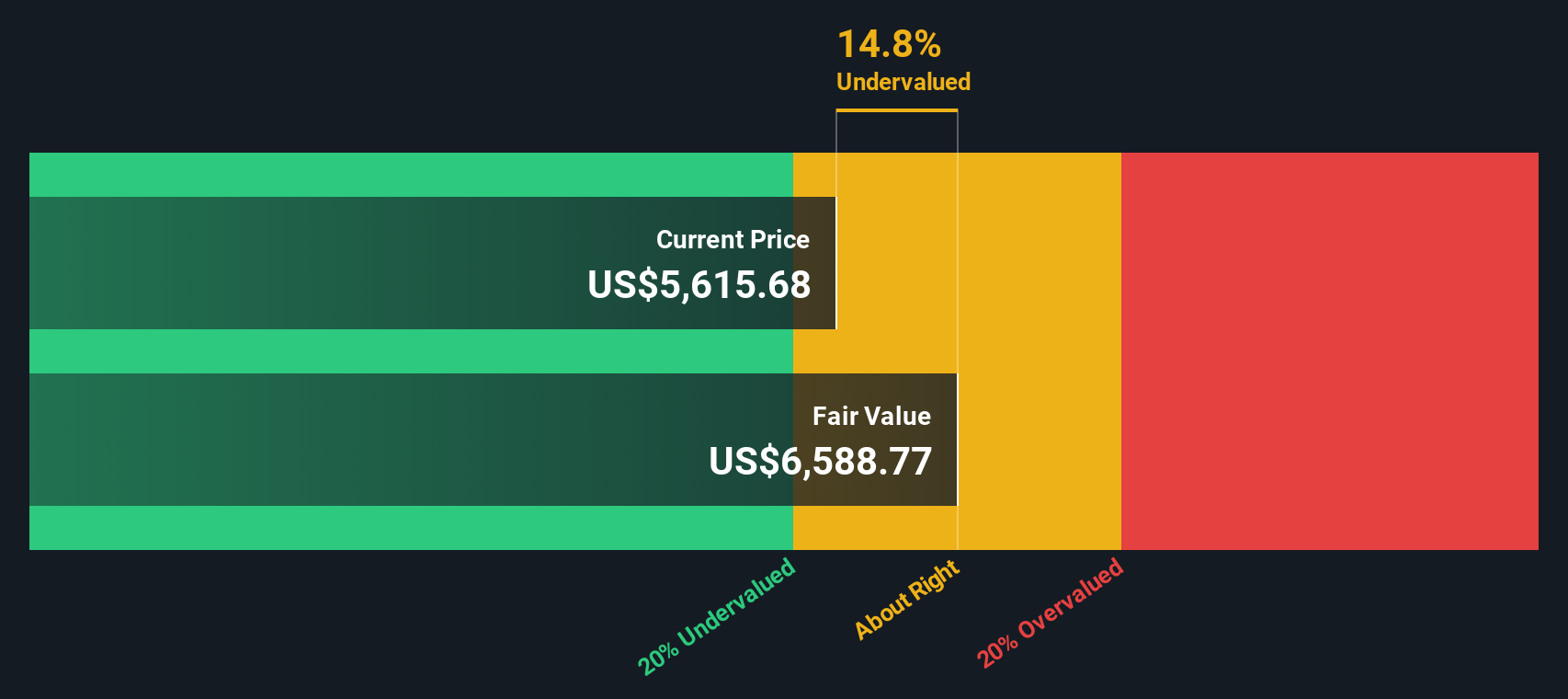

- For those keeping score on valuation, the company currently stands at 4 out of 6 for undervalued metrics. This is an impressive tally, but valuation isn't a one-size-fits-all story. We'll walk through traditional approaches next, but stick around for a fresh perspective on understanding value at the end of this article.

Approach 1: Booking Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by forecasting its future cash flows and then discounting them back to today's value. This approach provides a snapshot of what Booking Holdings could be worth based on the cash it is expected to generate over time.

Booking Holdings currently reports free cash flow of $8.23 billion. Analyst projections see this figure growing steadily, with free cash flow expected to hit $13.38 billion by 2029. Since analyst estimates typically cover only five years, later figures are extrapolated. The general trend points toward robust growth in the company's ability to generate cash in the years ahead.

Using these projections, the DCF model calculates an intrinsic value for Booking Holdings of $7,419 per share. This value is around 31.6% higher than the current share price, indicating that Booking Holdings stock is trading well below what its future cash flows justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booking Holdings is undervalued by 31.6%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Booking Holdings Price vs Earnings

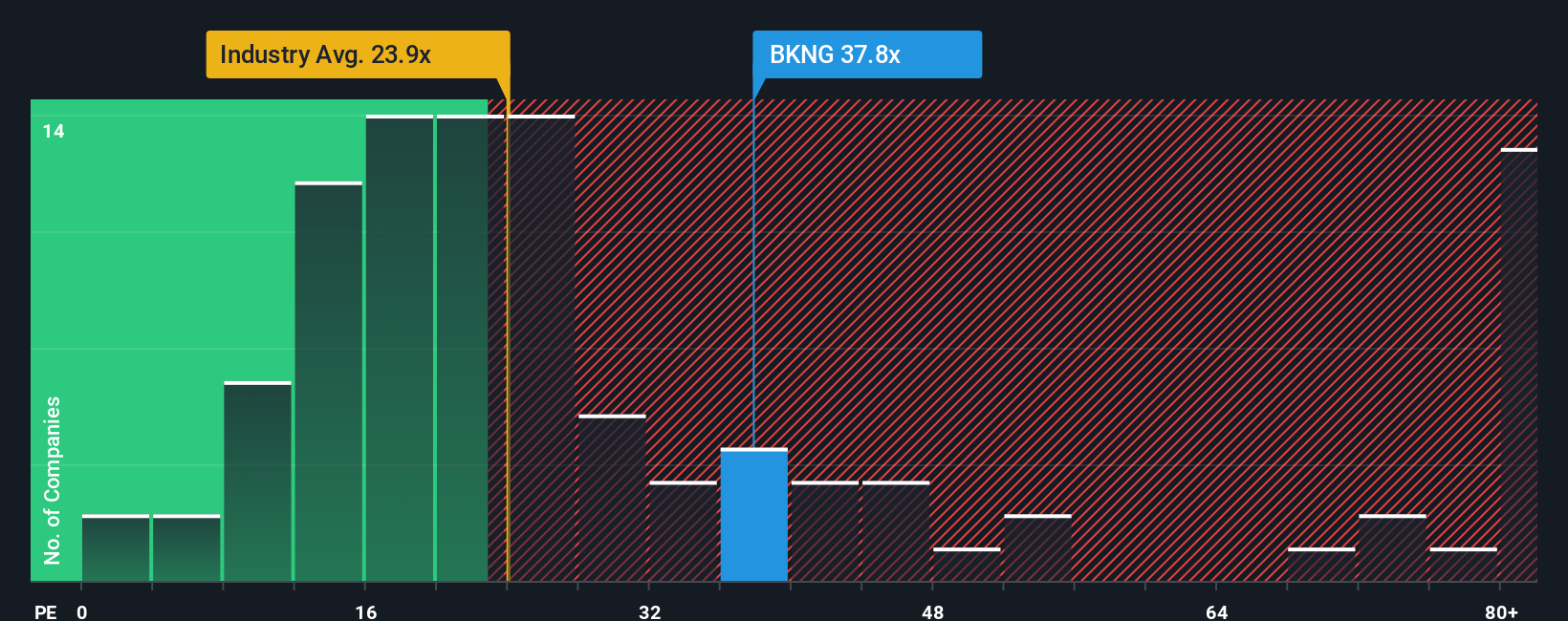

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly relates a company's current share price to its per-share earnings. For companies like Booking Holdings, which consistently generate substantial profits, the PE ratio offers a straightforward way to gauge how much investors are willing to pay for each dollar of earnings.

It's important to remember that what counts as a "normal" or "fair" PE ratio isn't static. High-growth companies with robust future prospects typically trade at higher PE ratios, while riskier or slower-growing businesses deserve a lower ratio. Market sentiment and broader industry trends also play a role in setting these benchmarks.

Booking Holdings currently trades at a PE ratio of 32.45x. This is higher than both the industry average for Hospitality companies at 23.34x and its average peer multiple of 28.32x. This signals that investors are factoring in strong growth potential or unique competitive strengths. However, Simply Wall St’s proprietary "Fair Ratio" for Booking Holdings is 39.82x. The Fair Ratio is a contextual metric. It weighs in factors like Booking’s earnings growth, profit margins, industry environment, market cap, and specific risks, making it a more tailored and holistic benchmark than a simple industry or peer comparison.

When comparing Booking Holdings’ actual PE ratio of 32.45x with its Fair Ratio of 39.82x, the stock currently trades below what the model finds justified. This implies that, on an earnings multiple basis, Booking Holdings could be undervalued given its growth profile and financial strength.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique story about Booking Holdings, linking the company’s strategy, opportunities, risks, and future to a set of financial forecasts such as revenue, earnings, and margins, and ultimately to what you believe is a fair value for the stock.

On Simply Wall St’s Community page, you can quickly create or use Narratives to see how a business’s story maps to its financial outlook, making it easy for anyone to connect “the why” behind a company’s outlook to “the numbers.” Narratives also empower you to make smarter buy or sell decisions by comparing your (or an analyst’s) Fair Value with the current share Price.

Unlike static models, Narratives update automatically as soon as news breaks or earnings are released, so they reflect the very latest information. For Booking Holdings, for example, some investors are optimistic that AI-driven features and travel demand will push fair value as high as $7,218, while others see risks capping upside at $5,200. This means there is room for multiple, well-informed perspectives around the same company, all backed by current data and your own point of view.

Do you think there's more to the story for Booking Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives