- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Does the Recent 4.7% Jump Make Booking Holdings a Bargain in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Booking Holdings stock is a hidden bargain or overpriced, you are not alone. Getting the real story on its value is not always as straightforward as it seems.

- Shares have posted a jump of 4.7% in the past week, although the 30-day return is down 6.5%, and the stock remains almost flat year-to-date, hinting at both volatility and potential opportunity for investors.

- Recent market moves have followed headlines about shifting travel trends and evolving digital booking habits, fueling lively debate about Booking Holdings' ability to keep up with industry changes. Investors are closely watching competition and regulatory news, both of which have added fresh context to the price swings seen lately.

- According to our value checks, Booking Holdings scores a 4 out of 6. This is not bad, but there is more to valuation than numbers alone. In the next sections, we will break down several valuation approaches, with a look at an even smarter way to judge fair value at the end of this article.

Approach 1: Booking Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to today's dollars. This approach provides a way to judge intrinsic value based on the money Booking Holdings is expected to generate moving forward.

Currently, Booking Holdings reports a Free Cash Flow of $8.23 billion. Analysts predict strong growth, with cash flows expected to reach $13.38 billion in 2029. While analyst projections typically cover the next five years, estimates beyond that are extrapolated using trends in the company's performance.

Using the 2 Stage Free Cash Flow to Equity model, the DCF calculation suggests the fair value of the stock is $7,650.59. This is roughly 35.8% above the current share price, which could indicate the market is underestimating Booking Holdings' future earning power.

With a solid track record of cash generation and promising future projections, the DCF analysis presents Booking Holdings as significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booking Holdings is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Booking Holdings Price vs Earnings

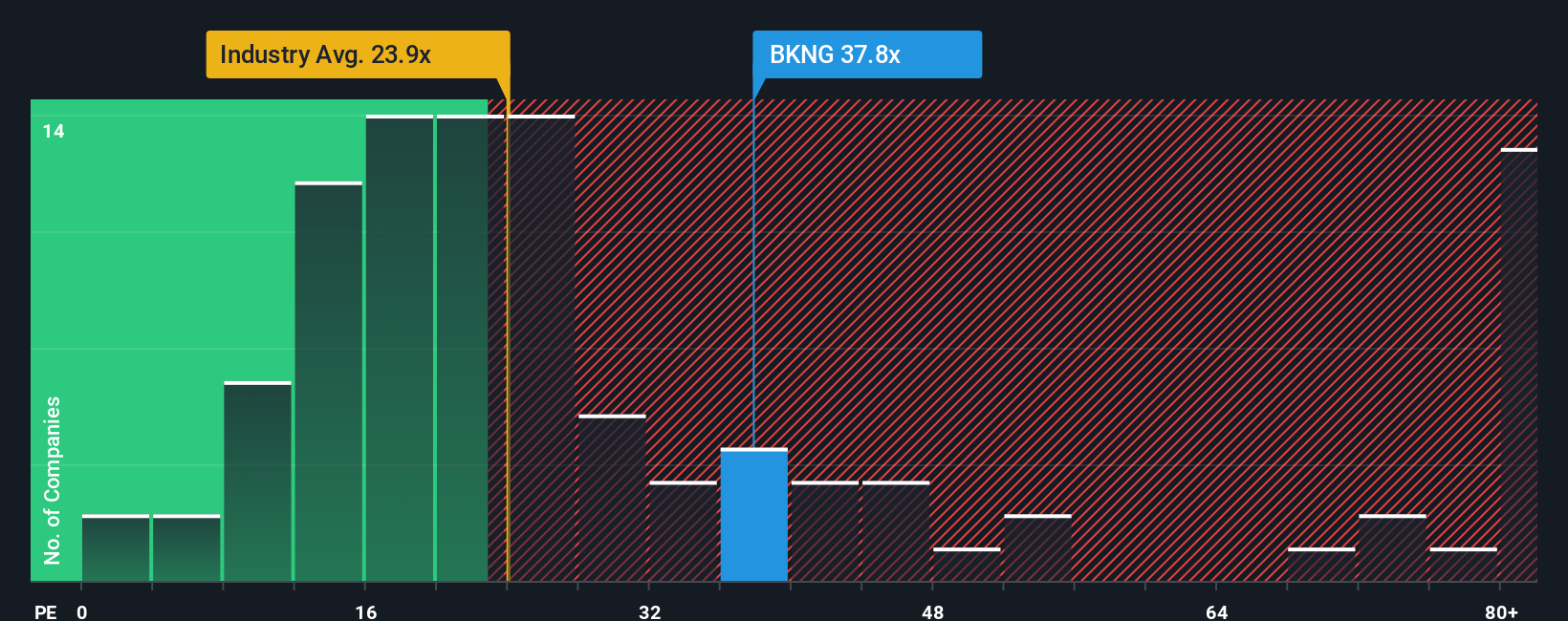

The Price-to-Earnings (PE) ratio is a well-established tool for valuing profitable companies like Booking Holdings, as it relates current share price to the company’s earnings. Investors favor this metric for mature businesses because it offers a direct way to judge how much the market is willing to pay for each dollar of profit. Higher ratios are often justified by strong growth prospects and lower risk.

However, what counts as a “normal” or “fair” PE ratio depends on several factors, including expected earnings growth and the risks unique to the company or industry. Companies with faster earnings growth and stable outlooks usually command a higher PE ratio, while those with inconsistent earnings or sector challenges generally trade on lower multiples.

Currently, Booking Holdings trades at a PE of 31.4x. This is noticeably above the Hospitality industry average of 21.4x and also higher than the peer group average of 29.0x. This signals the market’s confidence in its earning power. But simple comparisons like these miss the nuances around Booking Holdings’ specific growth trajectory and risk profile.

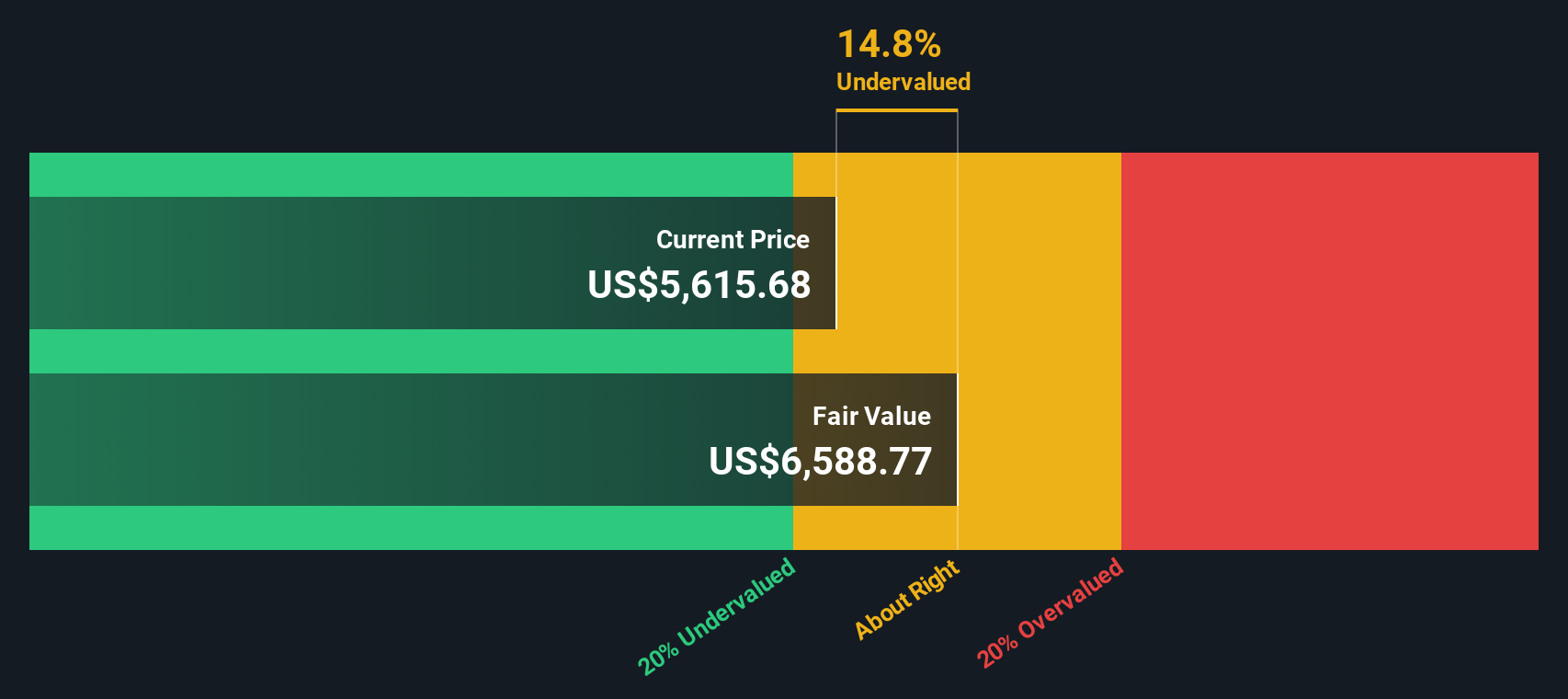

This is where Simply Wall St’s “Fair Ratio” comes in. Calculated with deeper analytics, including future earnings growth, profit margins, risk factors, market capitalization, and the characteristics of its sector, the Fair Ratio offers a more personalized benchmark. For Booking Holdings, the Fair Ratio stands at 37.1x, which is notably above its current PE.

By this measure, Booking Holdings’ shares appear to be undervalued on a PE basis. Its current premium to peers and the industry is justified in light of superior growth, scale, and profitability. All of these factors are better reflected in the Fair Ratio than in standard multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative lets you create and share your own story about Booking Holdings by combining your unique expectations for its revenue, earnings, and margins with a forward-looking estimate of fair value. Rather than relying solely on static valuation multiples, Narratives connect everything: your perspective on what will happen next, a financial forecast, and ultimately a calculated fair value based on your assumptions.

Narratives are easy to use and available to millions of investors right on the Simply Wall St Community page. They update automatically when major news, earnings, or other material events change the outlook, allowing you to always see how your story compares to the latest facts. Narratives help investors identify if Booking Holdings is truly a buy, hold, or sell right now by directly comparing fair value with the current share price, and you can track how your view compares to others in real-time.

For example, when looking at Booking Holdings, some investors see robust growth from AI adoption and global diversification, leading them to set a fair value as high as $7,218 per share, while others focus on rising competition and set a more cautious target around $5,200. Narratives put those perspectives side by side.

Do you think there's more to the story for Booking Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success