- United States

- /

- Hospitality

- /

- NasdaqGS:BJRI

BJ’s Restaurants (BJRI): $19.3M One-Off Loss Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

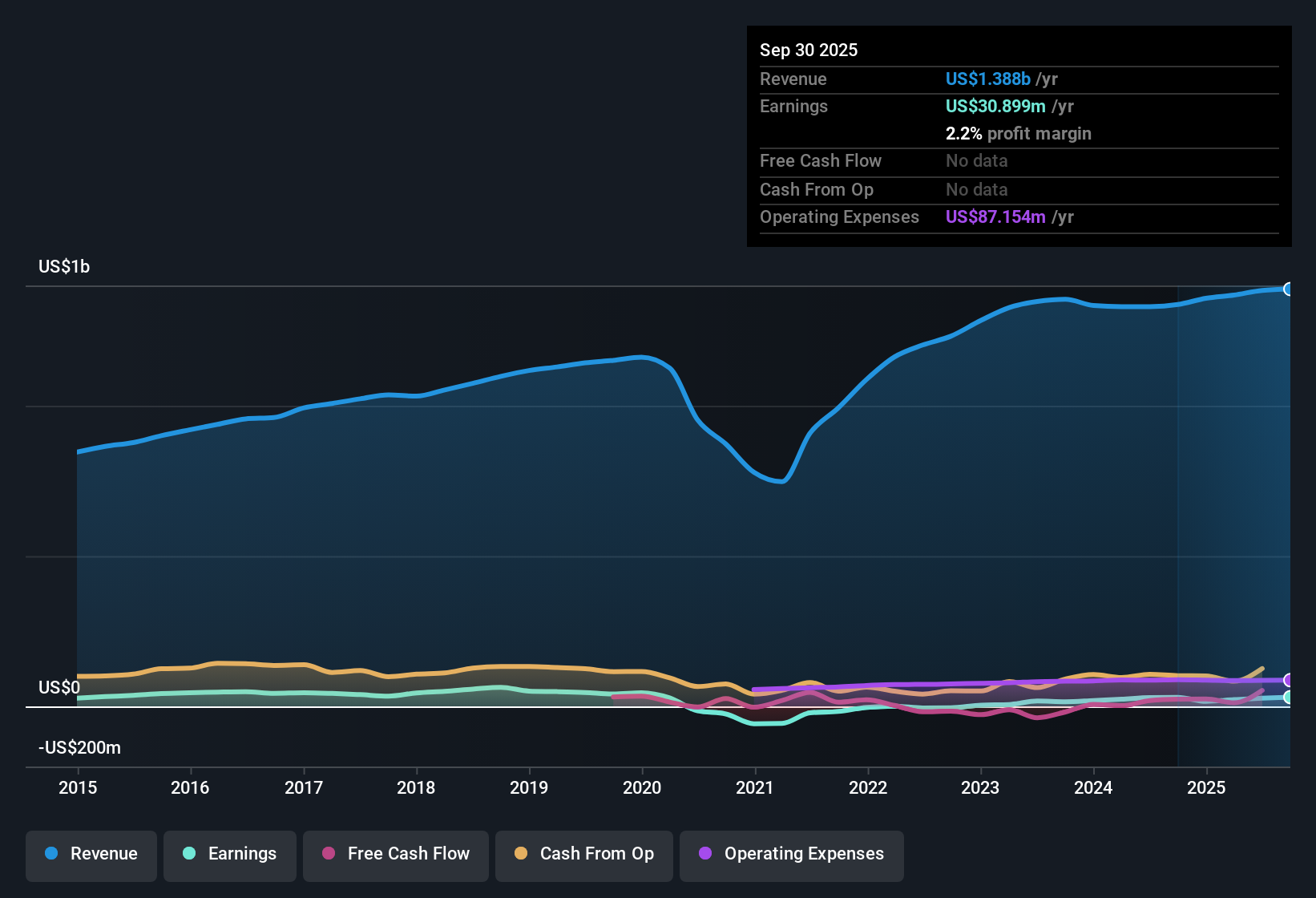

BJ's Restaurants (BJRI) posted a net profit margin of 2% for the past twelve months, just below last year’s 2.2%. This result reflects the impact of a significant one-off loss totaling $19.3 million. Looking ahead, analysts project revenue growth of 3% per year, which is markedly slower than the broader US market’s expected 10.3%. Shares are currently trading at $33.96, sitting above the company’s estimated fair value and supported by a price-to-earnings ratio of 27.3x. This figure outpaces both peer and industry averages. Investors may want to pay close attention to the company’s premium valuation in light of recent margin pressures and extraordinary losses.

See our full analysis for BJ's Restaurants.Next, we will put these headline numbers in perspective by comparing them to the market’s most widely followed narratives for BJ’s Restaurants, revealing where investor expectations might align or get shaken up.

See what the community is saying about BJ's Restaurants

Margin Targets Double, Backed by Tech Upgrades

- Analysts project net profit margins will increase from 2.0% today to 4.4% within three years, nearly doubling as the company pursues operational efficiencies.

- Analysts' consensus view points to improvements driven by technology adoption, including new AI-driven forecasting and upgraded reservation platforms. These changes help reduce labor costs and boost guest satisfaction.

- Lower labor costs and enhanced digital tools are expected to create a stronger foundation for profit improvement.

- Consensus narrative emphasizes that these upgrades could underpin sustainable gains as management pushes for higher margins, even with industry-wide wage pressures.

📈 Read the full BJ's Restaurants Consensus Narrative.

Share Count Decline Adds to EPS Growth

- With analysts anticipating the share count to fall by 3.03% per year over the next three years, this buyback trend is expected to amplify earnings per share growth along with forecasted earnings improvement.

- Analysts' consensus view highlights that fewer shares outstanding can increase per-share profitability, even with modest revenue expansion.

- Higher projected profit and a shrinking share base result in estimates that EPS will rise to $3.12 in 2028, compared to $27.5 million earnings today.

- Consensus commentary notes that this multiplier effect relies on sustained cash flow and successful execution of ongoing buybacks.

Premium Valuation Stirs Debate

- At $33.96, BJ’s trades above its DCF fair value of $28.09 and commands a price-to-earnings ratio of 27.3x, which is higher than both the peer average of 24.8x and the hospitality industry average of 23.5x.

- Analysts' consensus view argues this premium reflects confidence in future growth and profitability, but also indicates heightened expectations and limited downside protection.

- With the analyst price target set at 38.14, there is a 12% potential upside from the current share price. However, achieving this depends on profit margin expansion and steady top-line gains.

- The discussion centers on whether ambitious efficiency targets and brand initiatives can justify maintaining such a valuation premium in a competitive dining landscape.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BJ's Restaurants on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might have missed? Put your unique take into action and craft a personal narrative in just a few moments. Do it your way

A great starting point for your BJ's Restaurants research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Explore Alternatives

BJ’s Restaurants carries a premium valuation that depends on ambitious margin expansion targets. This situation can make the stock vulnerable if growth or efficiency improvements do not materialize as planned.

If you want more compelling value, check out these 832 undervalued stocks based on cash flows and discover companies that are trading below their fair value while offering stronger downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Restaurants might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BJRI

Adequate balance sheet with very low risk.

Market Insights

Community Narratives