- United States

- /

- Entertainment

- /

- NYSE:SE

3 Growth Companies With High Insider Ownership Achieving 43% Return On Equity

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but over the past 12 months, it has risen by 9.8%, with earnings forecasted to grow by 15% annually. In this context of steady growth and positive earnings outlook, identifying growth companies with high insider ownership can be a strategic approach as such stocks often reflect strong confidence from those closest to the company’s operations and potential for achieving significant returns on equity.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| FTC Solar (FTCI) | 27.7% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

| Antalpha Platform Holding (ANTA) | 18.4% | 40.4% |

Let's uncover some gems from our specialized screener.

Atour Lifestyle Holdings (ATAT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited, with a market cap of $4.35 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

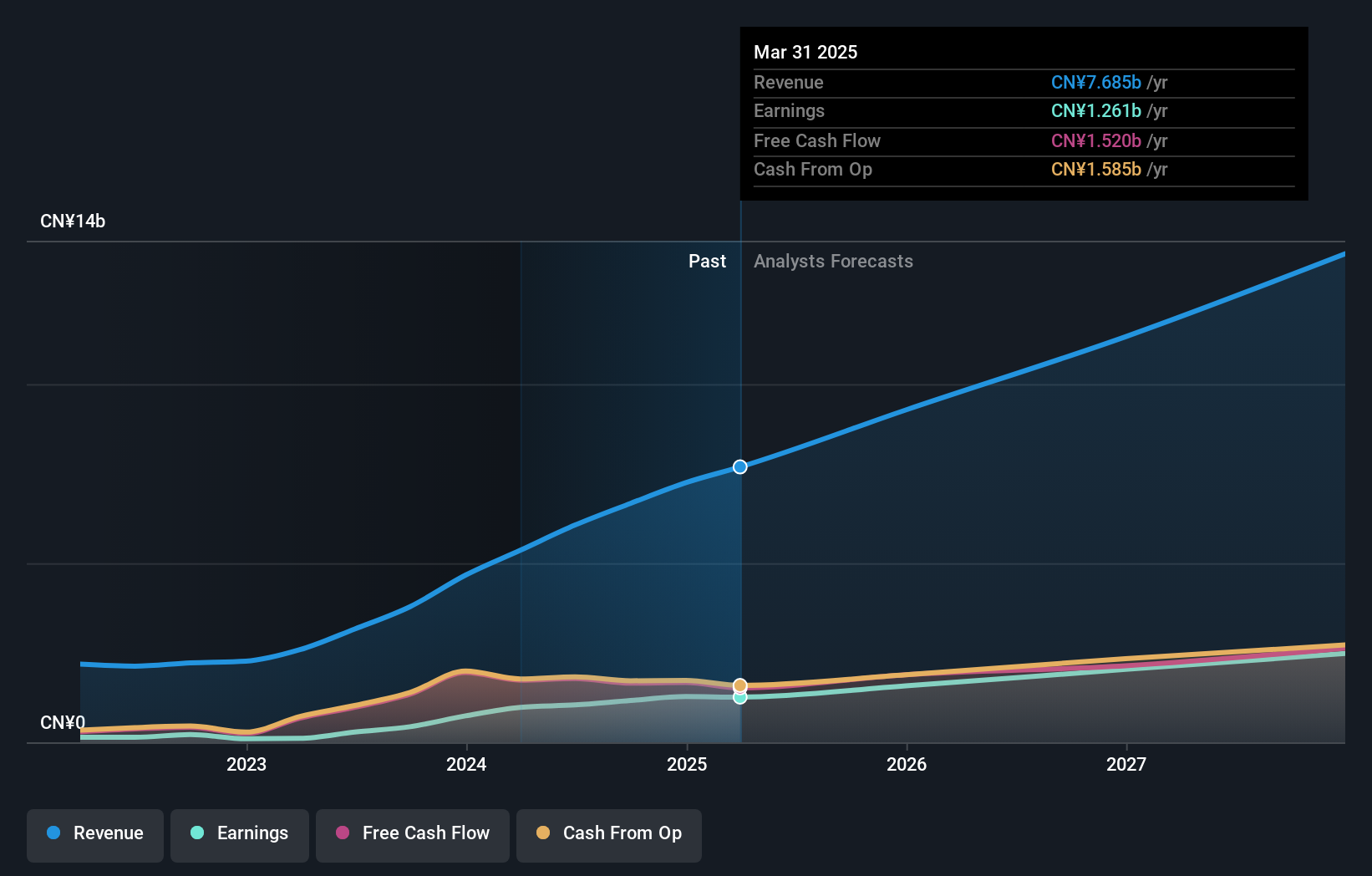

Operations: Atour Lifestyle Holdings generates revenue primarily through its Atour Group segment, which reported CN¥7.69 billion.

Insider Ownership: 22.6%

Return On Equity Forecast: 43% (2028 estimate)

Atour Lifestyle Holdings shows significant growth potential, with earnings expected to grow 24.1% annually, outpacing the US market. The company trades at a substantial discount to its estimated fair value and has announced a $400 million share repurchase program aimed at enhancing shareholder value. Despite recent dividend decreases, revenue guidance suggests a 25-30% increase for 2025. Insider transactions remain stable with no significant buying or selling reported in recent months.

- Unlock comprehensive insights into our analysis of Atour Lifestyle Holdings stock in this growth report.

- The analysis detailed in our Atour Lifestyle Holdings valuation report hints at an deflated share price compared to its estimated value.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of $62.14 billion.

Operations: Cloudflare generates revenue from its Internet Telephone segment, which amounts to $1.77 billion.

Insider Ownership: 10.8%

Return On Equity Forecast: 26% (2028 estimate)

Cloudflare has demonstrated strong growth potential, with earnings projected to grow 41.17% annually and revenue expected to increase faster than the US market. Despite reporting a net loss of US$38.45 million in Q1 2025, Cloudflare's strategic partnerships and product innovations bolster its position in cybersecurity and AI solutions. The recent $1.75 billion fixed-income offering supports expansion efforts, while high insider ownership aligns management interests with shareholders, though no substantial insider trading has occurred recently.

- Take a closer look at Cloudflare's potential here in our earnings growth report.

- Our valuation report unveils the possibility Cloudflare's shares may be trading at a premium.

Sea (SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited is a consumer internet company operating through its subsidiaries in Southeast Asia, Latin America, the rest of Asia, and internationally, with a market cap of approximately $93.65 billion.

Operations: The company's revenue streams are comprised of E-Commerce at $13.19 billion, Digital Entertainment generating $1.95 billion, and Digital Financial Services contributing $2.66 billion, alongside Other Services at $131.44 million.

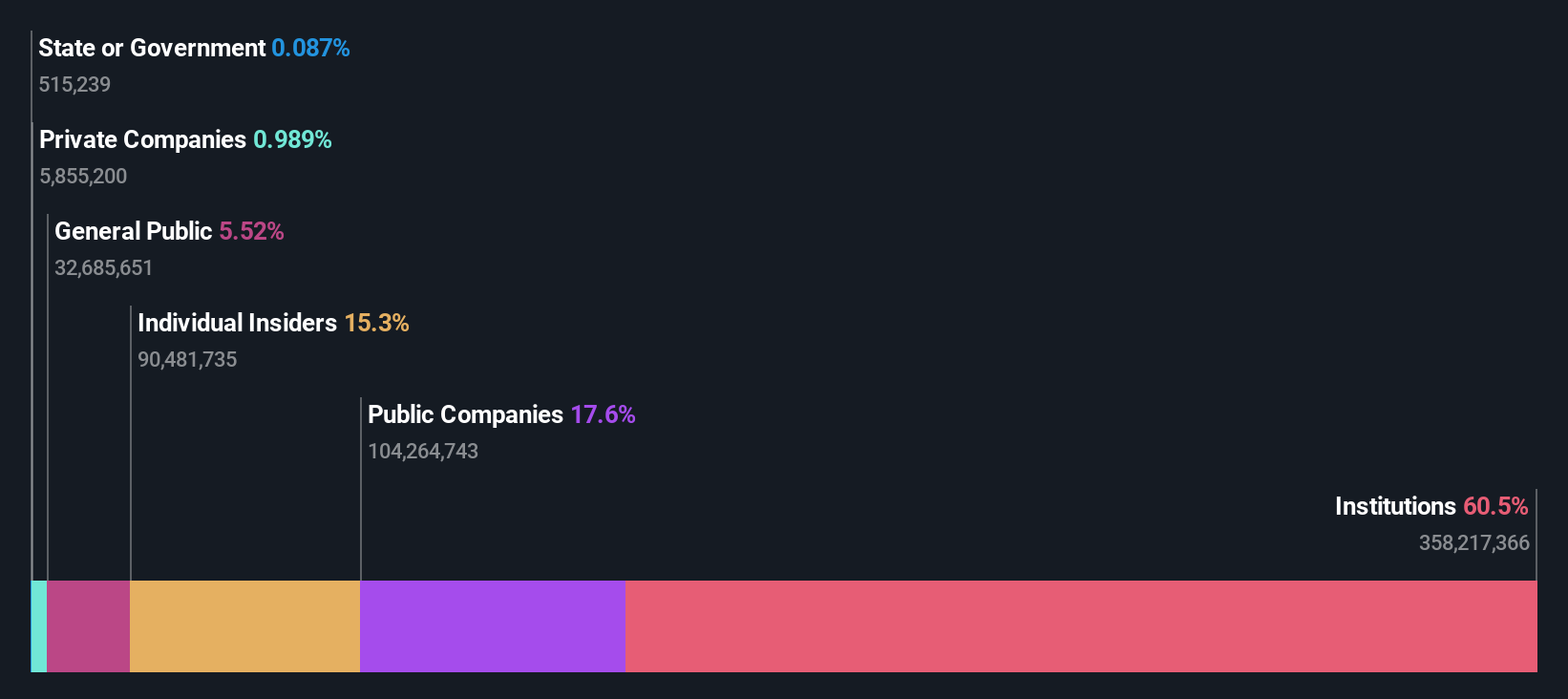

Insider Ownership: 15.3%

Return On Equity Forecast: 21% (2028 estimate)

Sea Limited's earnings are forecast to grow significantly at 30.2% annually, outpacing the US market, while revenue growth is expected to exceed the market average at 14.6% per year. The company's Q1 2025 results showed a substantial turnaround with net income of US$403.05 million compared to a loss last year, indicating strong financial recovery. High insider ownership aligns management interests with shareholders, though there has been no significant insider trading recently.

- Click to explore a detailed breakdown of our findings in Sea's earnings growth report.

- The valuation report we've compiled suggests that Sea's current price could be inflated.

Summing It All Up

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 191 companies by clicking here.

- Ready For A Different Approach? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives