- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Can Atour (ATAT) Unlock New Brand Value With a Retail Industry Veteran Joining Its Board?

Reviewed by Sasha Jovanovic

- Atour Lifestyle Holdings Limited recently announced that Mr. Cong Lin resigned from his director and committee roles on November 10, 2025, due to personal reasons, with leadership responsibilities passed to Mr. Yingchun Song, founder of Wuhan Today Dream Trading Co. Ltd. and a prominent figure in China's retail sector.

- The appointment of Mr. Song, whose experience spans retail, supply chain management, and significant roles in national business associations, positions Atour to potentially benefit from new perspectives in brand operations and corporate governance.

- We'll explore how the addition of an experienced retail leader to Atour's board could reshape its investment narrative and operational outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Atour Lifestyle Holdings Investment Narrative Recap

Investors in Atour Lifestyle Holdings need conviction in the company's ability to expand its hotel and retail brands across China's growing cities, leveraging its experiential brand differentiation to stay ahead of a competitive market. The recent board change, placing Mr. Yingchun Song in a key leadership role, is not expected to materially affect major short-term growth catalysts nor alter the central operational risks that currently define Atour's strategic path.

Among recent announcements, Atour's guidance targeting a 30% year-on-year revenue increase for 2025 stands out as particularly relevant. This reinforces the company’s growth ambitions, setting a high bar for execution just as a new board member with deep retail experience arrives, potentially adding fresh insight as Atour pursues both rapid expansion and franchise quality.

Yet, the greatest challenge for shareholders remains: if competition intensifies or franchise standards slip, the resulting impact on pricing power and profit margins may surprise those who expect uninterrupted gains...

Read the full narrative on Atour Lifestyle Holdings (it's free!)

Atour Lifestyle Holdings' outlook projects CN¥15.4 billion in revenue and CN¥2.8 billion in earnings by 2028. This is based on a 22.5% annual revenue growth rate and an increase in earnings of CN¥1.4 billion from the current level of CN¥1.4 billion.

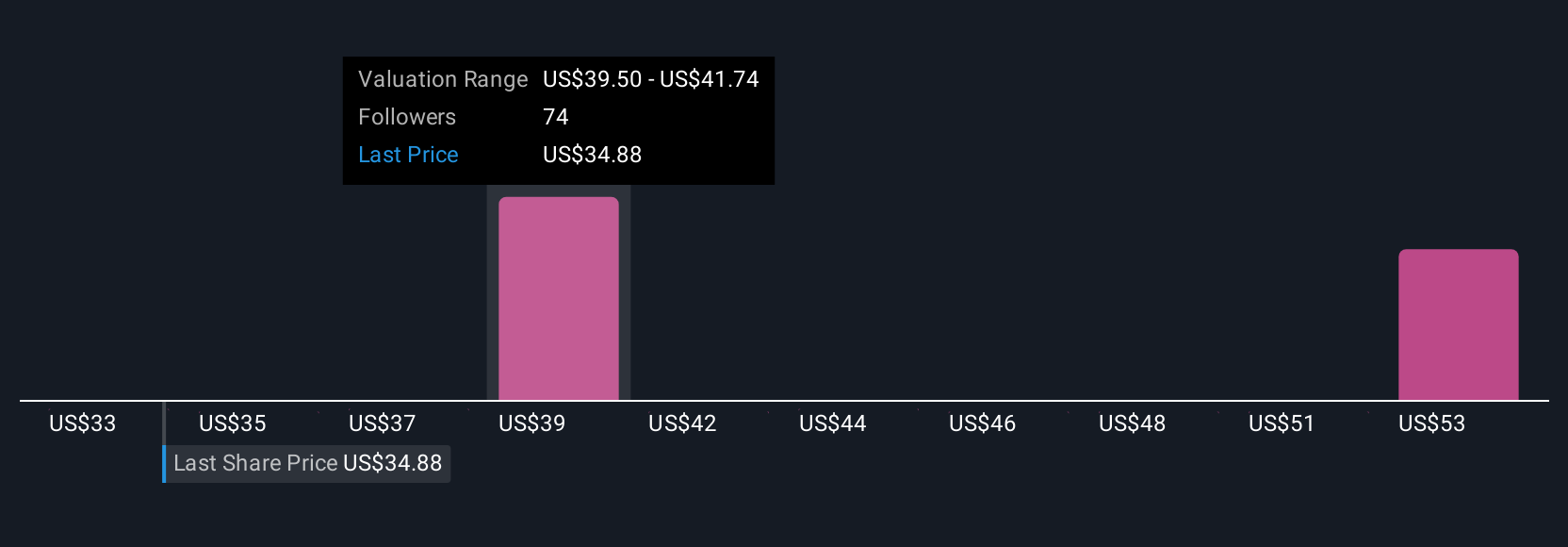

Uncover how Atour Lifestyle Holdings' forecasts yield a $43.77 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community estimate Atour’s fair value between US$37.92 and US$63.53, suggesting a wide gap in outlooks. As new retail expertise joins Atour’s board, opinions on how this affects growth potential and risk may diverge even further, explore the range of views here.

Explore 10 other fair value estimates on Atour Lifestyle Holdings - why the stock might be worth as much as 71% more than the current price!

Build Your Own Atour Lifestyle Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atour Lifestyle Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Atour Lifestyle Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atour Lifestyle Holdings' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives