- United States

- /

- Consumer Services

- /

- NasdaqGS:AFYA

Is Afya’s Recent 5% Jump a Sign of Hidden Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Afya is a hidden bargain or just fairly priced? Let’s take a closer look at what the numbers and market movements are telling us.

- The stock recently climbed 5.4% in the past week but is still down 0.6% over the last month and is sitting at -5.1% so far this year. This creates an interesting setup for investors weighing short-term sentiment versus long-term potential.

- There has been ongoing attention on Brazil’s higher education sector, with education reform discussions and shifts in student financing sparking renewed market interest in Afya. News of partnerships with healthcare networks and expansion into digital learning have also contributed to the conversation around the company’s growth prospects.

- Afya scores a solid 5 out of 6 on our undervaluation checks, suggesting that there may be more beneath the surface. Next, we will break down how different valuation models see the stock’s potential. Stay tuned for an even more insightful approach coming up later in the article.

Approach 1: Afya Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and then discounting them back to today’s value. This approach helps investors gauge whether a stock might be trading above or below its actual intrinsic worth.

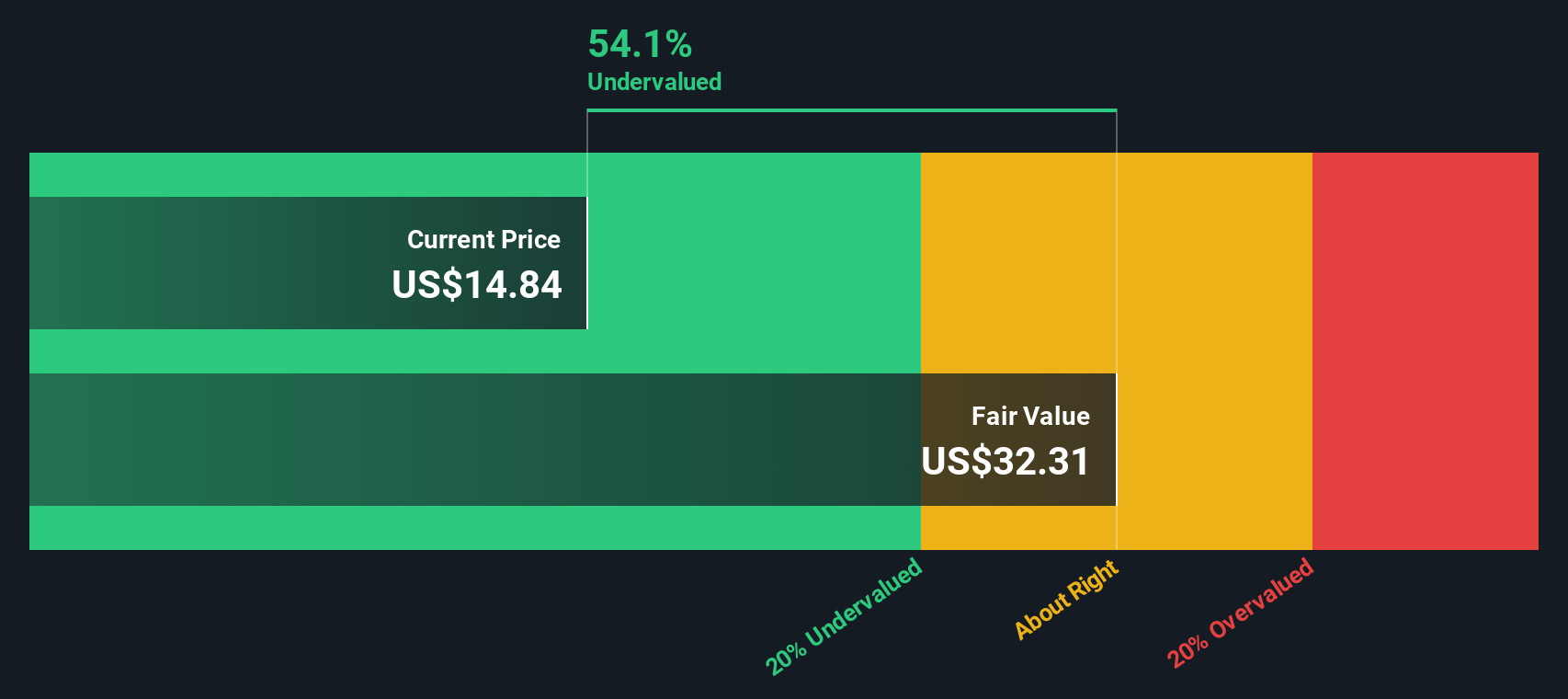

For Afya, the DCF uses a two-stage method focused on Free Cash Flow to Equity. The company’s latest reported Free Cash Flow stands at approximately R$1.18 billion. Analyst growth projections run through 2027, estimating Free Cash Flow to reach R$1.24 billion. Beyond this period, Simply Wall St extrapolates continued growth, forecasting Free Cash Flow to rise to R$1.58 billion by 2035.

According to the model, this series of projected cash flows results in an estimated intrinsic value of $32.24 per share. At current trading levels, this implies Afya is trading at a 54.0% discount to its fair value. This indicates a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Afya is undervalued by 54.0%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Afya Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for assessing profitable companies because it relates the price of a stock to the company’s actual earnings. This approach helps investors quickly judge how much they are paying for current profits and whether those profits are expected to grow.

A "fair" or "normal" PE ratio depends on growth forecasts and risk profile. Companies expected to grow faster or with less risk can justify higher PE multiples, while slower-growing or riskier companies should trade at lower PE ratios.

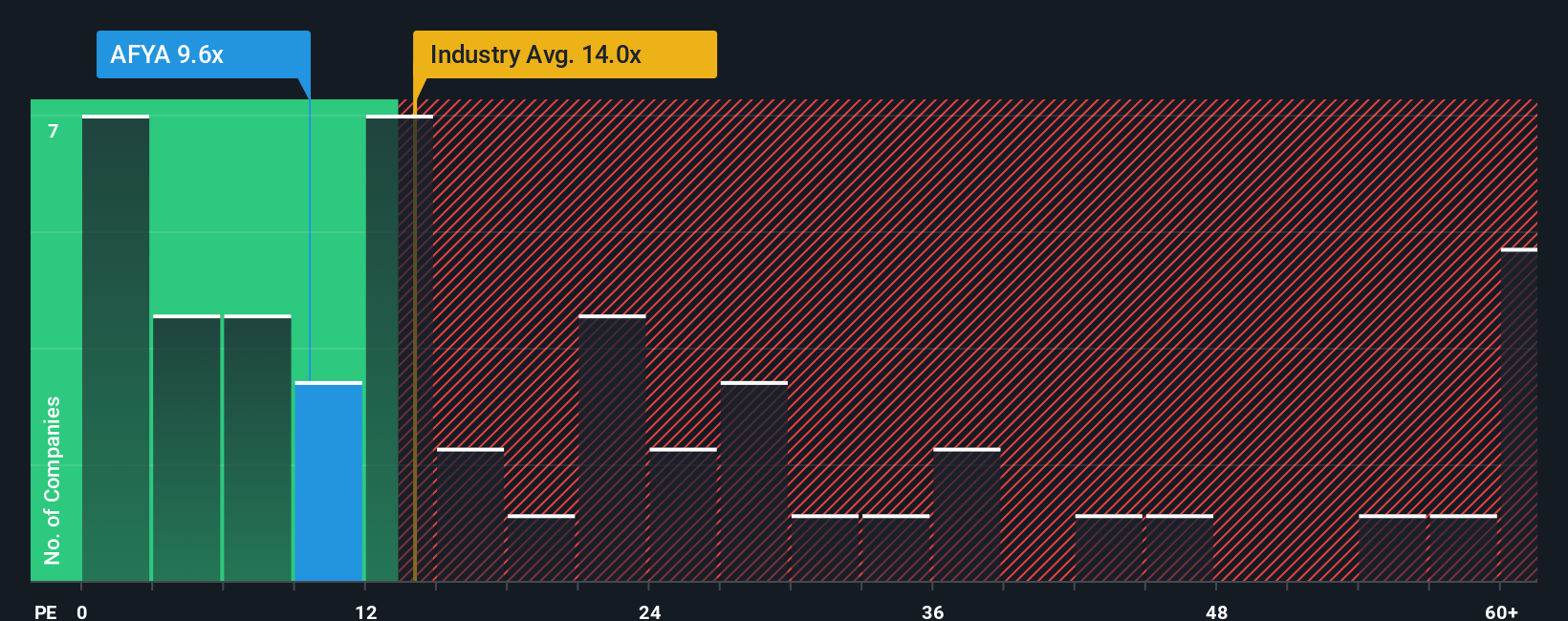

Afya currently trades at a PE ratio of 9.8x, which is notably lower than the Consumer Services industry average of 16.0x and its peer group average of 21.1x. On the surface, this suggests the stock is relatively cheap compared to industry norms and similar companies.

Simply Wall St’s “Fair Ratio” offers a more tailored benchmark by factoring in Afya’s specific growth outlook, profit margins, market cap, and risks. For Afya, the Fair PE Ratio is estimated to be 19.2x. A “neutral” valuation would occur if Afya traded at around this multiple. Unlike simple peer or industry comparisons, the Fair Ratio reflects Afya’s unique fundamentals for a more meaningful reference point.

With Afya’s current PE of 9.8x compared to its Fair Ratio of 19.2x, the stock appears clearly undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Afya Narrative

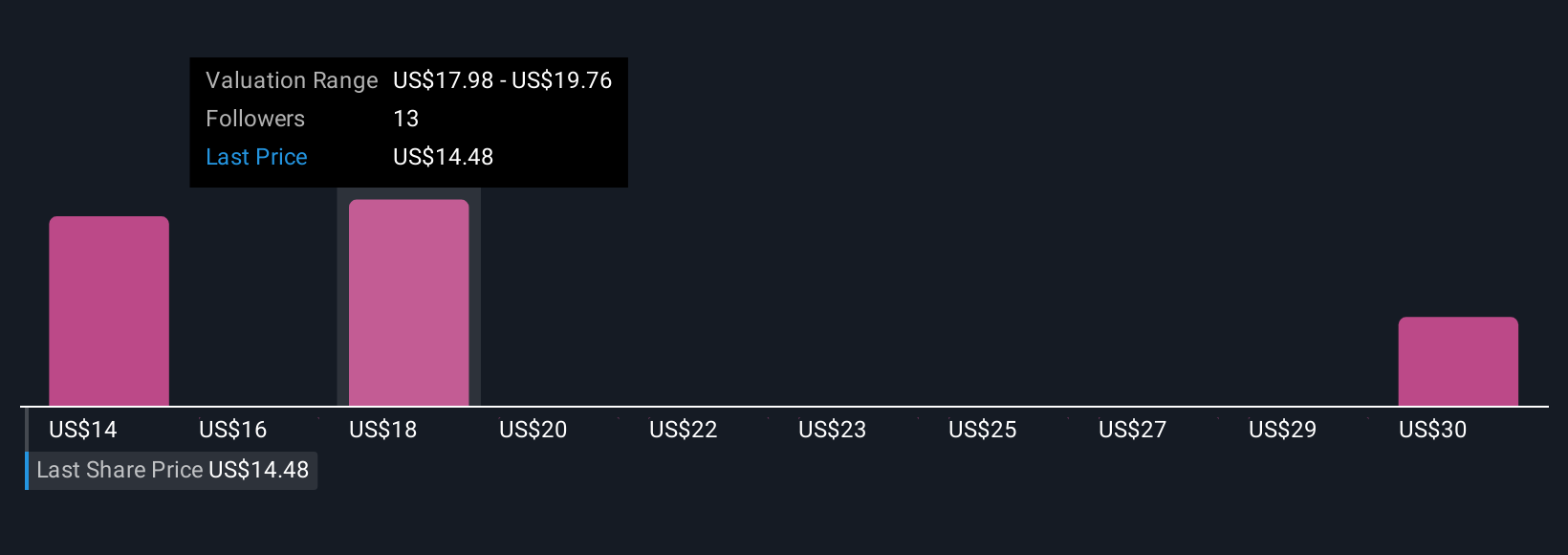

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you tell your own story about a company by connecting your beliefs about Afya’s future revenue, earnings, and margins to a financial forecast, and ultimately, to what you consider its fair value. Narratives bring numbers to life by linking your unique investment thesis to real projections, making it easy for anyone to visualize why they think Afya could be a buy or a sell.

Narratives are available right on the Community page at Simply Wall St, used by millions of investors, and are updated automatically as soon as new earnings reports, news, or business changes come in. This means your story and your Narrative stay fresh with every new development. By comparing your calculated Fair Value to the current stock price, you can decide instantly whether Afya is undervalued or overpriced according to your perspective.

For example, some investors create a bullish Narrative expecting Afya’s earnings to hit R$1.1 billion and a fair price of $25.45 per share, while more conservative users forecast as low as R$915 million earnings, arriving at a fair value of only $14.33. You can pick the Narrative that fits both your research and your outlook on the business.

Do you think there's more to the story for Afya? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFYA

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives