- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Will Airbnb’s (ABNB) Apartment List Partnership Redefine Demand for Flexible Renting Among Younger Users?

Reviewed by Sasha Jovanovic

- Earlier this month, Apartment List announced the addition of Airbnb-friendly apartments to its platform in 25 cities, enabling renters to easily identify properties permitting Airbnb hosting and expanding this feature over time.

- This collaboration directly targets the increasing demand for flexible housing options among Gen Z renters, highlighted by research showing strong financial interest in home-sharing solutions.

- We'll assess how expanded Airbnb-friendly rental options could influence Airbnb's longer-term investment narrative, particularly regarding user engagement and growth potential.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Airbnb Investment Narrative Recap

Owning Airbnb shares means believing in the company's ability to lead the shift towards flexible living and travel, driven by both long and short-term stays. The recent expansion of Airbnb-friendly rentals via Apartment List could support user growth and engagement but does not materially impact the primary short-term catalyst, which remains sustained growth in bookings amid evolving regulations. The biggest near-term risk continues to be regulatory challenges in key markets, especially as demand slows in mature regions.

Among recent company developments, the addition of the Airbnb-friendly filter to Apartment List stands out as most relevant. This partnership has the potential to increase Airbnb's supply pool and appeal, matching ongoing trends among Gen Z renters seeking flexible income solutions. While this may gradually bolster long-term growth prospects, it does little to change the heavier risk posed by regulatory pushback in major cities or the slower bookings growth seen in some core markets.

However, investors should not overlook the persistent threat of intensifying city regulations, especially since...

Read the full narrative on Airbnb (it's free!)

Airbnb's outlook anticipates $15.4 billion in revenue and $3.7 billion in earnings by 2028. Achieving this requires 10.0% annual revenue growth and an increase in earnings of $1.1 billion from the current $2.6 billion.

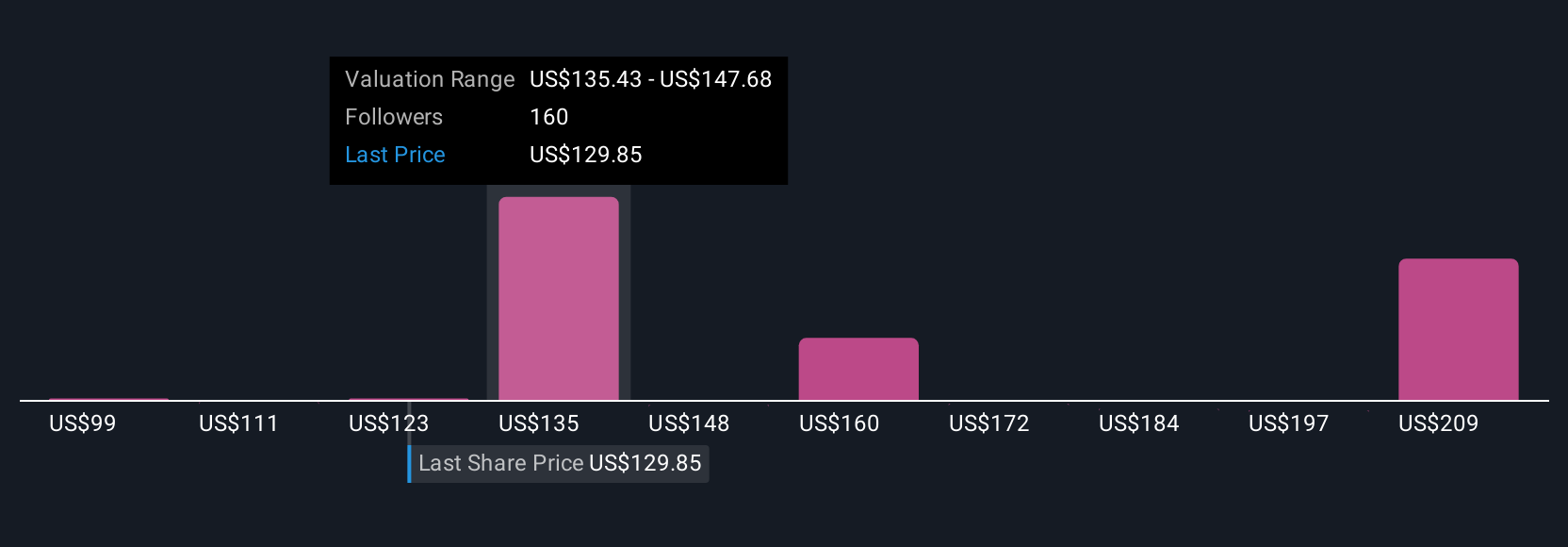

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Bullish analysts have forecast Airbnb’s annual revenue growth hitting 12.6% and earnings reaching US$4.3 billion by 2028, far above consensus. While this optimistic view reflects expectations that global expansion and new offerings like Experiences could accelerate growth, the latest push into Airbnb-friendly rentals could shift these projections yet again. It’s worth considering how widely perspectives vary and exploring which future you find most convincing for your own outlook.

Explore 23 other fair value estimates on Airbnb - why the stock might be worth 8% less than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives