- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Airbnb (ABNB): Evaluating Valuation as Global Expansion and AI Upgrades Drive Investor Interest

Reviewed by Simply Wall St

Airbnb (ABNB) has been catching investors’ eyes lately, with much of the focus on the company’s push into new international markets and ongoing work to improve its platform using artificial intelligence. These moves come at a time when expectations for earnings and revenue growth are gaining traction among shareholders.

See our latest analysis for Airbnb.

After a wave of attention on Airbnb’s global expansion and AI-driven initiatives, its share price has seen modest movement lately, climbing 7% over the past week but still slightly negative year-to-date. While this short-term pop reflects renewed optimism, the one-year total shareholder return of -7% suggests there’s room for momentum to build if the company sustains its growth push.

If you’re watching Airbnb’s shifts and want a fresh perspective, now’s a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

But do these positive trends mean that Airbnb shares are undervalued compared to their growth prospects, or is the market already accounting for what comes next? Is there real upside, or is the future already priced in?

Most Popular Narrative: 22% Undervalued

With Airbnb's fair value estimate set well above its last close price, there are clear signals that the narrative points to significant upside. This view hinges on an evolution in the company's business model and international growth push.

International markets are now picking up the growth while the US market is cooling a bit. They have launched long-term rentals, made over 500 product improvements, and are going all in on AI to make the platform smoother. It is easier now to find the right stay without scrolling for 20 minutes.

Curious which growth bets and profit assumptions justify such a bullish fair value? This narrative backs its price with aggressive international expansion, platform upgrades, and a long-term margin outlook rarely seen in travel. Click through to reveal the full playbook driving this optimistic valuation.

Result: Fair Value of $163.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter regulations in Europe and an unresolved $1.3 billion tax dispute with the IRS could quickly undermine Airbnb's current growth momentum.

Find out about the key risks to this Airbnb narrative.

Another View: What Do the Multiples Say?

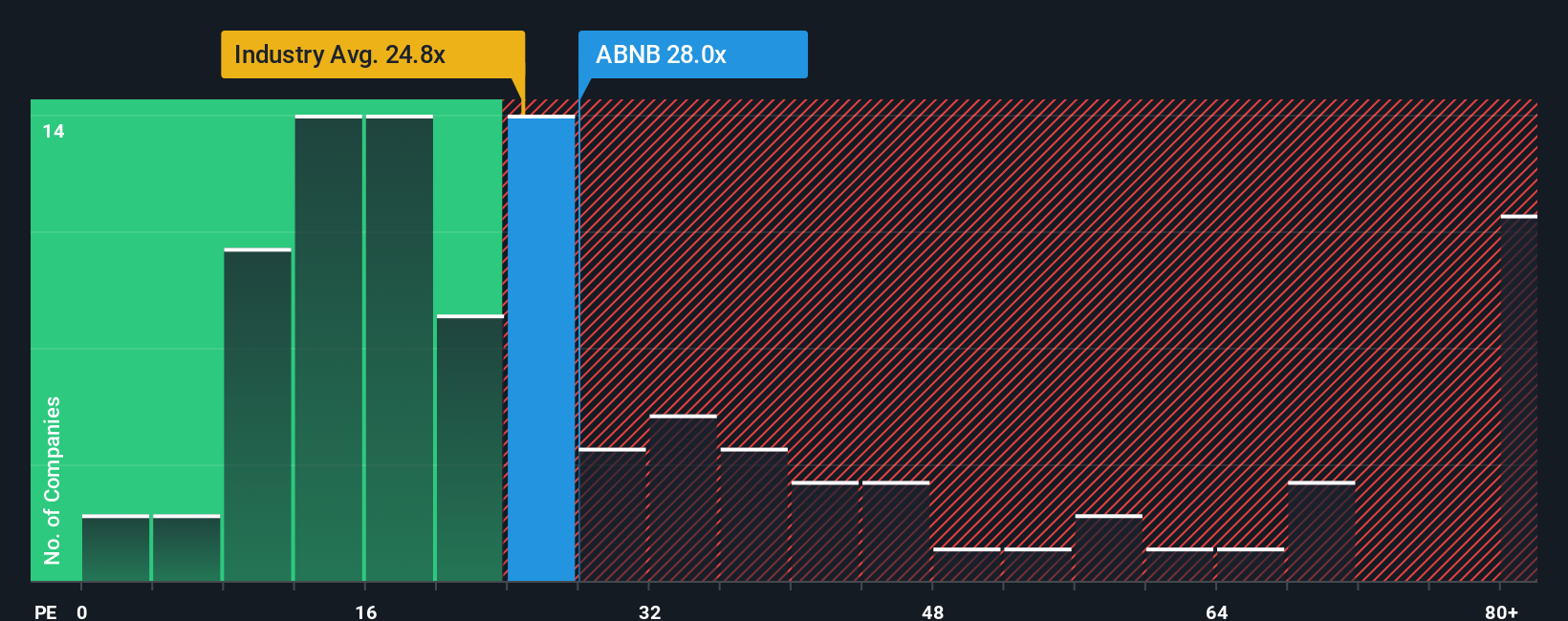

While the fair value estimate suggests Airbnb is undervalued, a look at its price-to-earnings ratio offers additional perspective. Airbnb trades at 29.7 times earnings, which is higher than the US hospitality industry average of 23.5 but slightly below the peer group average of 31.2 and close to its fair ratio of 31. For investors, this means the market is pricing in premium growth, but not excessively so. Does this suggest hidden upside, or is risk still present if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Airbnb Narrative

If you see things differently or want to dive deeper into the numbers yourself, it’s easy to interpret the data and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Airbnb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your horizons and strengthen your strategy by tapping into these timely market directions now.

- Uncover top companies reshaping digital payments and blockchain technology by tapping into these 79 cryptocurrency and blockchain stocks, a resource packed with forward-thinking businesses making headlines.

- Boost your passive income and find stable growth reminders with these 17 dividend stocks with yields > 3%, which spotlights businesses delivering reliable yields above 3%.

- Capitalize on artificial intelligence breakthroughs and see which companies stand out by using these 24 AI penny stocks, highlighting innovators in automation and smart tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives