- United States

- /

- Consumer Services

- /

- NasdaqCM:AACG

If You Had Bought ATA (NASDAQ:ATAI) Shares Three Years Ago You'd Have A Total Return Of 243%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is doubtless a positive to see that the ATA Inc. (NASDAQ:ATAI) share price has gained some 53% in the last three months.

See our latest analysis for ATA

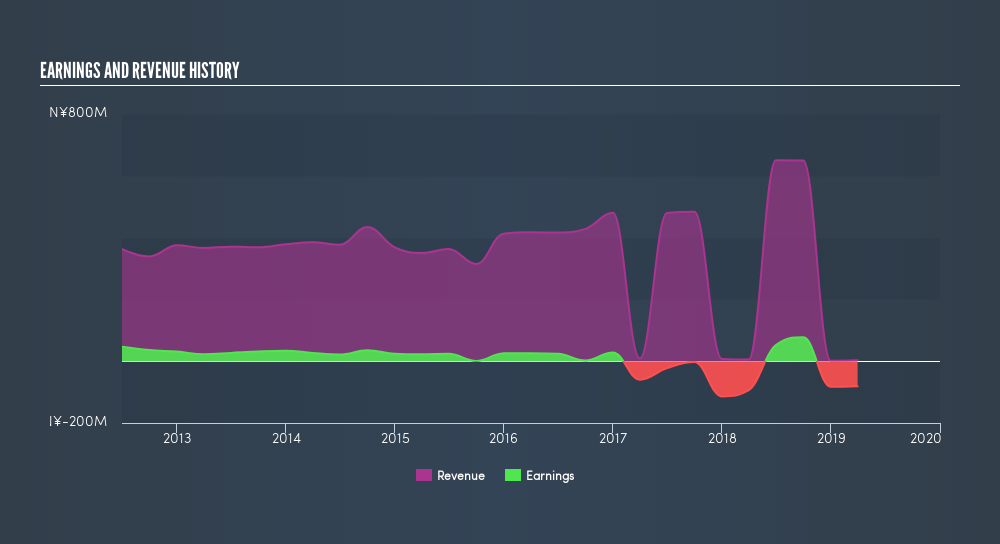

Given that ATA didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, ATA's revenue dropped 26% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 30% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered ATA's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for ATA shareholders, and that cash payout contributed to why its TSR of 243%, over the last 3 years, is better than the share price return.

A Different Perspective

It's good to see that ATA has rewarded shareholders with a total shareholder return of 213% in the last twelve months. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:AACG

ATA Creativity Global

Provides educational services in China and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives