- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart's (NYSE:WMT) Short-Term Pressures are Likely to Continue into Q4

While the market is closing the quarter on the pullback, the retail sector has been underwater for the whole summer. Walmart ( NYSE: WMT ) has now erased all the gains and sunk in the red despite an early rally.

Yet, the company is pushing back on multiple fronts, all while preparing for the holiday season.

Check out our latest analysis for Walmart

Supply Chains and Minimum Wages

Shipping lines are getting clogged while the holiday season is quickly approaching. Worker shortage combined with the buying surge resulted in port traffic jams , with Walmart and other retailers renting their ships.

Meanwhile, over half a million Walmart store workers are getting a US$1/h raise , with the new minimum wage set at US$12/h. But, this is still below the rivals like Amazon or Target that have it at US$15/h. As Walmart is looking to add 150,000 store associates for the upcoming season, the competition for labor is heating up, as seasonally adjusted job openings skyrocketed.

However, the membership service Walmart+ has broken a 32 million threshold by a Deutsche Bank estimation. The membership costs US$99/year and offers perks like free deliveries for orders over US$35 – a perk that might become even more attractive if the autonomous vehicle delivery service succeeds.

The collaboration between Ford Motor Company ( NYSE: F ), Argo AI, and Walmart will test the autonomous delivery service in Miami, Austin, and Washington, D.C. Ford's autonomous vehicles will use Argo AI's self-driving system to fulfill Walmart's orders.

A Look at the Profitability

A shareholder's return on equity or ROE is an essential factor to consider because it tells them how effectively their capital is being reinvested.In simpler terms, it measures the profitability of a company concerning shareholder's equity.

How Is ROE Calculated?

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Walmart is:

12% = US$10b ÷ US$87b (Based on the trailing twelve months to July 2021).

The 'return' is the yearly profit. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.12 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits.We now need to evaluate how much profit the company reinvests or "retains" for future growth, which gives us an idea about the company's growth potential.Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily bear these characteristics.

Walmart's Earnings Growth And 12% ROE

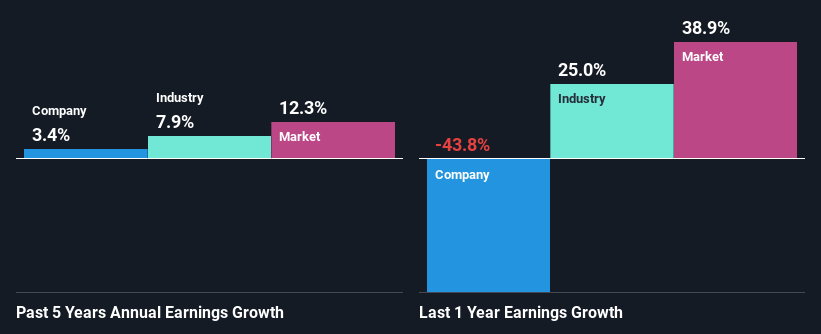

At first glance, Walmart seems to have a decent ROE.And on comparing with the industry, we found that the average sector ROE is similar at 12%.Walmart's five-year net income growth was relatively low despite the modest returns, averaging only 3.4%.

So, there could be some other factors at play that could be impacting the company's growth. For instance, the company pays out a considerable portion of its earnings as dividends or is faced with competitive pressures.

We then compared Walmart's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 7.9% in the same period, which is a bit concerning.

Earnings growth is an important factor in stock valuation.Investors need to determine next if the expected earnings growth, or the lack of it, is already built into the share price.Doing so will help them establish if the stock's future looks promising or ominous.

The intrinsic value infographic in our free research report helps visualize whether the market currently misprices WMT.

Is Walmart Using Its Retained Earnings Effectively?

Despite having an average three-year median payout ratio of 47% (or a retention ratio of 53%) over the past three years, Walmart has seen very little growth in earnings.Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Moreover, Walmart has been paying dividends for at least ten years or more, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Existing analyst estimates indicate that the company's future payout ratio is expected to drop to 35% over the next three years.Accordingly, the predicted drop in the payout ratio explains the anticipated increase in the company's ROE to 20% over the same period.

Conclusion

In total, it does look like Walmart has some positive aspects to its business.However, given the high ROE and high-profit retention, we expect the company to deliver solid earnings growth, but that isn't the case here.

This suggests that there might be some external threat to the business that's hampering its growth - just like we see with the supply chain, minimum wage, and worker shortage issues.

With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts' predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives