- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart's (NYSE:WMT) Dividend Still has a Place in Defensive Portfolios

Despite doing reasonably well through this year, Walmart Inc. ( NYSE: WMT ) failed to break a key level of US$152 for the third time in less than a year. While the company has done alright in the last few quarters, the stock remains flat for the year, significantly lagging behind the main competitors.

In this article, we'll take a look at the latest development and examine the quality of Walmart's dividend.

Q3 Earnings Results

- Non-GAAP EPS: US$1.45 (beat by US$0.06)

- Revenue: US$140.5b (Y/Y increase 4%)

While international net sales decreased 20% from last year, a significant increase came from the more important domestic market, where comparable sales increased 9.6% Y/Y. Furthermore, eCommerce sales increased 8% Y/Y, showing that the company is doing well as a competitive online retailer.

Management is staying optimistic regarding the FY comparable sales growth and EPS, expecting 6% growth and EPS around US$6.40, well above the consensus of US$6.20-6.35.

CEO Dough McMillon reflected on the developments , quoting easing labor market pressures and success in fighting inflation. While stocks like Walmart are known for inflationary resilience, low-cost brands have to be creative about preserving that narrative, squeezing the value elsewhere and not hurting the brand.

A Look Into Walmart's Dividend

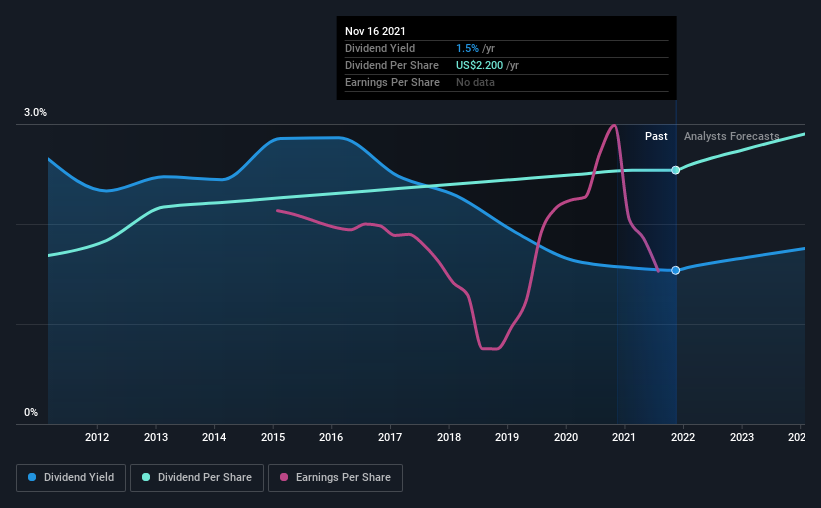

A 1.5% yield is nothing to get excited about, but investors probably think the long payment history suggests Walmart has some staying power.The company also bought back stock equivalent to around 1.8% of market capitalization this year.

There are a few simple ways to reduce the risks of buying Walmart for its dividend, and we'll go through these below. You can watch an in-depth analysis of Walmart through our platform on our YouTube channel.

Click the interactive chart for our full dividend analysis

Payout ratios

In the last year, Walmart paid out 61% of its profit as dividends.This is a reasonably normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders limiting the capital retained in the business - which could be good or bad.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend.Walmart's cash payout ratio in the last year was 34%, which suggests dividends were well covered by cash generated by the business.It's positive to see that both profits and cash flow cover Walmart's dividend since this is generally a sign that the dividend is sustainable. A lower payout ratio usually suggests a more significant margin of safety before the dividend gets cut.

Remember, you can always get a snapshot of Walmart's latest financial position by checking our visualization of its financial health .

Dividend Volatility and Growth Potential

Walmart's dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends.During the past 10-year period, the first annual payment was US$1.5 in 2011, compared to US$2.2 last year.This works out to be a compound annual growth rate (CAGR) of approximately 4.2% a year over that time.

While the consistency in the dividend payments is impressive, we think the relatively slow growth rate is unappealing.Over the past five years, it looks as though Walmart's EPS have declined at around 5.0% a year.

If earnings continue to decline, the dividend may come under pressure. Every investor should assess whether the company is taking steps to stabilize the situation.

Conclusion

Dividend investors should always want to know if a company's dividends are affordable, if there is a track record of consistent payments, and if the dividend can grow.

Walmart's payout ratios are within a normal range for the average corporation, and we like that its cash flow was more robust than reported profits. However, it's not great to see earnings per share shrinking. Meanwhile, the dividends have been consistent, and there is a rich multi-decade history of consistent payouts.

In sum, while we're not highly excited about Walmart's dividend, we can see it as a part of yield-oriented defensive portfolios.

Despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 4 warning signs for Walmart that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalization above $1bn and yielding more than 3%.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives