- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT) Valuation: Is There More Upside Ahead After a Year of Steady Gains?

Reviewed by Kshitija Bhandaru

See our latest analysis for Walmart.

Walmart's share price has seen modest gains over the past year, with a one-year total shareholder return of 27% reflecting steady resilience even as short-term moves remain muted. This points to ongoing confidence in the company's fundamentals and future prospects as it adapts to a changing retail environment.

If you're curious about where the next big opportunities might come from, now is the perfect time to spot new leaders by exploring fast growing stocks with high insider ownership

Yet with shares hovering just below analyst targets and strong long-term performance, investors are left wondering whether Walmart’s current price reflects its true value or if another buying opportunity is just ahead.

Most Popular Narrative: 8.9% Undervalued

With Walmart’s last close at $102.07 and the narrative consensus fair value set at $112, investors see meaningful upside in the current price if core assumptions hold true. This has sparked debate about what’s fueling this optimism.

Expansion of high-margin business streams such as Walmart Connect (advertising, up 31-46% globally), marketplace, and Walmart+ memberships (global advertising up 46%, membership income up 15%) is diversifying Walmart's income base beyond retail, gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Want to uncover the headline numbers and bold projections that power this bullish fair value? The secret isn't just in retail sales. It's about a new earnings trajectory and margin mix that has analysts rethinking what Walmart could be worth. Discover what underpins these ambitious expectations, because the key assumptions may surprise you.

Result: Fair Value of $112 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures in international operations and rising competition in digital retail could present real challenges to Walmart's optimistic growth outlook.

Find out about the key risks to this Walmart narrative.

Another View: Multiples Tell a Different Story

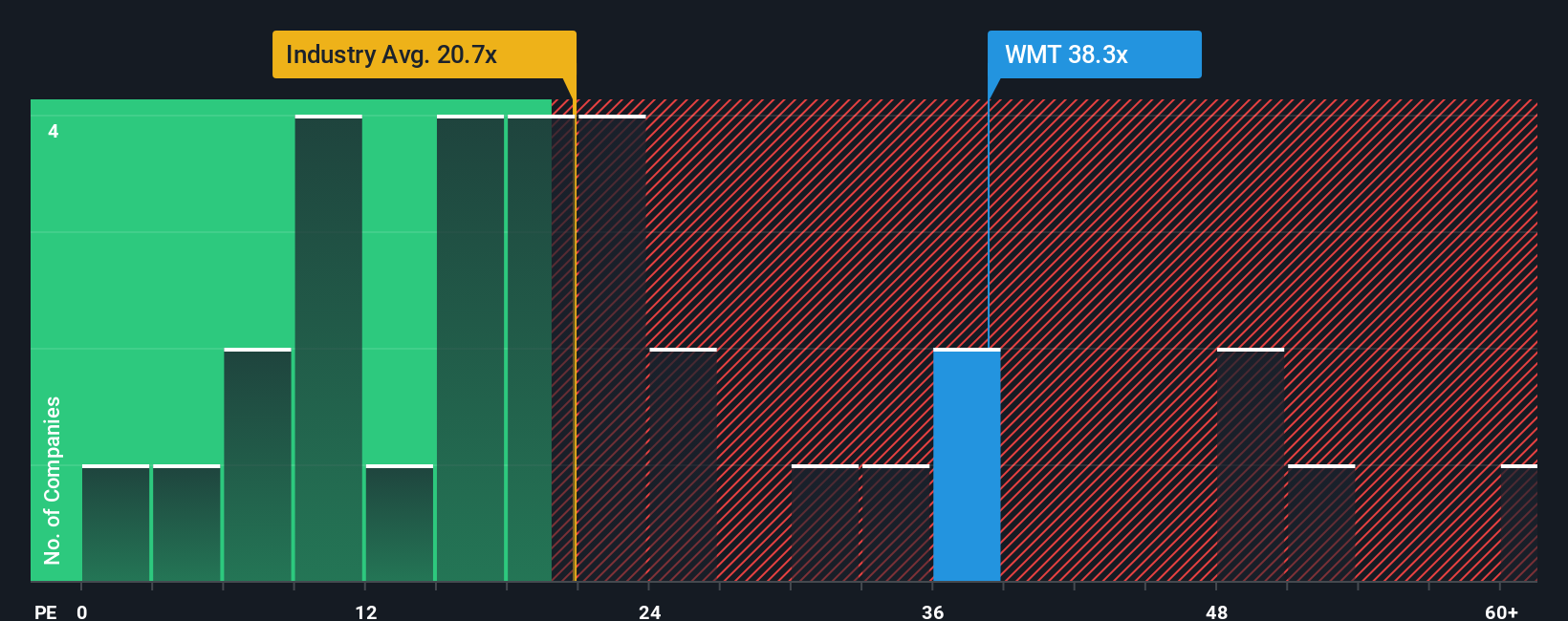

Looking at Walmart's valuation through the lens of price-to-earnings, the picture changes. Its P/E ratio of 38.1x is much higher than the industry average of 21x and also exceeds the peer average of 25x, as well as the fair ratio of 31.9x. This premium puts Walmart in expensive territory and may raise concerns for investors about valuation risk, especially if growth targets are missed. Could the market be too optimistic, or is this premium truly justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If you want to dive deeper or have a different perspective, you can quickly explore the data and craft your own take in just a few minutes. Do it your way

A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step confidently into the world of smart investing and be the first to spot tomorrow’s top performers. Don’t let these unique opportunities pass you by!

- Unlock high yields, dependable cash flow, and stable returns by tapping into these 19 dividend stocks with yields > 3%, which offers generous payouts above 3%.

- Spot underappreciated gems that may be ready for re-rating with these 896 undervalued stocks based on cash flows, which is based on in-depth cash flow analysis and market mispricings.

- Explore the next AI innovation wave and consider your growth potential by reviewing these 24 AI penny stocks, which features cutting-edge business models and strong momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives