- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT) Net Margin Improvement Reinforces Bullish Profitability Narratives Despite Rich Valuation

Reviewed by Simply Wall St

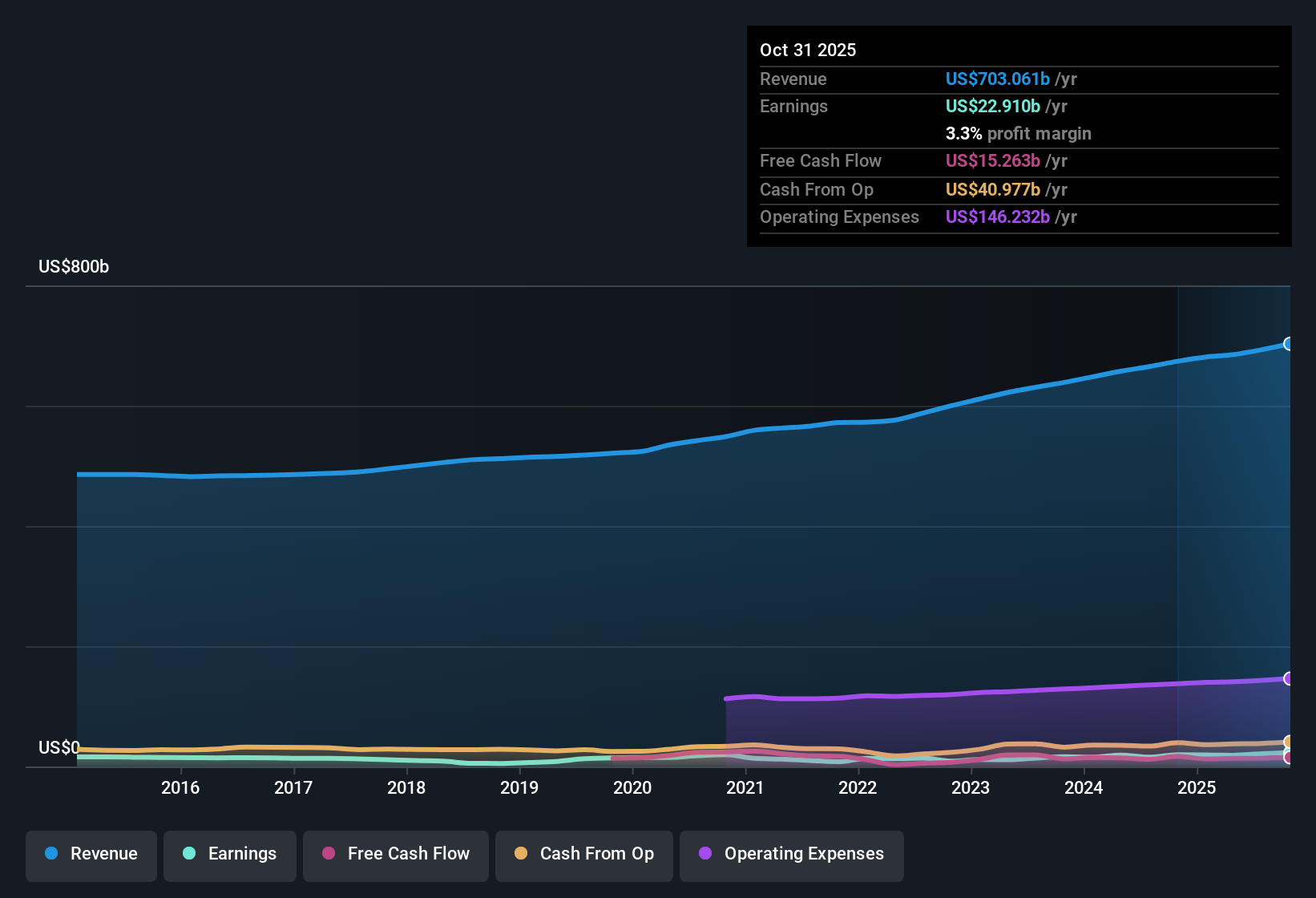

Walmart (WMT) just posted its Q3 2026 numbers, with revenue of about $179.5 billion and net income of roughly $6.1 billion translating to EPS of $0.77 as investors focus on how these figures feed into the retailer’s earnings momentum story. The company has seen revenue move from around $169.6 billion in Q3 2025 to $179.5 billion in Q3 2026, while trailing twelve month net income climbed from about $19.4 billion to $22.9 billion. This sets the stage for investors to parse how sustained profitability and a firmer margin profile shape the near term outlook.

See our full analysis for Walmart.With the headline figures on the table, the next step is to see how they line up against the prevailing narratives around Walmart’s growth, margins, and long term profit trajectory.

See what the community is saying about Walmart

Margins Climb To 3.3 Percent

- Over the last 12 months, net profit margin improved to 3.3 percent from 2.9 percent while net income reached about $22.9 billion on roughly $703.1 billion of revenue.

- Analysts' consensus view sees omni channel and higher margin streams as key drivers of future profitability. However, the current 3.3 percent net margin still sits well below the 3.5 percent margin they expect in about three years. Investors will watch whether cost pressures in international e commerce and logistics slow that shift, even as higher margin areas like advertising and memberships expand.

Earnings Growth Outpaces Sales

- Trailing 12 month earnings grew 16.4 percent to about $22.9 billion, versus revenue growth of around 4.5 percent to $703.1 billion, pointing to profit rising faster than the top line.

- Bulls argue that investments in AI, faster delivery, and higher margin businesses justify this 16.4 percent earnings growth and a 5 year earnings CAGR of 11.8 percent. However, the fact that revenue is only forecast to grow 4.5 percent per year while earnings are expected to grow about 6.11 percent means the bullish case rests on continued margin expansion rather than a major acceleration in sales.

Premium Valuation Versus Peers

- The stock trades around $114.84, which is above the DCF fair value of about $110.94, and on roughly 40 times earnings compared with about 26 times for peers and 20.7 times for the broader US consumer retailing industry.

- Bears highlight that paying about 40 times earnings when earnings are forecast to grow roughly 6.11 percent annually and revenue about 4.5 percent per year could be demanding, especially since the current price of $114.84 already sits above both the DCF fair value of $110.94 and an illustrative analyst price target of $118.79. Any slowdown in the recent 16.4 percent earnings growth could make that premium harder to defend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Walmart on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can turn that perspective into a fresh narrative that reflects your own outlook: Do it your way.

A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

While Walmart is posting healthy profit gains, its premium valuation and dependence on ongoing margin expansion leave little room for missteps or slower earnings growth.

If you are uneasy about paying up for that kind of uncertainty, use our these 908 undervalued stocks based on cash flows to quickly find companies where current prices better reflect their fundamentals and upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026