- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT): Evaluating Valuation as the Retailer Expands Branded Stores into South Africa

Reviewed by Kshitija Bhandaru

Walmart (WMT) is making headlines again, this time with its decision to open the company's first branded stores in South Africa. Investors who track Walmart's ongoing international push will recognize this as more than just another expansion, as it represents a strong commitment to growth in emerging markets. With sites already being developed and a clear focus on omni-channel capabilities, Walmart is signaling its intent to broaden its global reach and build relationships with local suppliers. For current and prospective shareholders, this new front raises the question: how much is this expansion going to shape the company's value going forward?

The timing of this move comes as Walmart's momentum has built steadily over the past year, reflected in the stock's 31% gain. Recent months have seen Walmart in the news with launches and strategic partnerships, from retailing new wellness brands to debuting responsible e-waste solutions in Canada. In the short term, the stock is up over 5% in the last month, which suggests markets are starting to take notice of these expansion efforts and, perhaps, of the company’s improved growth profile relative to previous years.

So, after a strong run this year and new excitement over international growth, is Walmart offering a true buying opportunity, or are markets already pricing in everything for the next phase?

Most Popular Narrative: 8.6% Undervalued

The current consensus suggests Walmart is undervalued by 8.6%, with market watchers pointing to growing earnings power and long-term business transformation as drivers of further upside.

Expansion of high-margin business streams, marketplace, and Walmart+ memberships is diversifying Walmart's income base beyond retail. This is gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time. Strengthening international footprint, notably in fast-growing markets such as China, Mexico and India, leverages urbanization and middle-class expansion. Localization strategies and tech platform rollouts are expected to fuel both top line and bottom line growth.

Want to know the secret behind Walmart’s big valuation call? Analysts are betting on a game-changing financial mix, blending new income streams and profit levers usually seen in entirely different sectors. What is the boldest quantitative assumption hidden in their math? Find out which numbers are quietly driving this fair value and why they might surprise you.

Result: Fair Value of $112 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent losses in international e-commerce, or escalating cost pressures such as tariffs and inflation, could quickly dampen Walmart’s growth momentum and valuation outlook.

Find out about the key risks to this Walmart narrative.Another View: Multiples Tell a Different Story

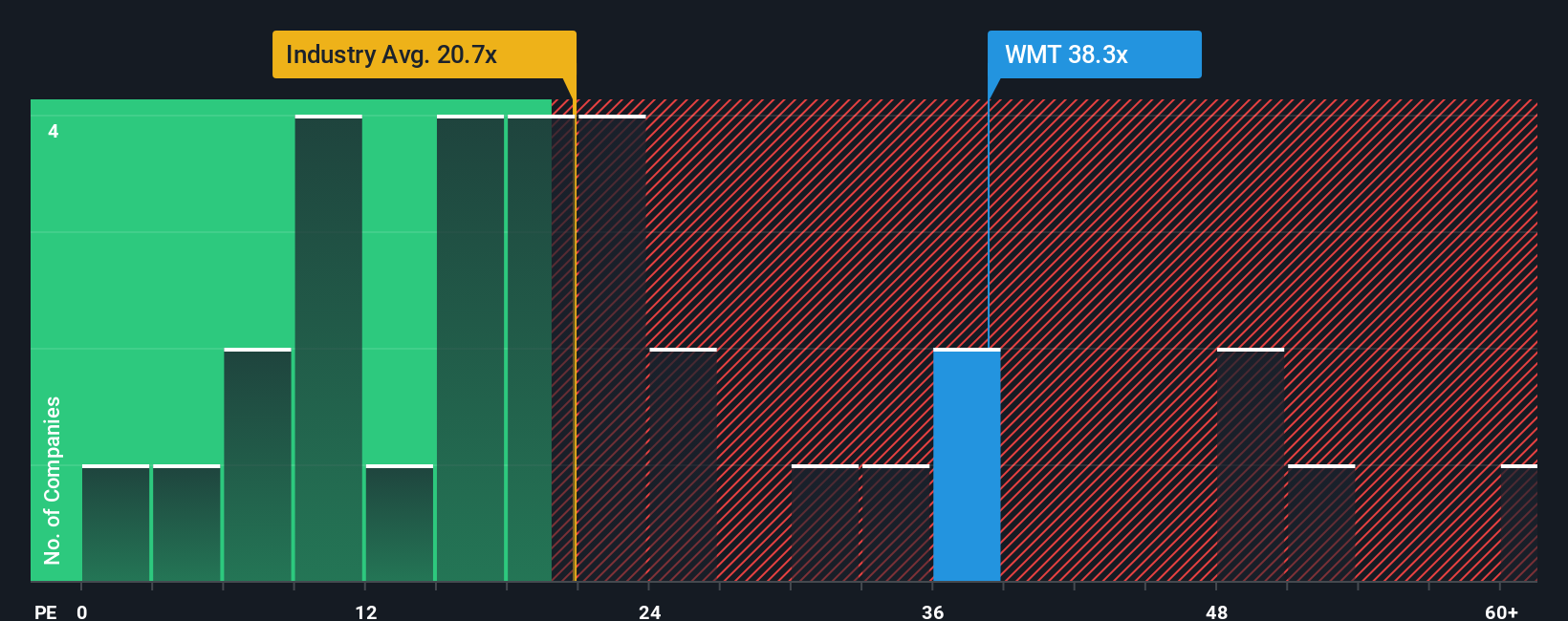

While the consensus sees Walmart as undervalued, another angle using its earnings ratio paints a more cautious picture. This suggests the shares may be pricier than the industry average. Has optimism run too far, or does momentum justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If you see the numbers differently or want to test your own insights, the tools are here for you to build a custom Walmart story in just a few minutes. Do it your way.

A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors know that the strongest portfolios often include companies shaping tomorrow’s trends. Don’t let key opportunities pass you by. Let these expertly curated ideas inspire your next big move:

- Capture value by uncovering hidden gems among undervalued stocks based on cash flows using undervalued stocks based on cash flows. See which overlooked companies could challenge the market’s expectations.

- Pursue stability and income by searching for dividend stocks with yields greater than 3% through dividend stocks with yields > 3%. Set yourself up for reliable returns, even when markets fluctuate.

- Get ahead of the curve and position yourself with AI-driven innovators when you explore AI penny stocks, featuring businesses at the forefront of automation, artificial intelligence, and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives