- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

How Investors May Respond To Walmart (WMT) Expanding Milk Production And Higher-Margin Beauty And Food Brands

Reviewed by Sasha Jovanovic

- In recent weeks, Walmart opened a US$350.00 million, 300,000+ square-foot milk processing facility in Valdosta, Georgia and welcomed multiple brand partners, including a nationwide GLO24K LED skincare rollout to more than 200 stores and expanded availability of Filippo Berio olive oils across its U.S. network.

- These moves underline Walmart’s push to deepen control over essential grocery supply chains while broadening into higher-margin, innovation-led categories like beauty technology and premium food.

- We’ll now examine how Walmart’s new Valdosta milk facility and GLO24K partnership influence its investment narrative around supply chain control and category mix.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Walmart Investment Narrative Recap

To own Walmart, you generally need to believe its scale, omni-channel strategy, and higher-margin businesses can offset thin retail margins and rising costs. The new Valdosta milk facility and GLO24K rollout modestly support this thesis near term by tightening control over grocery supply and nudging mix toward premium and innovation-led categories, but they do not materially change the key short term catalyst of scaling profitable digital/omni-channel growth or the biggest risk around ongoing margin pressure from logistics, wages, and competition.

The Valdosta milk facility is the most relevant recent announcement here, because it directly touches Walmart’s supply chain economics in a core, everyday category. By processing and bottling Great Value and Member’s Mark milk for more than 650 stores and clubs across the Southeast, it fits into the same story as e-commerce logistics and automation: if Walmart can squeeze more efficiency from essential grocery, it has more room to invest in customer experience, digital capabilities, and higher-margin categories like beauty tech devices and premium food.

Yet even with these supply chain gains, investors still need to be aware that persistent delivery and wage cost inflation could...

Read the full narrative on Walmart (it's free!)

Walmart's narrative projects $789.9 billion revenue and $27.4 billion earnings by 2028. This requires 4.5% yearly revenue growth and about a $6.1 billion earnings increase from $21.3 billion today.

Uncover how Walmart's forecasts yield a $118.38 fair value, a 3% upside to its current price.

Exploring Other Perspectives

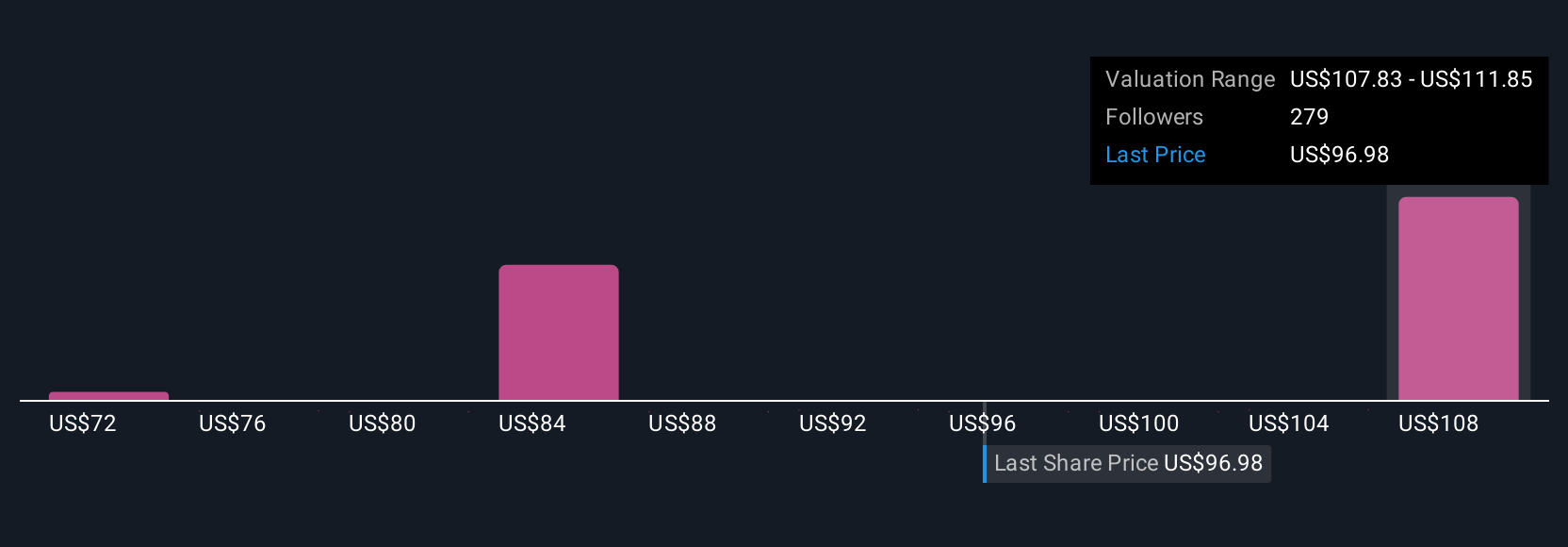

Seventeen members of the Simply Wall St Community currently see Walmart’s fair value between US$91.38 and US$118.38, underscoring how far views can spread. Set against this, the biggest near term watchpoint remains whether rising logistics and labor costs outpace the benefits from e-commerce scale and mix shift, so it is worth comparing several of these perspectives before forming your own view.

Explore 17 other fair value estimates on Walmart - why the stock might be worth 21% less than the current price!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026