- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Does Walmart’s Stock Still Offer Value After 29% Gain and Prescription Delivery News?

Reviewed by Simply Wall St

Thinking about what to do with Walmart stock right now? You are not alone. Whether you have held onto it for years or are considering jumping in, Walmart continues to capture investors’ attention with growth and adaptability. Just look at its recent performance. In the last year, Walmart stock has delivered an impressive 29.2% return. Over five years, it is up a remarkable 140.9%. Even in the past month, it has climbed 6.2%, which is noteworthy for a retail giant often labeled as a defensive play.

What has been fueling this momentum? News headlines are part of the answer. Walmart is not standing still; it is taking steps to expand into fresh markets, from launching same-day pharmacy deliveries (even for refrigerated prescriptions like Ozempic) to rolling out a branded wireless plan through OnePay. The company's bold moves, especially in logistics and digital services, are rewriting what big-box retail can look like and shifting how investors perceive its long-term growth and risk profile.

Despite this solid price action and the narrative of innovation, valuation metrics tell a different story. Using a 6-point checklist to assess if the stock is undervalued, Walmart scores a 0, meaning it is not undervalued by any of the standard measures we are tracking.

Let’s break down the valuation approaches behind that score, then see if there is another, smarter way to understand where Walmart’s value really lies.

Walmart scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common approach used to estimate what a business is worth by projecting its future cash flows and then discounting those figures back to today's value. This helps investors gauge if a stock is trading at a fair price given its future earning potential.

For Walmart, the current Free Cash Flow is reported at $15.7 Billion. Analysts forecast steady growth, projecting Free Cash Flow to reach $28.9 Billion by 2030, with estimates extending further based on historical trends and modest growth rates. Notably, analyst projections are typically most reliable up to five years, with longer-term forecasts extrapolated from available data.

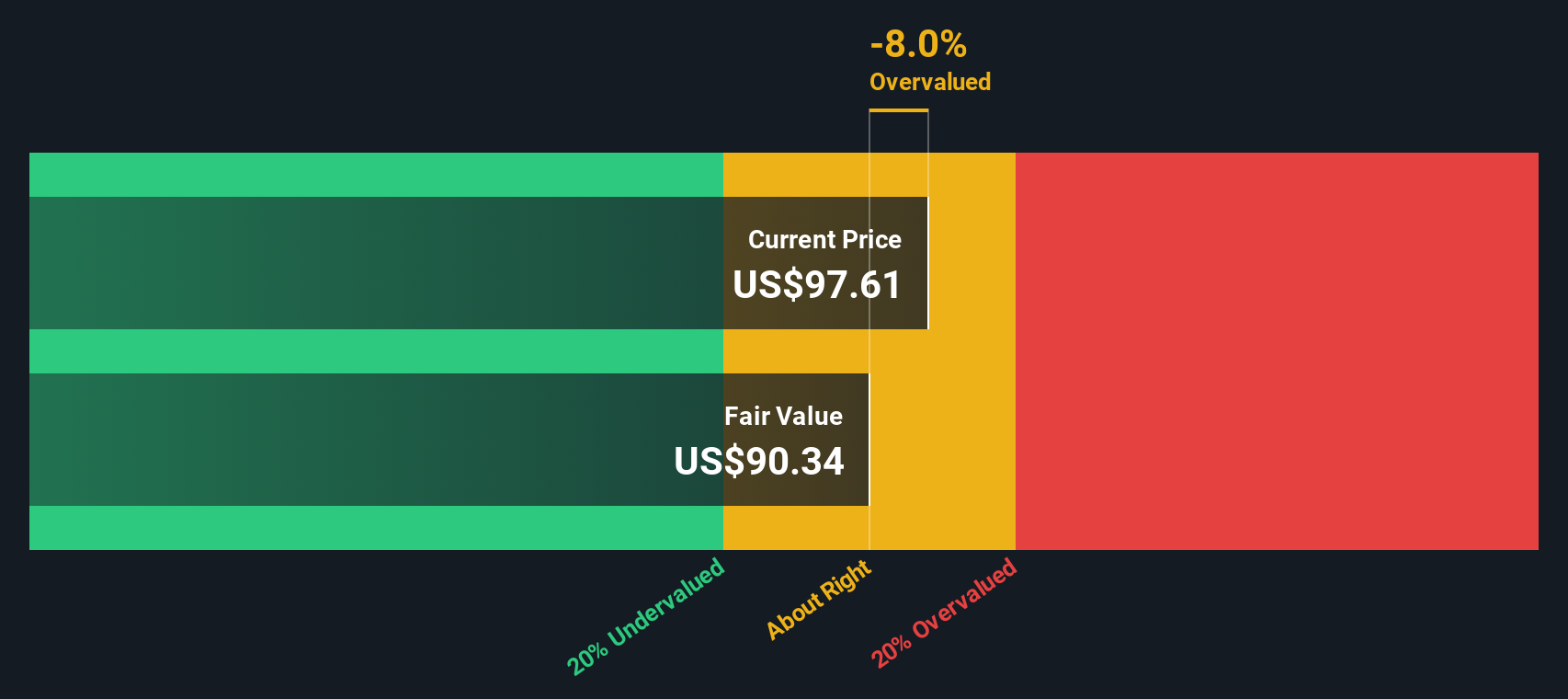

According to this DCF analysis, Walmart's calculated fair value comes out to $94.39 per share. Compared to its current market price, this means the stock is about 8.9% overvalued. Although this exceeds the DCF estimate, it is only a marginal difference and signals that Walmart's shares are trading slightly above their intrinsic value at present.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Walmart.

Approach 2: Walmart Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely recognized valuation metric for profitable companies like Walmart. It provides insight into how much investors are willing to pay for each dollar of earnings, making it particularly useful when evaluating mature businesses with steady profits.

Growth expectations and perceived risk play a significant role in shaping what is considered a "normal" or "fair" PE ratio. Companies with higher earnings growth and stronger competitive positions usually warrant higher PE ratios. Those facing uncertainty or slower growth typically deserve lower ratios.

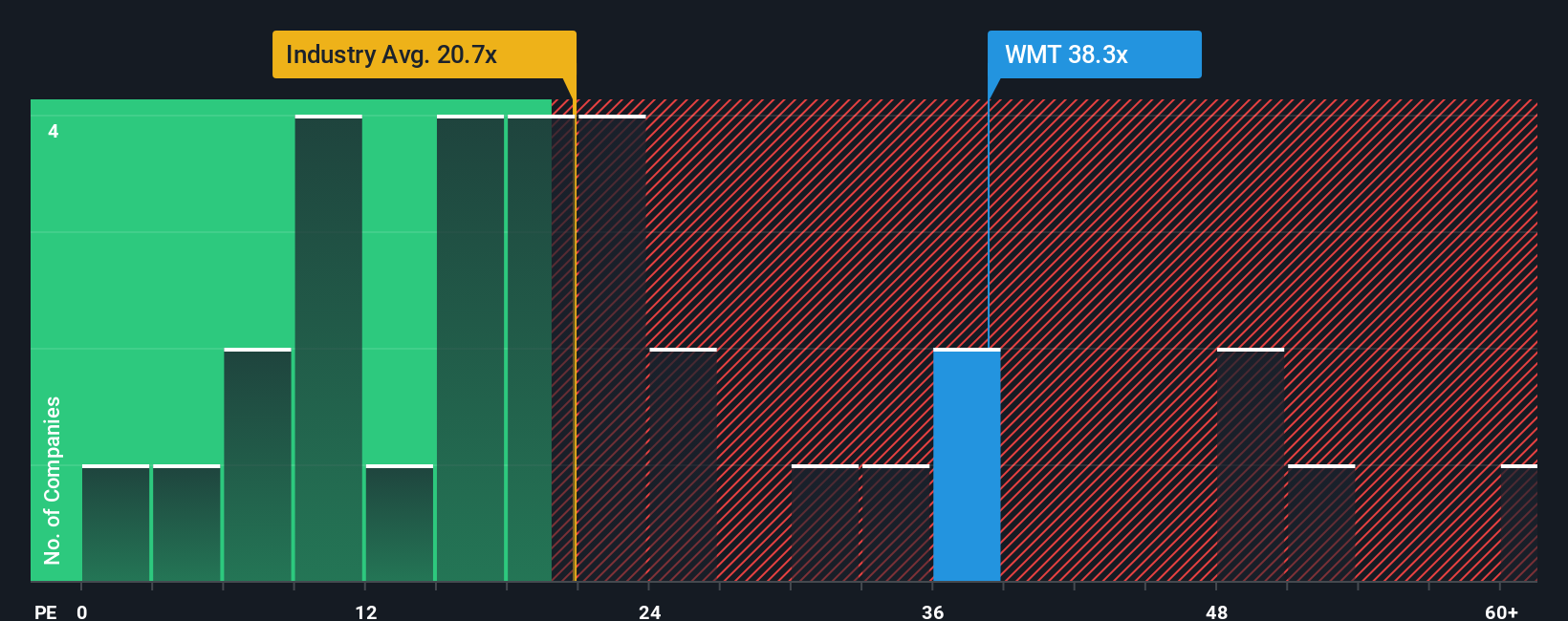

Walmart's current PE ratio stands at 38.4x. For comparison, the Consumer Retailing industry average is 20.7x, and the average among Walmart’s direct peers is 26.0x. At first glance, Walmart appears to be trading at a premium to both its industry and peers.

To offer a more tailored benchmark, the Fair Ratio devised by Simply Wall St considers Walmart’s unique attributes such as its earnings growth, profit margins, size, and risk profile. This proprietary metric gives a calculated Fair PE Ratio of 35.4x for Walmart. Unlike a simple peer or industry comparison, the Fair Ratio adjusts for what actually matters to Walmart’s long-term value drivers and gives investors a clearer lens for checking valuation.

Comparing Walmart’s current PE of 38.4x to its Fair Ratio of 35.4x, the difference is small and within normal ranges. This suggests that Walmart’s shares are priced about right on this measure.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Walmart Narrative

Earlier, we mentioned there is an even better way to understand a company's value. Let us introduce you to Narratives. A Narrative is a personalized story that connects your perspective on Walmart, including how you see its strategy, risks, and opportunities, to a clear set of financial forecasts and, ultimately, your calculated fair value.

With Narratives, you move beyond static valuation ratios to a living and adaptable framework that links what is happening in Walmart's business to updated revenue, earnings, and margin assumptions. This tool is available right now on Simply Wall St’s Community page, used by millions of investors who want to compare their Narrative with others and see the full reasoning behind every estimate.

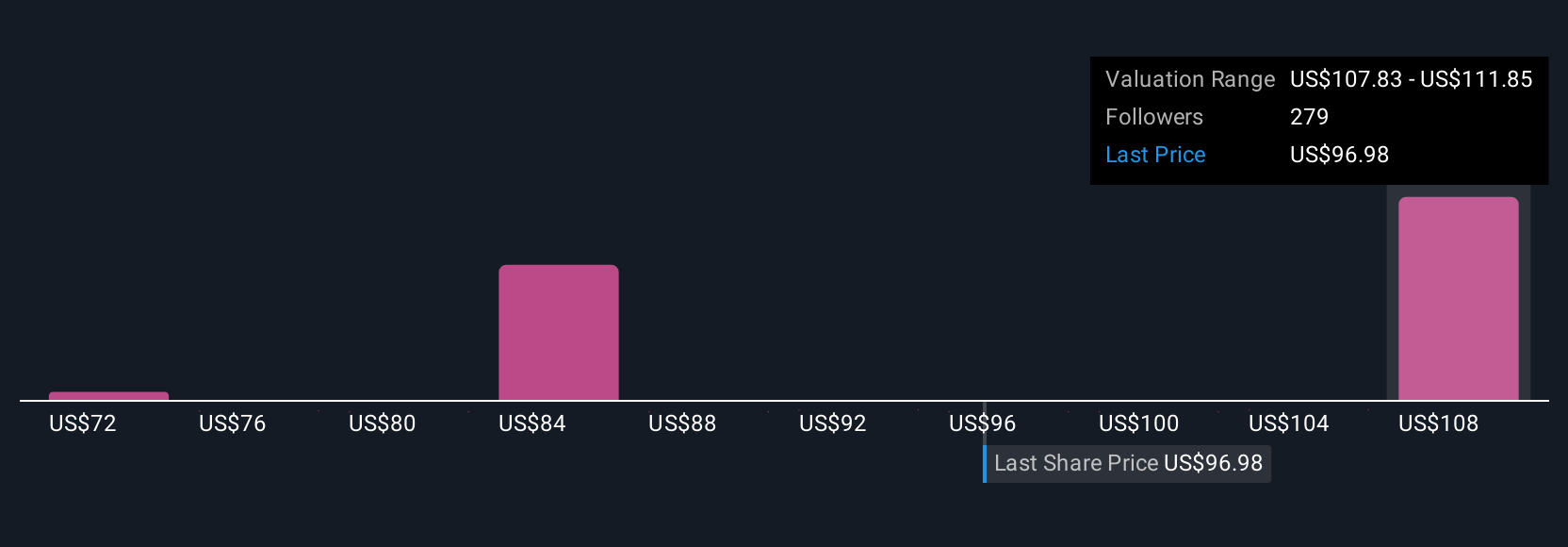

Narratives help you decide when to buy or sell by showing whether your fair value is above or below today’s price. The calculations automatically update as new news or earnings arrive. For example, one investor might see Walmart’s global AI adoption, digital expansion, and faster delivery as driving a fair value of $127. Another, more cautious perspective focused on international risks and margin pressures could lead to a fair value of $64. Narratives show there is no single answer, putting the power of dynamic, evidence-based investing in your hands.

Do you think there's more to the story for Walmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives