- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:WMT

Does Walmart’s New Sensor Rollout Signal a Fair Price for Shares in 2025?

Reviewed by Bailey Pemberton

If you have been watching Walmart's stock and wondering if now is the moment to buy, sell, or just stick with it, you are not alone. The company has been making headlines with its bold use of sensors to streamline grocery logistics and a CEO who says AI is about to reshape the company’s entire workforce. But what has this really meant for the share price? Despite a flurry of innovation, Walmart shares have held fairly steady in the short term, with a slight dip of 0.2% over the past week and a gentle 1.4% uptick in the last 30 days. However, the bigger story lies in its powerful long-term growth. The stock is up 13.2% year-to-date, 28.4% over the past year, and 143.4% over the last three years.

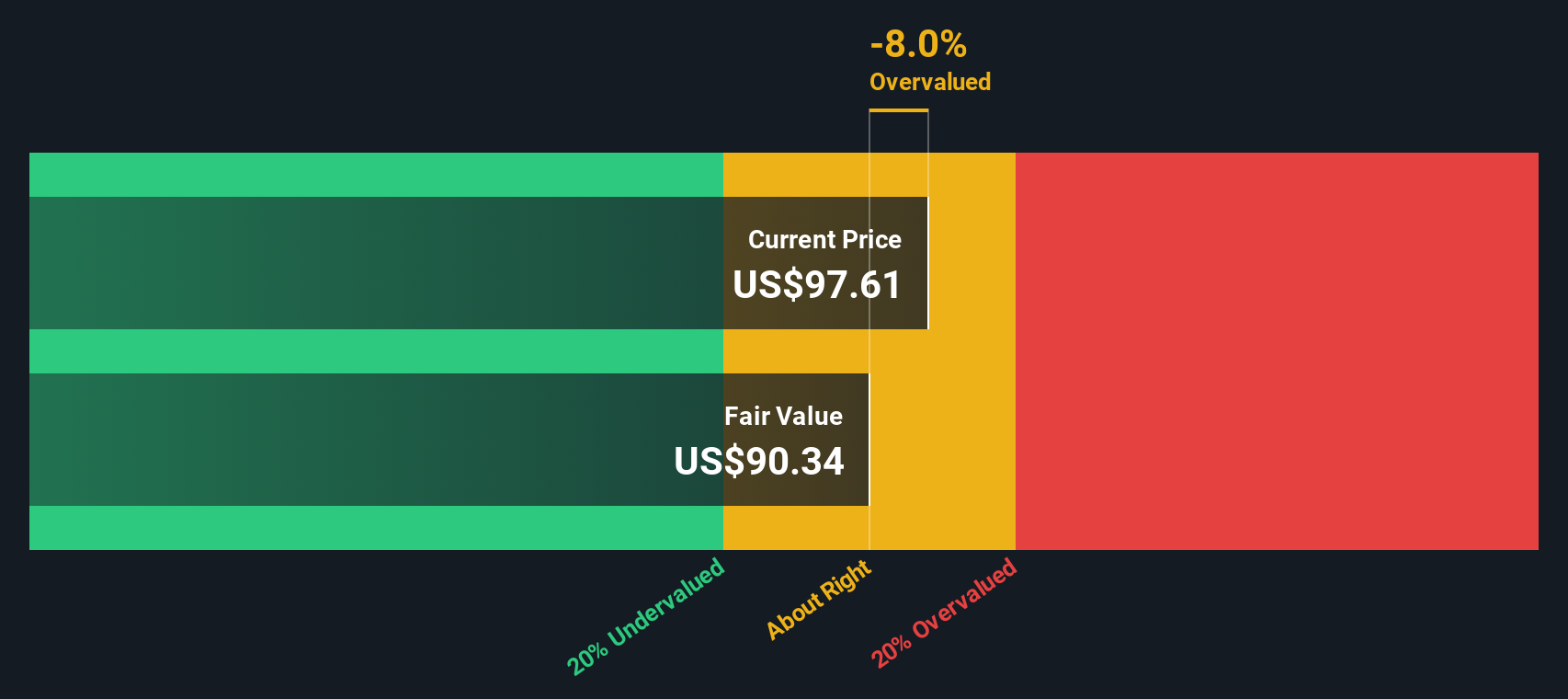

Still, the heart of any investment decision lies in its valuation. Is Walmart’s current price actually justified, or could there be more upside or risk than meets the eye? According to our value score, which adds a point for each of six key checks where a stock is undervalued, Walmart gets a 1 out of 6. This suggests that the company only appears undervalued in a single area and there may be limited hidden bargains here, at least on the surface.

In the next section, let’s break down the main valuation methods and see how Walmart stacks up. And stay tuned, because at the end, we will look at an even smarter way to think about what this valuation really means for your investment strategy.

Walmart scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. For Walmart, this approach relies on projecting the company’s future Free Cash Flow (FCF), then calculating what those future dollars are worth right now.

Currently, Walmart’s Free Cash Flow stands at $15.7 Billion. Analyst estimates suggest healthy annual cash flow growth, with projections reaching $30.98 Billion by 2030. While analyst data typically extends only five years into the future, Simply Wall St extrapolates further to provide a longer-term outlook.

This model calculates an intrinsic value of $106.59 per share. Given the present share price, the DCF model implies the stock is about 4.5% undervalued. This suggests Walmart’s current market price is largely in line with its likely future cash generation.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walmart's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

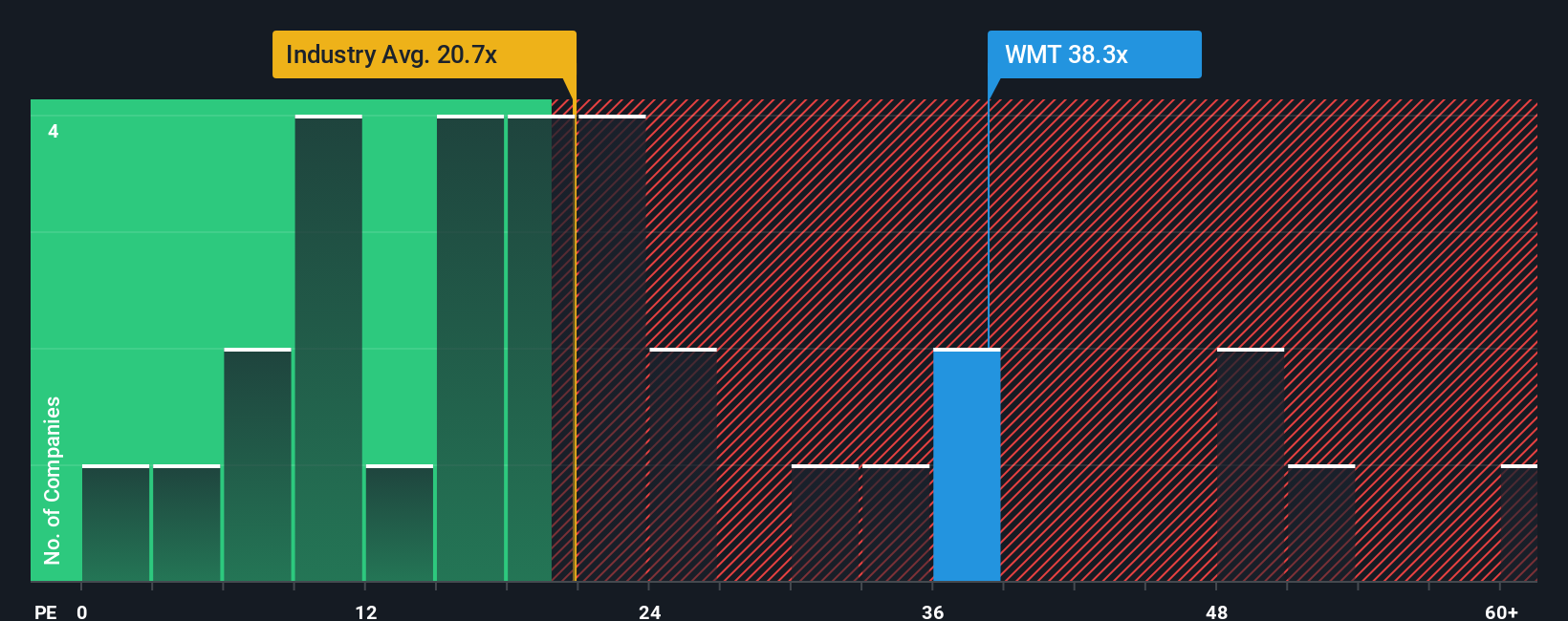

Approach 2: Walmart Price vs Earnings

For established, profitable companies like Walmart, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It lets investors quickly see how much they are paying for each dollar of earnings, which is a useful way to compare companies in the same sector.

Understanding what makes a "normal" or "fair" PE ratio takes more than just reading current numbers. Expectations around future growth, as well as the perceived risks associated with a business, influence whether a higher or lower PE is justified. Fast-growing or lower-risk companies often merit higher multiples, while slower growers or riskier businesses might see lower ones.

Walmart currently trades at a PE ratio of 38x. Compared to the Consumer Retailing industry average of 20.5x and a peer average of 24.9x, it is noticeably higher. This might initially suggest overvaluation, but context is key.

Simply Wall St’s proprietary "Fair Ratio," a custom benchmark that factors in not just peer and industry valuations, but also Walmart’s growth prospects, profit margins, market cap, and risk profile, puts a fair PE at 31.9x. This approach is more comprehensive and helps investors avoid common pitfalls of surface-level comparisons by considering all the factors that truly drive long-term value.

Comparing Walmart’s actual PE to the Fair Ratio, the two are close, with only a modest gap. This implies the stock price is largely in line with its expected performance given its strengths and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walmart Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you capture your own perspective on a company’s future by telling the story behind the numbers. Rather than just plugging in financial forecasts and fair value estimates, you connect those numbers to the real-world trends, strategies, and risks that matter most.

With Narratives, you link Walmart’s evolving story, such as the rise of omni-channel retail, innovations in AI, or the challenges of international expansion, directly to assumptions about future growth, margins, and what the business should be worth. This approach brings your investment decisions to life and makes them easier to follow and adjust as new information emerges, whether from news events or fresh earnings reports.

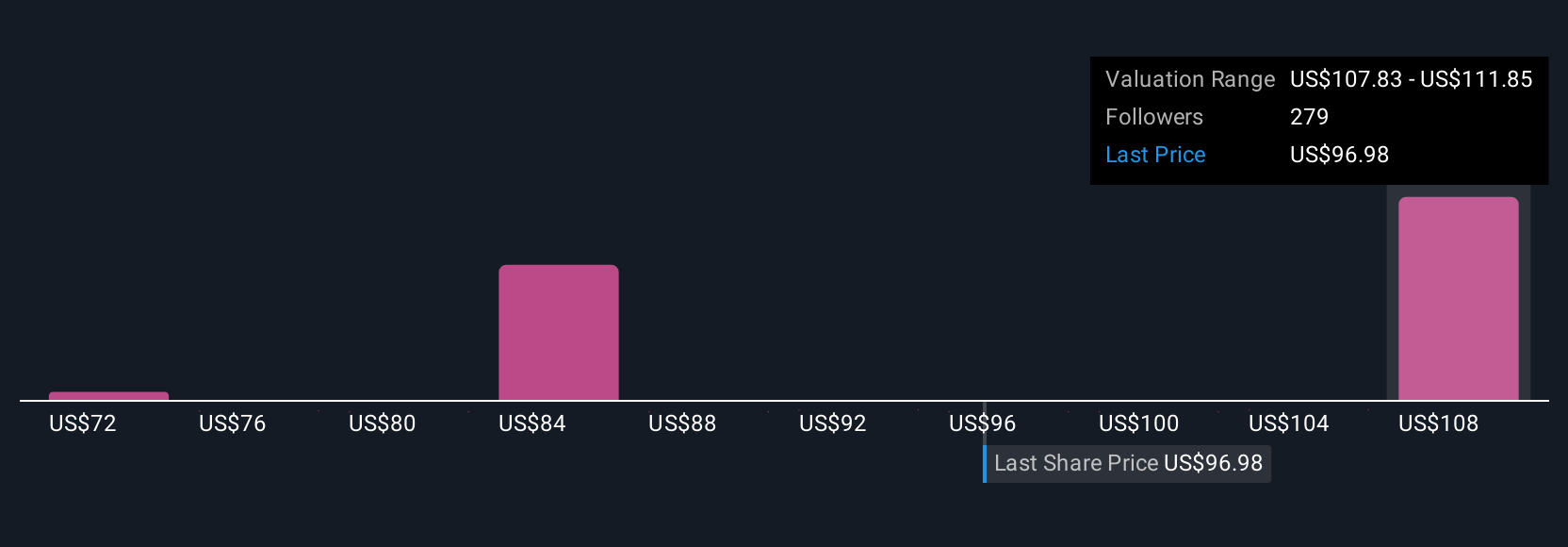

Millions of investors share and update their Narratives every day on Simply Wall St’s Community page. By comparing your Narrative’s Fair Value with the latest share price, you can see instantly whether you think Walmart is a buy, a hold, or a sell, and see how your view stacks up against others in real time.

For example, some investors believe that Walmart’s relentless push into digital and advertising will justify a future price as high as $127, while more cautious perspectives, factoring in global risks and margin pressures, see a fair value closer to $64.

Do you think there's more to the story for Walmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion