- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Did Walmart's (WMT) AI Shopping and Beyond Meat Expansion Just Reshape Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Walmart recently announced an expanded partnership with Beyond Meat, making several new plant-based products available at over 2,000 stores across the US while also rolling out advanced AI shopping through an integration with OpenAI's ChatGPT-powered Instant Checkout.

- This combination of AI-driven e-commerce and new product innovation signals Walmart's push to strengthen its position as a technology-enabled retailer and meet evolving consumer preferences for convenience and value.

- We'll explore how Walmart's embrace of AI-powered checkout could reinforce its omni-channel and technology adoption thesis within its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Walmart Investment Narrative Recap

Walmart’s investment thesis centers on leveraging its massive scale and omnichannel innovation to sustain revenue and earnings growth, even as retail competition intensifies. The recent expanded partnership with Beyond Meat and rollout of AI-driven Instant Checkout highlight Walmart’s commitment to capturing consumer demand for convenience and new product categories, but these moves are unlikely to materially affect its most important short-term catalyst: sustained margin expansion across core U.S. operations. Key risks, particularly rising delivery and labor costs, remain front of mind for shareholders.

The newly announced partnership with OpenAI to enable shopping through ChatGPT is especially relevant, given its potential to reinforce Walmart’s omni-channel advantage and drive operational efficiency, critical factors in offsetting competitive and margin pressures. As Walmart accelerates tech adoption across logistics and customer touchpoints, investors are watching closely to see if these digital initiatives can meaningfully protect or improve profitability in the face of industry headwinds.

Yet, in contrast to these growth storylines, investors should be aware of...

Read the full narrative on Walmart (it's free!)

Walmart's projections call for $789.9 billion in revenue and $27.4 billion in earnings by 2028. This implies a 4.5% annual revenue growth rate and a $6.1 billion increase in earnings from the current $21.3 billion level.

Uncover how Walmart's forecasts yield a $113.12 fair value, a 7% upside to its current price.

Exploring Other Perspectives

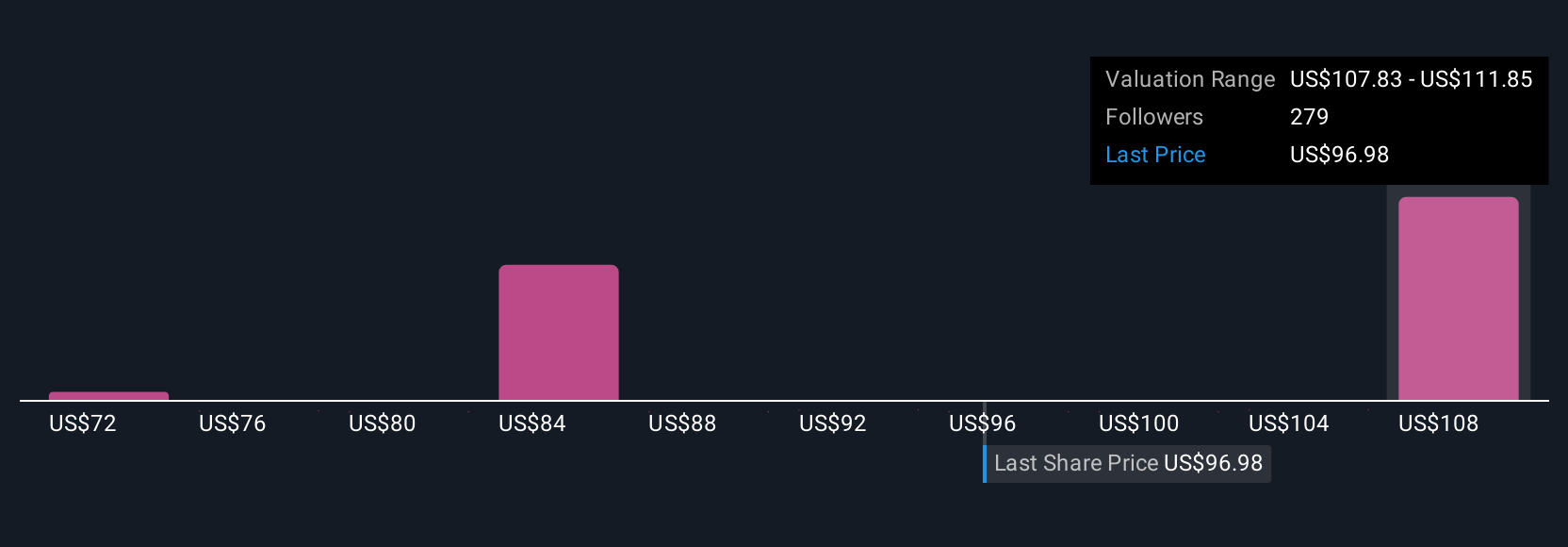

Seventeen individual fair value estimates from the Simply Wall St Community span a wide range, from US$87.15 to US$113.13 per share. Amid this diversity of opinion, sustained cost inflation and pressure on delivery margins continue to challenge the company’s path to higher profitability, making it essential to consider several viewpoints before forming your outlook.

Explore 17 other fair value estimates on Walmart - why the stock might be worth 18% less than the current price!

Build Your Own Walmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Walmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walmart's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives