- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

Will USFD’s $533 Million Buyback and Lowered Sales Outlook Shift US Foods’ Investment Narrative?

Reviewed by Sasha Jovanovic

- US Foods Holding Corp. recently completed the repurchase of 6,625,127 shares for US$533.3 million and reported third quarter earnings, with sales rising to US$10.19 billion and net income to US$153 million.

- The company also revised its fiscal year 2025 net sales growth guidance downward, signaling caution on near-term revenue expectations despite ongoing profitability improvements and capital returns.

- We'll assess how the completion of a sizeable share buyback shapes the company’s outlook within its broader investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

US Foods Holding Investment Narrative Recap

Investors in US Foods Holding often look for a recovery in away-from-home dining demand and steady margin improvement, setting expectations for both top-line and bottom-line progress. The recently completed US$533.3 million share buyback and solid third quarter results offer some short-term support, but the company’s lowered sales guidance will likely dampen enthusiasm around near-term revenue catalysts, while persistent macroeconomic headwinds remain the core risk to watch; the broader narrative remains largely unchanged by these updates.

Among recent news, the downward revision of 2025 net sales growth guidance, now set at 4% to 5%, speaks most directly to ongoing sector challenges and moderates optimism following strong capital returns and operational improvements in the quarterly results.

However, investors should also be aware that, despite margin gains, the ongoing disconnect between case volume growth and profitability may pose a material risk if...

Read the full narrative on US Foods Holding (it's free!)

US Foods Holding's narrative projects $45.1 billion in revenue and $1.1 billion in earnings by 2028. This requires 5.3% yearly revenue growth and an increase of $547 million in earnings from $553 million today.

Uncover how US Foods Holding's forecasts yield a $92.40 fair value, a 29% upside to its current price.

Exploring Other Perspectives

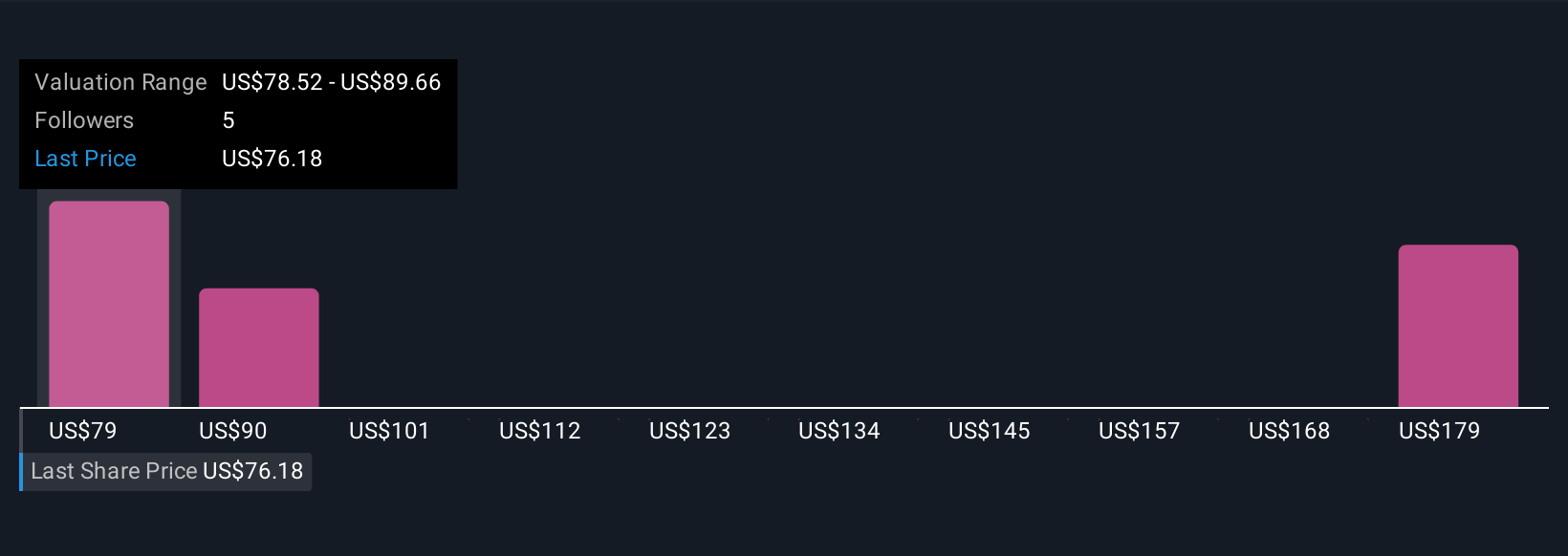

Seven Simply Wall St Community fair value estimates for US Foods Holding range from US$78.52 to US$204.51 per share. The company’s muted sales growth outlook highlights why individual views on its earnings path and future revenue mix can strongly influence performance expectations.

Explore 7 other fair value estimates on US Foods Holding - why the stock might be worth just $78.52!

Build Your Own US Foods Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your US Foods Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free US Foods Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate US Foods Holding's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives