- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

US Foods Holding (USFD): Exploring Valuation as Shares Trend Toward New Highs

Reviewed by Simply Wall St

US Foods Holding (USFD) shares have been trending higher over the past month, with the stock gaining around 6%. Investors appear interested in how the company’s fundamental performance is holding up, especially as market sentiment shifts.

See our latest analysis for US Foods Holding.

Building on its upward momentum, US Foods Holding has seen a 17.05% year-to-date share price return, fueled by solid execution and a pickup in investor confidence. With a 12.93% total shareholder return over the past year and longer-term gains more than doubling over three and five years, the company’s performance shows both steady growth and staying power.

If you’re interested in what else is moving this season, now is an ideal moment to broaden your investing universe and discover fast growing stocks with high insider ownership

But with US Foods Holding’s stock near all-time highs and analysts still seeing potential upside, the question remains: is this the start of a new leg higher for the company, or is all the expected growth already reflected in the share price?

Most Popular Narrative: 14.6% Undervalued

US Foods Holding’s current share price of $78.88 sits well below its most widely followed fair value estimate of $92.40. This suggests meaningful upside potential if analyst projections play out. The narrative driving this valuation relies on the company’s ability to maintain superior efficiency and capitalize on evolving industry dynamics in the coming years.

US Foods' accelerated investment in digital platforms and supply chain automation, such as the MOXe platform and Descartes routing, has driven record operational efficiency, reduced costs, and enabled best-in-class customer experiences. This sets the stage for sustained net margin expansion and higher long-term profitability.

Want to know what bold assumptions fuel this valuation? The secret lies in forecasts of margin expansion and profit growth that could reshape expectations for the entire sector. How big are these projected gains? Only a deep dive into the full story reveals the metrics behind the optimism and whether this momentum can last.

Result: Fair Value of $92.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing consumer demand for dining out and the ongoing risk of integration challenges from potential mergers could quickly change the current trajectory of US Foods.

Find out about the key risks to this US Foods Holding narrative.

Another View: Multiple-Based Valuation Raises a Flag

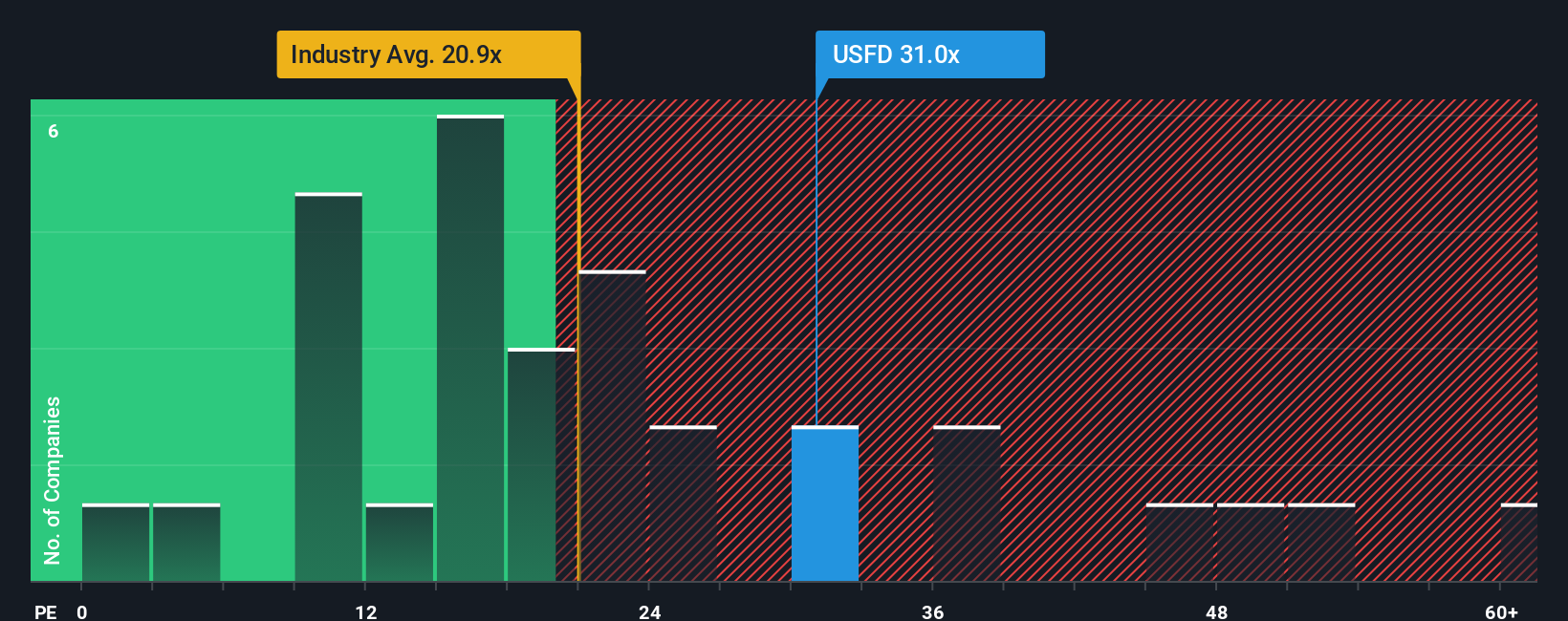

Looking beyond fair value estimates, US Foods Holding currently trades at a price-to-earnings ratio of 30.9x. That is substantially higher than both the US Consumer Retailing industry average of 19.7x and the fair ratio of 28.5x that the market could move toward. This premium hints at higher expectations baked into the share price, which could amplify valuation risk if growth falls short. Is the market’s optimism justified or has it run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own US Foods Holding Narrative

If you’re looking to dig deeper or challenge the prevailing view, you can analyze the numbers and build your own perspective in just a few minutes, Do it your way

A great starting point for your US Foods Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio when there are so many unique opportunities at your fingertips. Turn your curiosity into results by checking out these handpicked stock ideas:

- Capture the momentum by spotting growth potential with these 3580 penny stocks with strong financials showing robust fundamentals that may be overlooked by the mainstream market.

- Harness income certainty by securing your allocations in these 14 dividend stocks with yields > 3% offering yields above 3% for steady returns.

- Ride the next technology wave and fuel your watchlist with these 26 AI penny stocks that are transforming industries through artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success