- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Target (TGT) Margin Miss Reinforces Community Concern Over Profitability Challenges

Reviewed by Simply Wall St

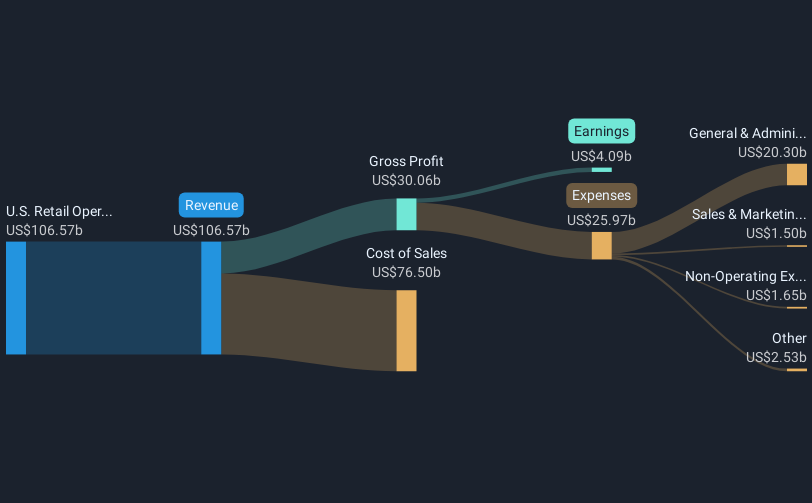

Target (TGT) just reported Q3 2026 results, posting revenue of $25.3 billion and basic EPS of $1.52, alongside net income of $689 million and a same store sales slip of 2.7%. Looking at a broader time frame, revenue across the last three quarters has held just above the $25 billion mark each period while EPS has trended down from $2.28 in Q1 to $1.52 in the latest quarter. Margins were squeezed this quarter, putting profitability under the spotlight for investors.

See our full analysis for Target.Now that we have the headline numbers, let's see how the results measure up against the key market narratives driving expectations for Target right now.

See what the community is saying about Target

Profit Margins Narrow to 3.6%

- Net profit margin for the trailing twelve months slipped to 3.6%, down from 4.1% a year ago. This indicates that for every dollar of sales, Target is retaining less profit than before.

- Consensus narrative notes that operational inefficiencies and ongoing industry price competition could continue to put downward pressure on margins as regulatory, labor, and supply chain costs affect earnings.

- The latest drop in margin supports the consensus view that Target is facing challenges in addressing margin compression, with cost headwinds becoming increasingly difficult to offset.

- Some investments may increase efficiency in the long term, but rising expenses could outweigh any potential benefit, especially as operational rivals update their capabilities more rapidly.

Price-to-Earnings Plunges Against Peers

- Target trades at a Price-To-Earnings ratio of 10.8x, well below its peer group average of 27.6x and the broader industry’s 20.1x. This suggests that investors are valuing earnings more conservatively than for most competitors.

- Consensus narrative states that this discounted valuation, combined with a share price at $89.80 and a DCF fair value of $131.80, could be considered by value-oriented investors.

- A high dividend yield of 5.08% adds to the appeal, providing income-focused investors with an incentive even as growth moderates.

- However, ongoing debt levels and slow earnings growth may be factors in the stock’s lower multiple compared to peers, matching the cautious consensus sentiment.

Revenues Steadily Trail US Retail Market

- Over the past year, Target’s total revenue of $105.2 billion rose 2.2% annually, falling short of the US market’s projected growth rate of 10.5%. This highlights a persistent challenge in keeping pace with competitors.

- Consensus narrative points out that weak discretionary spending and slow adaptation to younger consumer tastes could limit sales growth, helping explain why analysts expect Target’s future topline growth to lag broader retail benchmarks.

- Current trends, such as a 2.7% decline in same store sales this period, reinforce concerns about softening demand.

- Without improvement in consumer momentum, Target’s competitive position may come under further pressure as peers increase investments in digital and experiential upgrades.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Target on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpreting the numbers in a new light? Share your take and shape a personalized narrative in just a few minutes by clicking Do it your way

A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Target’s slowing revenue growth, shrinking margins, and cautious valuation highlight its challenges in keeping pace with stronger and more stable competitors.

If you’d like to focus on companies demonstrating consistent earnings and sales even when others falter, zero in on stable growth stocks screener (2075 results) to find stocks delivering steady performance through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.