- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

How Investors Are Reacting To Sysco (SYY) Union Strike Threat and Labor Unrest in Portland

Reviewed by Sasha Jovanovic

- In early October 2025, Sysco faced major labor turmoil as Teamsters union members at its Portland facility voted overwhelmingly to authorize a strike, with over 270 drivers, mechanics, and warehouse staff demanding improved wages and working conditions.

- This strike authorization highlights ongoing labor pressures within Sysco’s operations, raising the possibility of significant supply chain disruptions for one of the largest U.S. foodservice distributors.

- We'll examine how the threat of a union-led work stoppage could shape Sysco’s investment outlook and future business stability.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sysco Investment Narrative Recap

Sysco’s investment case centers on its scale and leading position in U.S. food distribution, supported by ongoing initiatives in salesforce productivity and geographic expansion. However, the recent labor unrest in Portland highlights that supply chain continuity remains the most immediate risk, potentially outweighing weather or consumer demand trends as a short-term catalyst for the stock. The strike authorization, while not yet a work stoppage, brings labor relations to the forefront of near-term investor concerns.

In direct context, the July 2025 Teamsters contract agreement in Illinois, awarding a 36% wage increase and enhanced benefits, shows that labor pressures are not isolated, increasing operational and margin risks across more parts of Sysco’s network. With upcoming earnings and continued labor tensions, investors are closely watching how delayed or costly resolutions could affect Sysco’s operational stability and margin outlook.

In contrast, what many investors may overlook is just how quickly a localized labor impasse could ripple through distribution networks and affect customer retention...

Read the full narrative on Sysco (it's free!)

Sysco's narrative projects $91.9 billion revenue and $2.6 billion earnings by 2028. This requires 4.2% yearly revenue growth and a $0.8 billion earnings increase from $1.8 billion today.

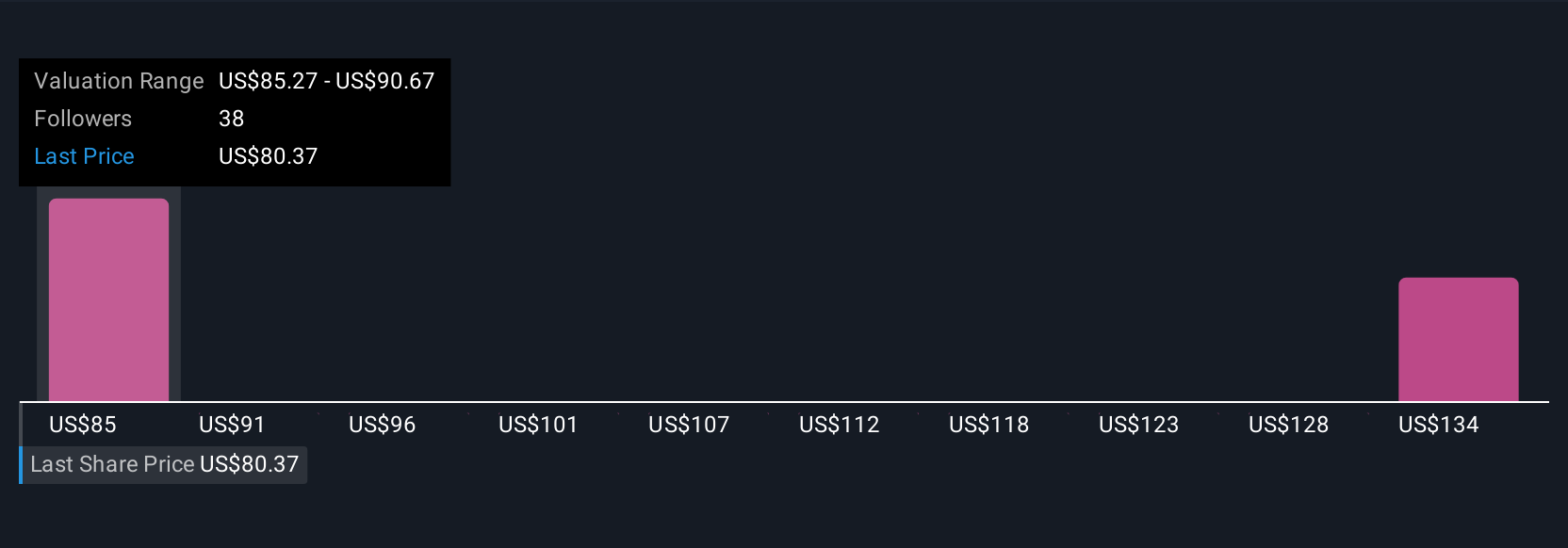

Uncover how Sysco's forecasts yield a $85.60 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Community members’ fair value estimates for Sysco range from US$85.60 to US$145.40, based on two distinct analyses in the Simply Wall St Community. While members see wide potential value, current labor challenges could be a key factor in driving future sentiment and business results.

Explore 2 other fair value estimates on Sysco - why the stock might be worth just $85.60!

Build Your Own Sysco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sysco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sysco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sysco's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives