- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

Does Performance Food Group Still Offer Growth Potential After Recent Price Pullback?

Reviewed by Bailey Pemberton

Thinking about what to do next with Performance Food Group stock? You are not alone. With shares closing recently at $102.57 and the company posting a robust 22.0% gain year-to-date, investors are weighing both the impressive long-term growth and some cooling momentum in the short run. Over the last week, shares slipped by 1.6%, and they are down 2.7% over the last month. However, when you look at the bigger picture, the story appears much brighter, with a remarkable 126.2% return in three years and a substantial 160.7% gain over five years. That kind of long-term performance has certainly attracted attention in the market, but it is also prompting questions about whether the current price still presents real value, especially as the stock market responds to changing consumer spending patterns and shifts in food distribution trends.

So, does Performance Food Group still have room to grow, or are investors now facing more risk for less reward? According to a widely used valuation framework, the company is considered undervalued in only 2 out of 6 checks, giving it a value score of 2. But is that the full story? Read on as we break down the most popular ways to assess the company’s valuation, and stay with us until the end for an even more insightful approach to understanding what this stock may truly be worth.

Performance Food Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Performance Food Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to today's dollars. This approach examines how much Performance Food Group is expected to generate in free cash flow, which is essentially how much cash the company will have left after paying its bills and investing in its business.

Performance Food Group reported a last twelve months (LTM) free cash flow of $792.95 million. Analyst estimates predict this figure will rise, reaching an estimated $1.17 billion by 2028. While analysts provide projections for the next five years, longer-term forecasts are extrapolated based on recent trends, with the company's free cash flow consistently growing in the hundreds of millions of dollars each year.

After running the numbers through a two-stage DCF model, the estimated "intrinsic" value for Performance Food Group is $171.79 per share. That figure is markedly higher than its current share price of $102.57, which implies the stock is trading at a 40.3% discount to its calculated fair value.

This model suggests there could be meaningful upside in Performance Food Group shares based on projected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Performance Food Group is undervalued by 40.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Performance Food Group Price vs Earnings (PE Ratio)

For a profitable company like Performance Food Group, the Price-to-Earnings (PE) ratio is one of the most widely used metrics for assessing valuation. This approach is suitable because it relates the company’s current share price to its earnings per share, providing a quick snapshot of what investors are willing to pay today for a dollar of future earnings. Companies with higher earnings growth and lower risk typically command higher "fair" PE ratios, while those facing more uncertainty or slower growth tend to trade at lower multiples.

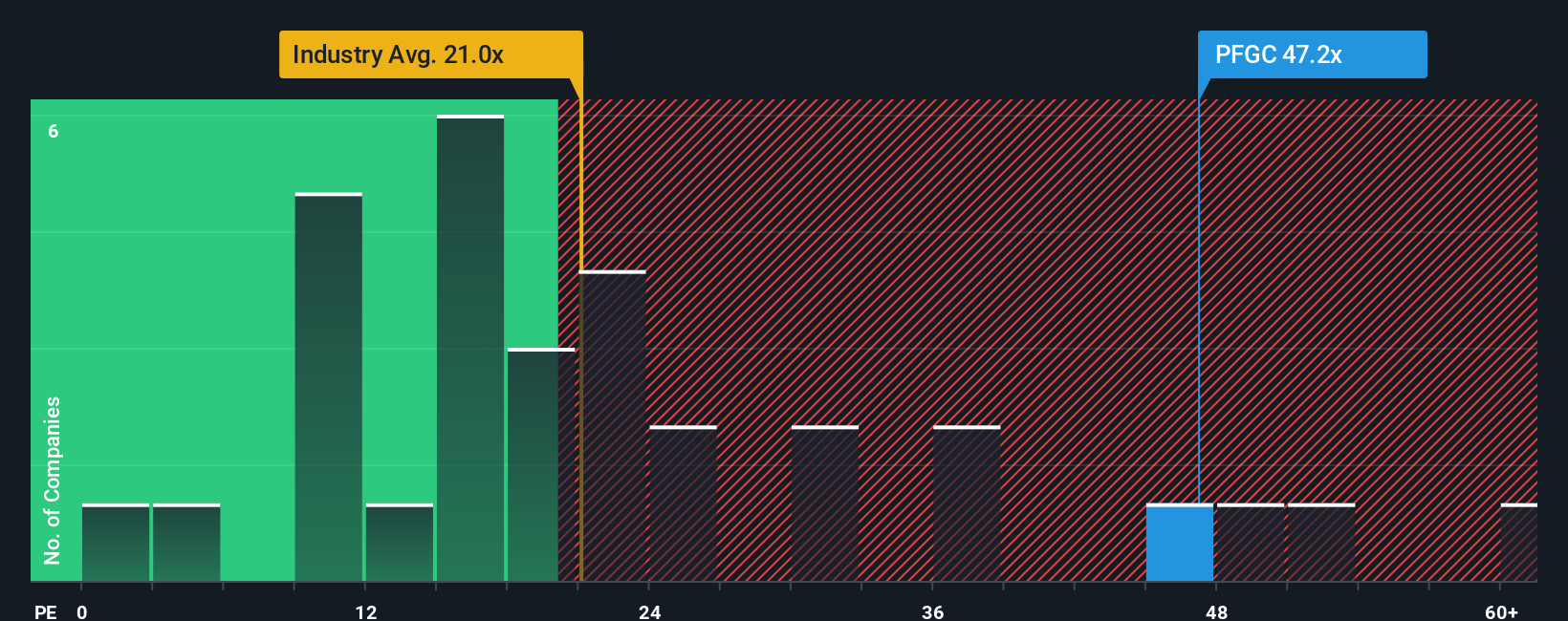

Performance Food Group currently trades at a PE ratio of 47.2x, which is noticeably higher than the Consumer Retailing industry average of 21.0x and also above the average of its direct peers at 25.6x. However, looking beyond simple benchmarks, Simply Wall St’s proprietary "Fair Ratio" model calculates a fair PE of 28.6x for Performance Food Group. This metric stands out because it adjusts for the company’s earnings growth trajectory, business risks, market capitalization, and profit margin, making it more comprehensive than relying solely on peer or industry averages.

Compared to its actual PE, Performance Food Group’s stock price appears stretched relative to what would be considered fair based on its fundamentals and risk profile. This suggests the stock could be considered overvalued when viewed through the lens of earnings multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Performance Food Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company that connects what you believe about its future, such as how fast revenues will grow, where margins could land, and what fair value truly means, with a set of financial forecasts and an actionable estimate of intrinsic value. Narratives allow you to move beyond just the numbers, giving context and perspective to your investment decision and making it easier to act with confidence.

On Simply Wall St's Community page, millions of investors use easy and intuitive Narrative tools to map out their viewpoint, link those beliefs to their own fair value estimate, and instantly see how it stacks up against the latest share price. Narratives make the process of investing dynamic; your forecasts and value update as soon as new news, quarterly results, or company updates are released, so your view is always current.

For example, some investors may believe in a bullish Narrative for Performance Food Group, expecting continued digital innovation and successful acquisitions to justify a higher fair value like $127.0 per share. Others may be more cautious, focusing on integration risks and industry challenges, and set their value at $102.0. With Narratives, you can see these different perspectives, understand why opinions diverge, and decide for yourself which Narrative fits your view of Performance Food Group’s future, helping you make smarter buy or sell decisions.

Do you think there's more to the story for Performance Food Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives