- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

A Fresh Look at Performance Food Group (PFGC) Valuation Following Recent Investor Momentum

Reviewed by Simply Wall St

Performance Food Group (PFGC) stock has seen some price swings lately, catching the attention of investors interested in food distribution and logistics. The company’s recent momentum, combined with its long-term growth trends, raises some interesting questions about current valuation.

See our latest analysis for Performance Food Group.

Performance Food Group’s share price has moved steadily upward in 2024, with recent volatility reflecting both renewed optimism about expansion and some caution from investors after a strong run. The stock’s 20.75% year-to-date share price gain highlights solid momentum, while a 23% total shareholder return over the past year reinforces the company’s longer-term growth story.

If supply chain trends in food distribution have you thinking bigger, now is a good moment to explore opportunities through our fast growing stocks with high insider ownership.

With robust returns on the table and analysts seeing further upside, is Performance Food Group undervalued based on its fundamentals, or is the market already pricing in all of its future growth potential?

Most Popular Narrative: 15% Undervalued

With Performance Food Group closing at $101.49 and the most popular narrative setting fair value at $119.36, the gap hints at a market that isn't fully buying into bullish analyst assumptions. What exactly drives this optimism? Below, a direct quote spotlights one catalyst that could change how investors judge this stock’s potential.

Ongoing investments in digital ordering platforms and e-commerce capabilities, particularly in the rapidly growing specialty and convenience divisions, are driving higher order frequency, increased client stickiness, and double-digit e-commerce sales growth, contributing to recurring revenue and improved customer lifetime value.

Analysts are betting on much more than headline growth. The fair value depends on a series of bold financial projections, including rising profit margins and a future profit multiple that is rarely seen outside of top-tier market leaders. Want to see the numbers and understand how this valuation is built? The next part of the narrative breaks down each crucial assumption driving this striking gap between price and value.

Result: Fair Value of $119.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent sales declines in Convenience or escalating competitive pressures could challenge Performance Food Group’s growth story and force investors to quickly reassess expectations.

Find out about the key risks to this Performance Food Group narrative.

Another View: What Do Market Multiples Say?

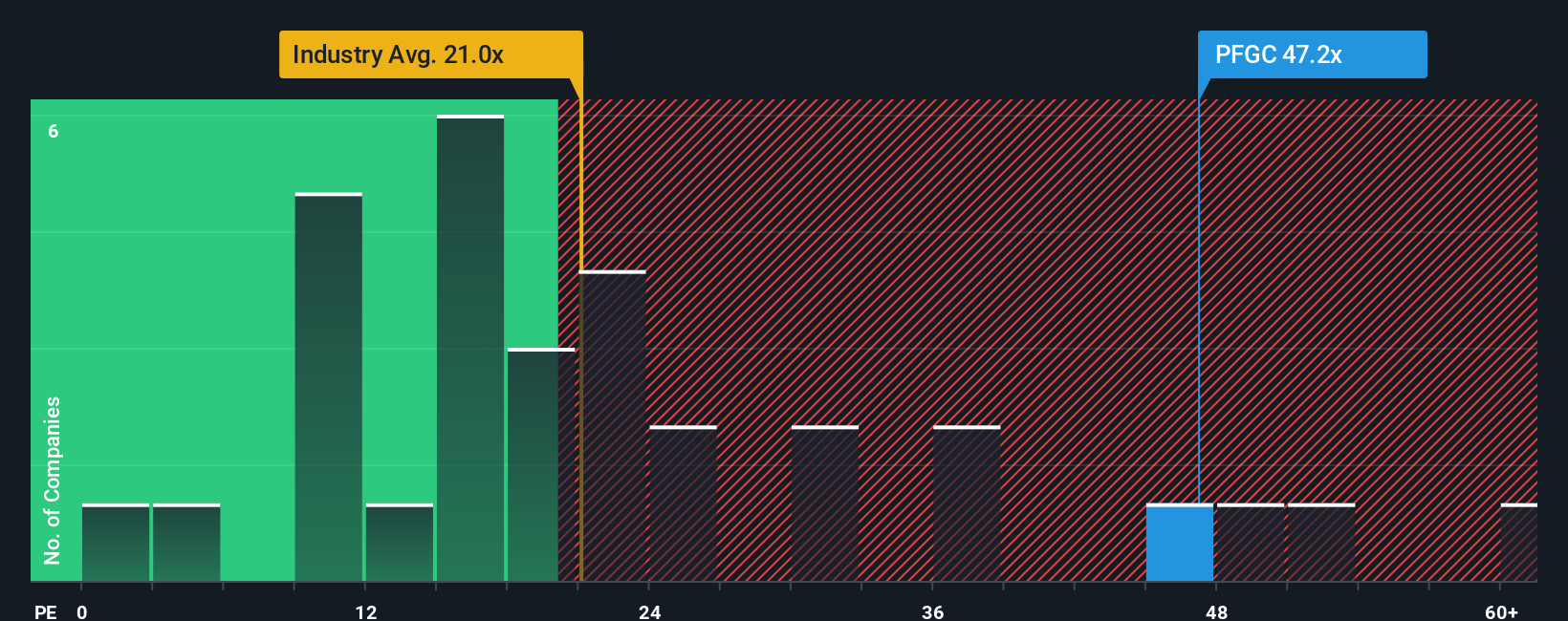

Switching gears, a look at the current price-to-earnings ratio reveals a striking difference. Performance Food Group trades at 46.8 times earnings, making it much more expensive than both the industry average of 20.9x and a fair ratio of 28.7x. This gap suggests the market is already expecting remarkable growth, or it could be a warning that there is less margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Performance Food Group Narrative

If this analysis does not match your perspective, you can easily dive into the data and shape your own view in just a few minutes by using Do it your way.

A great starting point for your Performance Food Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when new winners could be just ahead. Use these targeted strategies to stay ahead in different corners of the market.

- Find real growth by targeting high-potential AI disruptors with these 24 AI penny stocks. These companies are reshaping entire industries and powering the next wave of automation.

- Seize value now with these 872 undervalued stocks based on cash flows. These opportunities might be overlooked by the broader market, offering a window to get in before prices catch up.

- Tap into steady cash flow by seeking these 17 dividend stocks with yields > 3%. These investments often provide robust yields that add resilience to your portfolio and help cushion against volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives