- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (NYSE:KR) Elevates Digital Commerce With New eCommerce Unit Under Yael Cosset

Reviewed by Simply Wall St

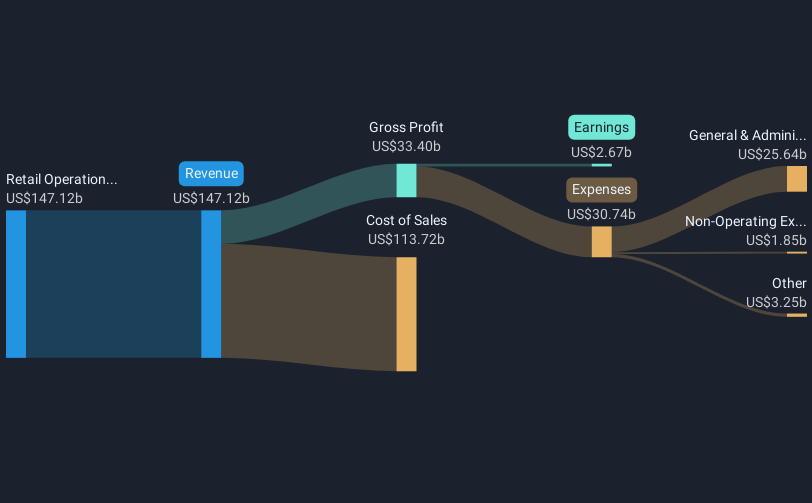

Kroger (NYSE:KR) recently made headlines with several significant developments, including the appointment of Yael Cosset as Executive Vice President and Chief Digital Officer to lead a new eCommerce business unit. This move aims to enhance the company's digital capabilities and customer engagement. Despite mixed financial results, with sales and net income experiencing declines, the company reported an increase in full-year net income and earnings per share. Meanwhile, the wider market experienced a downturn due to geopolitical concerns, with stocks showing a notable slide partly attributed to tariff news from the U.S. government. Amid these challenges, Kroger's share price saw a price movement of 11%, reflecting investor reactions to its internal transformations and external economic conditions impacting the broader market. This positioning may suggest investor confidence in Kroger's restructuring plans against a backdrop of broader economic volatility.

Click to explore a detailed breakdown of our findings on Kroger.

Over the last five years, Kroger has delivered a remarkable total shareholder return of 142.31%. This performance signifies a substantial value creation, bolstered by various strategic moves. The resignation of long-time CEO Rodney McMullen in March 2025 due to personal misconduct has been a recent development, with Ronald Sargent stepping in as interim CEO. Meanwhile, Kroger's announcement of a $7.5 billion share buyback program in December 2024 indicates a focus on returning capital to shareholders, which can enhance share value.

Additionally, Kroger's valuation appears attractive compared to industry standards, with a favorable price-to-earnings ratio which may have supported its long-term appreciation. The company's one-year return surpassed the broader US market but underperformed the US Consumer Retailing industry, demonstrating relative resilience. Furthermore, the expansion into eCommerce and infrastructure in Texas reflects Kroger's efforts to pursue growth avenues amid evolving market demands. These strategic decisions have been central to its impressive shareholder returns over the five-year horizon.

- Unlock the insights behind Kroger's valuation and discover its true investment potential

- Assess the potential risks impacting Kroger's growth trajectory—explore our risk evaluation report.

- Is Kroger part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives