- United States

- /

- Food and Staples Retail

- /

- NYSE:GRDN

What Recent Drop Means for Guardian Pharmacy Services Stock in 2025

Reviewed by Bailey Pemberton

If you are wondering what to do next with Guardian Pharmacy Services stock, you are in good company. With its shares closing at $23.94 and a one-year return of 37.9%, the company has caught plenty of attention from investors seeking growth. The start of the year brought optimism, with the stock up 20.4% year-to-date, but the past month has tested that resolve, as the price dropped 15.7% in the last 30 days and 8.0% over the past week. This recent dip may stir anxiety or curiosity, depending on your market outlook, but it also prompts a closer look. Are these just short-term jitters, or signals of a new risk environment?

Part of what makes Guardian Pharmacy Services interesting is how quickly sentiment can shift, often driven by broader market factors rather than just company-specific headlines. While there have not been any pivotal developments to explain the sharp swings, these movements reflect changes in risk perceptions and appetite among investors. If you are considering buying or holding, valuing the stock correctly becomes even more important in moments like these.

Here's one way to look at it: according to our valuation score (which checks if the stock is undervalued by six different measures), Guardian Pharmacy Services scores a 0 out of 6. That means, on the numbers alone, it does not appear to be undervalued by any of the checks we apply. But standard valuation methods can sometimes miss the real story.

Let's break down these traditional valuation approaches, and later, I will reveal an even more insightful way to understand what Guardian Pharmacy Services may truly be worth.

Guardian Pharmacy Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Guardian Pharmacy Services Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows, then discounting them back to today using a required rate of return. The idea is to capture what all those future dollars are worth in today’s terms, offering a snapshot of “intrinsic value” based purely on expected financial performance.

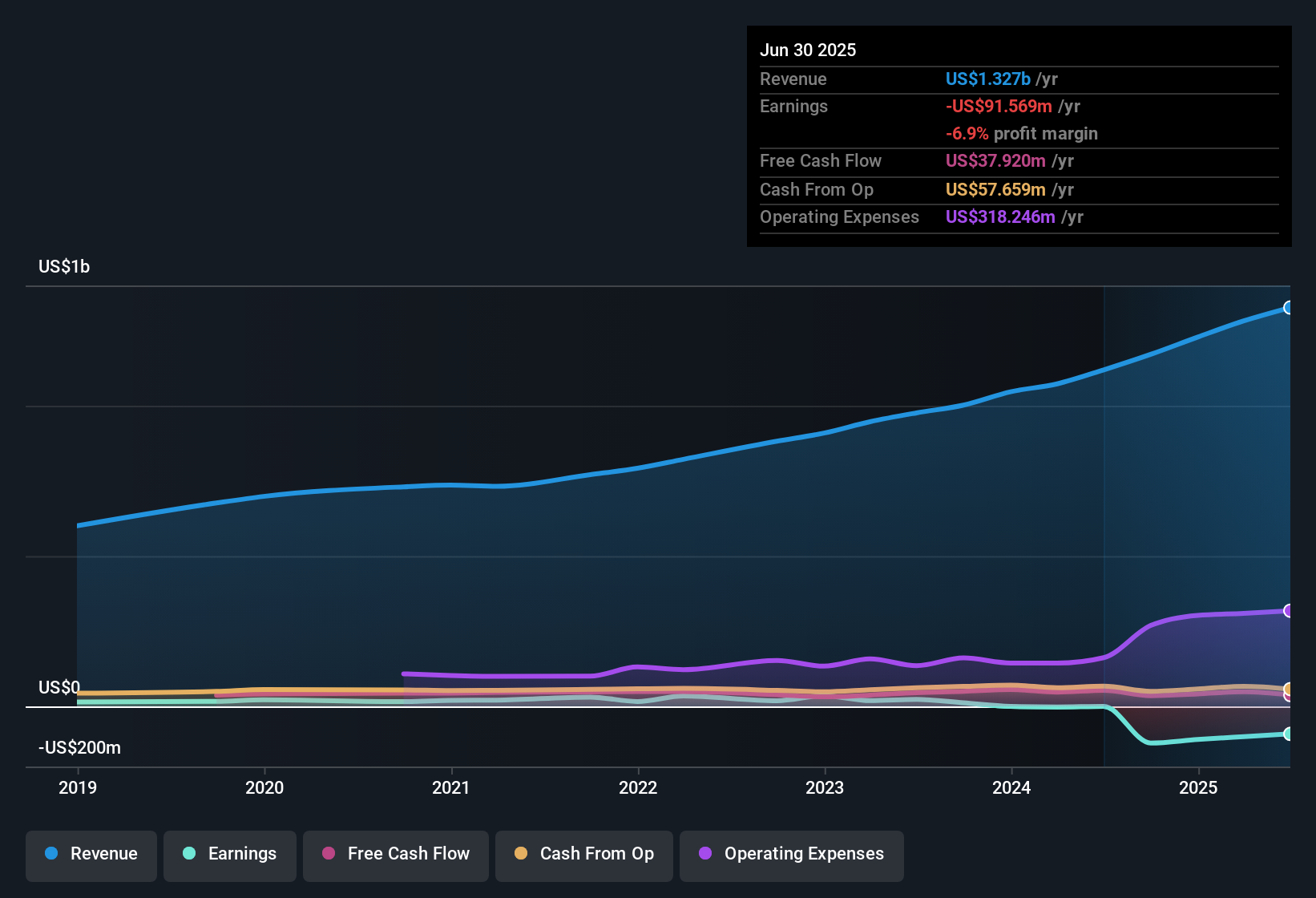

For Guardian Pharmacy Services, the most recent reported Free Cash Flow stands at $38.29 million. Looking ahead, analysts expect Free Cash Flow to be $30.4 million next year. Over the coming decade, projections show modest variability, with estimates such as $33.62 million in 2026 and $19.89 million by 2035. Keep in mind these longer-range numbers are extrapolations rather than direct analyst forecasts, so real outcomes could differ.

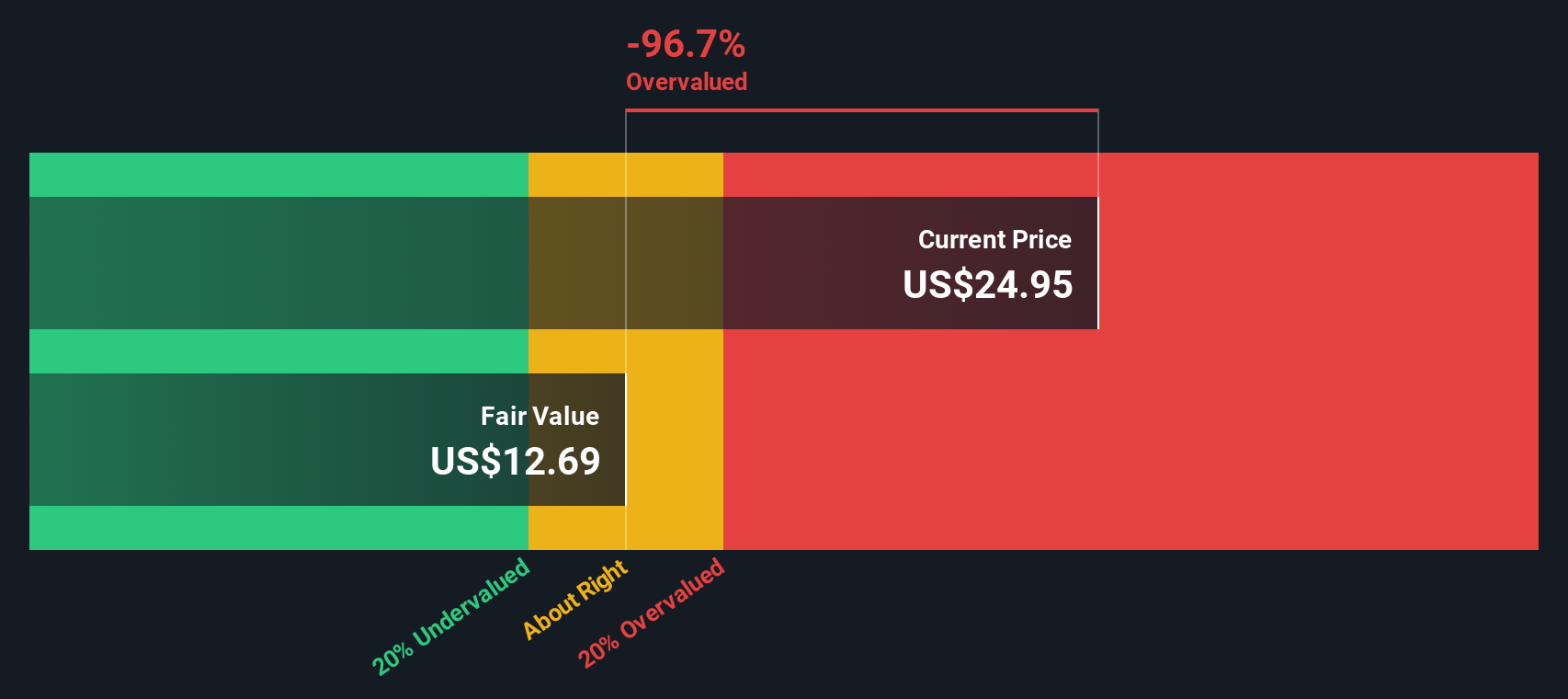

Based on this 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $12.67. With the current share price at $23.94, the DCF suggests the stock is about 89.0% overvalued relative to its discounted cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Guardian Pharmacy Services may be overvalued by 89.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Guardian Pharmacy Services Price vs Sales

The Price-to-Sales (PS) ratio is a practical valuation metric, especially for companies where profitability may not fully capture their market potential. For Guardian Pharmacy Services, PS is the preferred lens because the company’s earnings are currently negative. In such cases, comparing the stock price to sales helps investors focus on revenue-generating capacity instead of profit volatility.

Growth expectations and risk perception play a crucial role in what constitutes a "normal" or "fair" PS ratio. Rapidly growing, low-risk businesses often trade at higher multiples, while slower growers or riskier firms command discounts. Context is key, so benchmarks matter.

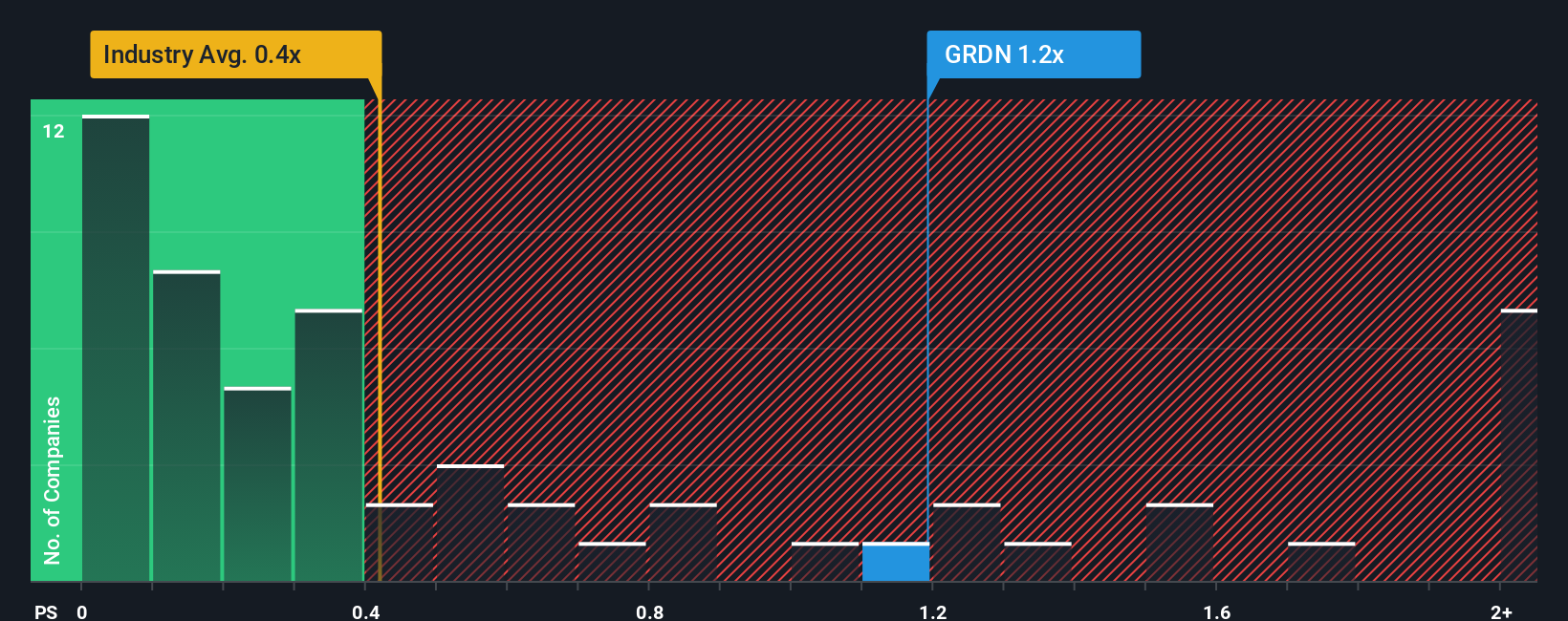

Currently, Guardian Pharmacy Services trades at a PS ratio of 1.14x. This is substantially higher than both the industry average of 0.46x and the peer average of 0.21x. To provide a more nuanced view, Simply Wall St uses its proprietary Fair Ratio, set at 0.27x for Guardian. Unlike basic peer or industry comparisons, this measure synthesizes factors like sales growth, profit margin, company size, industry characteristics, and inherent risks. It offers a more tailored valuation and helps investors avoid misleading conclusions based solely on surface-level averages.

When comparing the company’s current PS ratio (1.14x) to its Fair Ratio (0.27x), Guardian Pharmacy Services appears significantly overvalued based on its current revenue multiple.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Guardian Pharmacy Services Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own story or perspective on a company, where you outline what you believe about its future, such as expected revenue growth, profit margins, or fair value, and then see how these beliefs translate into numbers and investment decisions.

Narratives bridge the gap between a company's story and a concrete financial forecast, connecting your view of Guardian Pharmacy Services to an estimated fair value and a practical plan. They are easy to use and fully accessible on Simply Wall St’s platform, right on the Community page used by millions of investors.

This approach helps you decide whether to buy, sell, or hold by showing if your Narrative’s fair value is above or below the current share price. Because Narratives are updated automatically when news or earnings are released, your story always reflects the latest information.

For example, with Guardian Pharmacy Services, one investor’s optimistic Narrative might put fair value at $35 per share, while another, more cautious investor might see it as just $11. This shows how different perspectives can drive different decisions, all grounded in your own assumptions.

Do you think there's more to the story for Guardian Pharmacy Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRDN

Guardian Pharmacy Services

A pharmacy service company, provides a suite of technology-enabled services to help residents of long-term health care facilities (LTCFs) in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives