- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

Will Dollar General's (DG) Tech-Driven Stores Redefine Its Competitive Edge in Discount Retail?

Reviewed by Sasha Jovanovic

- In recent weeks, Dollar General has drawn significant industry attention after reports emerged of its technology-driven, employee-free store pilot and the company's participation at the CSCMP EDGE 2025 Conference, where transportation and supply chain leadership shared insights.

- Research also highlighted a sharp rise in consumer intent to shop at discount retailers this holiday season, with digital convenience and discovery features playing an increasingly important role in customer engagement.

- We'll now explore how Dollar General's early technology adoption could reshape its investment narrative and support future earnings assumptions.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dollar General Investment Narrative Recap

To be a shareholder in Dollar General, you need confidence that the company’s value-driven model can sustain growth through economic cycles and changing shopping behaviors. The recent headlines about tech-enabled, employee-free stores may boost digital appeal, but the biggest short-term catalyst remains continued customer traffic and sales growth, while key risks center on potential over-saturation and heightened competition. These new technology experiments, while interesting, are not yet material to the main catalysts or core risks investors face.

Among the recent announcements, Dollar General’s partnership with Uber Eats, bringing 14,000 locations onto the platform, directly ties to the push for digital convenience highlighted in consumer research. With growing customer intent to shop discount retailers digitally, this move complements the company’s omni-channel efforts, supporting the near-term driver of robust same-store sales and helping counter immediate threats from online competitors.

But, in contrast to digital optimism, investors should also keep a close watch on the risk that core U.S. markets may face over-saturation if expansion plans outpace demand and ...

Read the full narrative on Dollar General (it's free!)

Dollar General's outlook forecasts $46.9 billion in revenue and $1.7 billion in earnings by 2028. This scenario assumes annual revenue growth of 4.1% and a $0.5 billion increase in earnings from the current $1.2 billion level.

Uncover how Dollar General's forecasts yield a $120.11 fair value, a 14% upside to its current price.

Exploring Other Perspectives

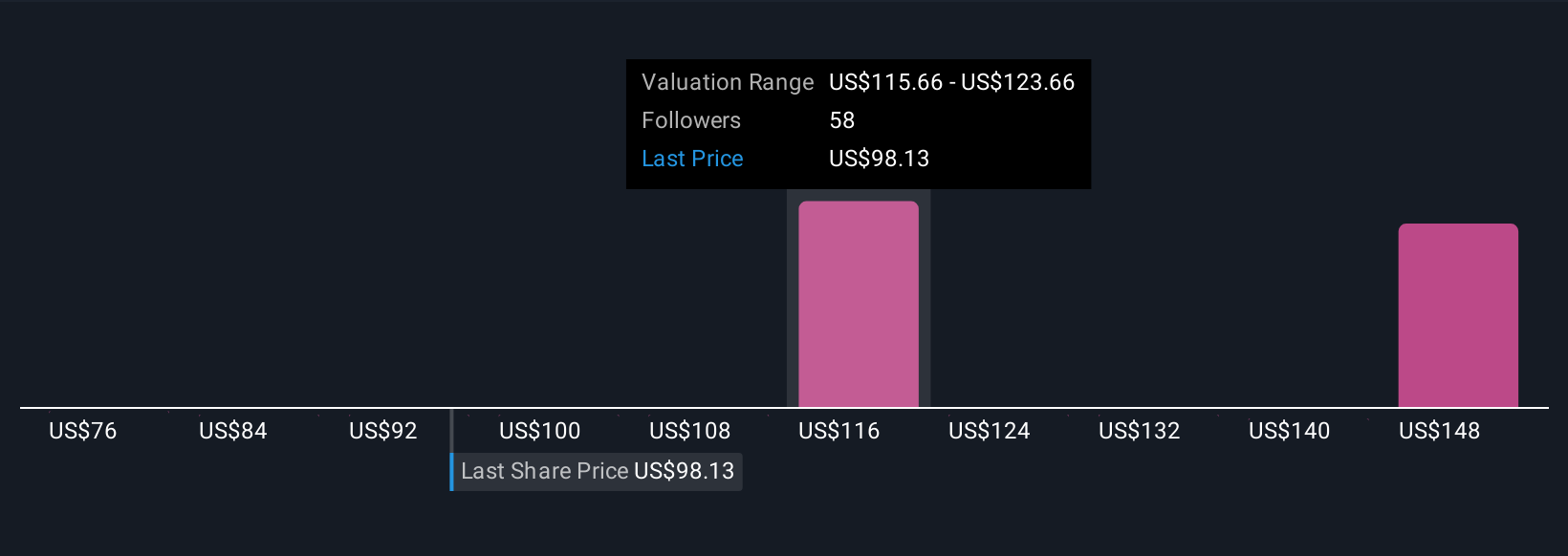

Ten Simply Wall St Community members provided fair value estimates for Dollar General between US$75.64 and US$157.44 per share. Despite wide-ranging views, many are closely monitoring the company’s push for digital and delivery innovation as competition intensifies. Explore how your viewpoint compares.

Explore 10 other fair value estimates on Dollar General - why the stock might be worth 28% less than the current price!

Build Your Own Dollar General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollar General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar General's overall financial health at a glance.

No Opportunity In Dollar General?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives