- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

How Will Dollar General’s (DG) New AI Leader Shape Its Efficiency Drive and Customer Focus?

Reviewed by Sasha Jovanovic

- In recent days, Dollar General announced it has hired Travis Nixon as Senior Vice President of AI Optimisation to accelerate operational efficiency through artificial intelligence.

- This key leadership addition signals Dollar General’s intent to use AI-driven innovation to further improve cost efficiency and enhance customer-centric operations across its retail footprint.

- We'll explore how the company's commitment to AI optimisation could shape its future prospects and investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Dollar General Investment Narrative Recap

To be a Dollar General shareholder today, you need to believe in the company's ability to grow profitably in rural America by driving operational efficiencies and staying competitive despite slow market growth. The recent recruitment of a Senior Vice President of AI Optimisation marks an effort to unlock new cost savings, though it does not immediately change the biggest current catalyst: the company's aggressive store expansion, nor the most pressing risk of over-saturation in core markets.

The recently announced partnership with Uber Eats to expand delivery options is closely connected to Dollar General’s push toward omni-channel revenue streams. As the company works to strengthen its digital and convenience offerings, this initiative runs parallel to broader efforts, like AI optimisation, that could enhance its edge amid rising competition and evolving shopper habits.

On the flip side, if customer migration out of rural areas accelerates faster than expected, investors should be aware of ...

Read the full narrative on Dollar General (it's free!)

Dollar General's outlook anticipates $46.9 billion in revenue and $1.7 billion in earnings by 2028. This scenario is based on a 4.1% annual revenue growth rate and a $0.5 billion earnings increase from the current $1.2 billion level.

Uncover how Dollar General's forecasts yield a $120.11 fair value, a 15% upside to its current price.

Exploring Other Perspectives

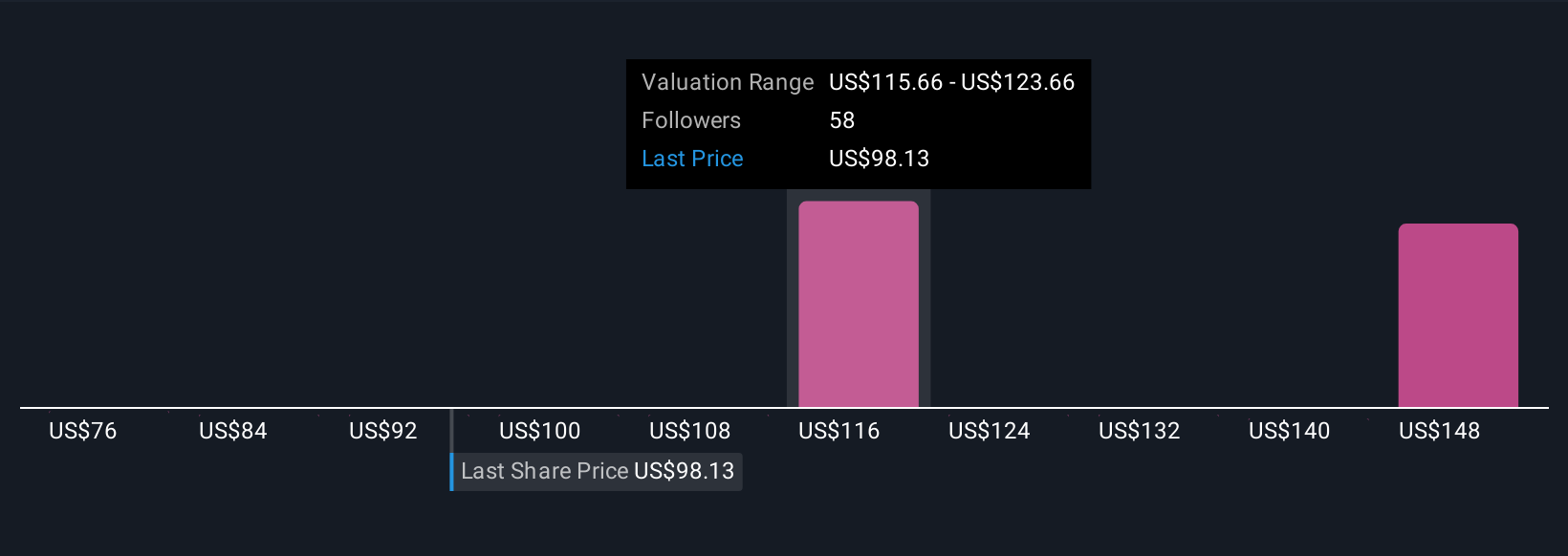

Private investors from the Simply Wall St Community have set Dollar General’s fair value anywhere between US$76.27 and US$158.46 across 7 perspectives. With such divergent opinions and persistent concerns about rural demographics, you may want to explore several viewpoints for a fuller picture of possible outcomes.

Explore 7 other fair value estimates on Dollar General - why the stock might be worth as much as 52% more than the current price!

Build Your Own Dollar General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollar General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar General's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives