- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

BJ’s Wholesale Club (BJ): Valuation Insights Following New Analyst Coverage and Strong Quarterly Results

Reviewed by Kshitija Bhandaru

BTIG just initiated coverage on BJ's Wholesale Club Holdings (BJ), highlighting the company's defensive business model and growth outlook. Their recent quarterly results topped expectations, which has helped fuel some renewed optimism among investors.

See our latest analysis for BJ's Wholesale Club Holdings.

Following BTIG’s upbeat coverage and another strong quarter, BJ’s Wholesale Club Holdings has seen a healthy build in momentum. The stock’s recent 7-day share price return of 4.56% hints at renewed confidence among investors, while its latest $94.19 share price is backed by a 12-month total shareholder return of 7.27%. Looking longer-term, holders have enjoyed a remarkable 141% gain over five years, signaling steady compounding for those who stuck with the club through market cycles.

If BJ’s latest surge has you wondering what else might be gaining traction, it could be the perfect opportunity to discover fast growing stocks with high insider ownership

With analyst opinions divided and the stock trading below the latest price targets, should investors see this as a hidden value play, or is the market already accounting for every bit of future growth?

Most Popular Narrative: 18.5% Undervalued

With BJ's Wholesale Club Holdings shares closing at $94.19 and the most-followed narrative suggesting a fair value of $115.63, there's a notable gap in expectations. This setup highlights the belief that market participants may be overlooking some crucial growth catalysts for the business.

Accelerated membership and footprint expansion in new markets strengthens recurring income and supports long-term revenue and margin growth. Growing digital adoption and enhanced merchandising increase customer loyalty, shopping frequency, and operational efficiency amidst value-focused consumer trends.

Ever wonder what it takes to justify such a premium price target on a retailer? The secret lies in bold forecasts for membership growth, digital transformation, and future profit multiples that outpace the entire industry. Ready to see what kind of projections could power that valuation? The details just might surprise you.

Result: Fair Value of $115.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and a slowdown in general merchandise sales could present challenges to the bullish outlook for BJ's Wholesale Club Holdings.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

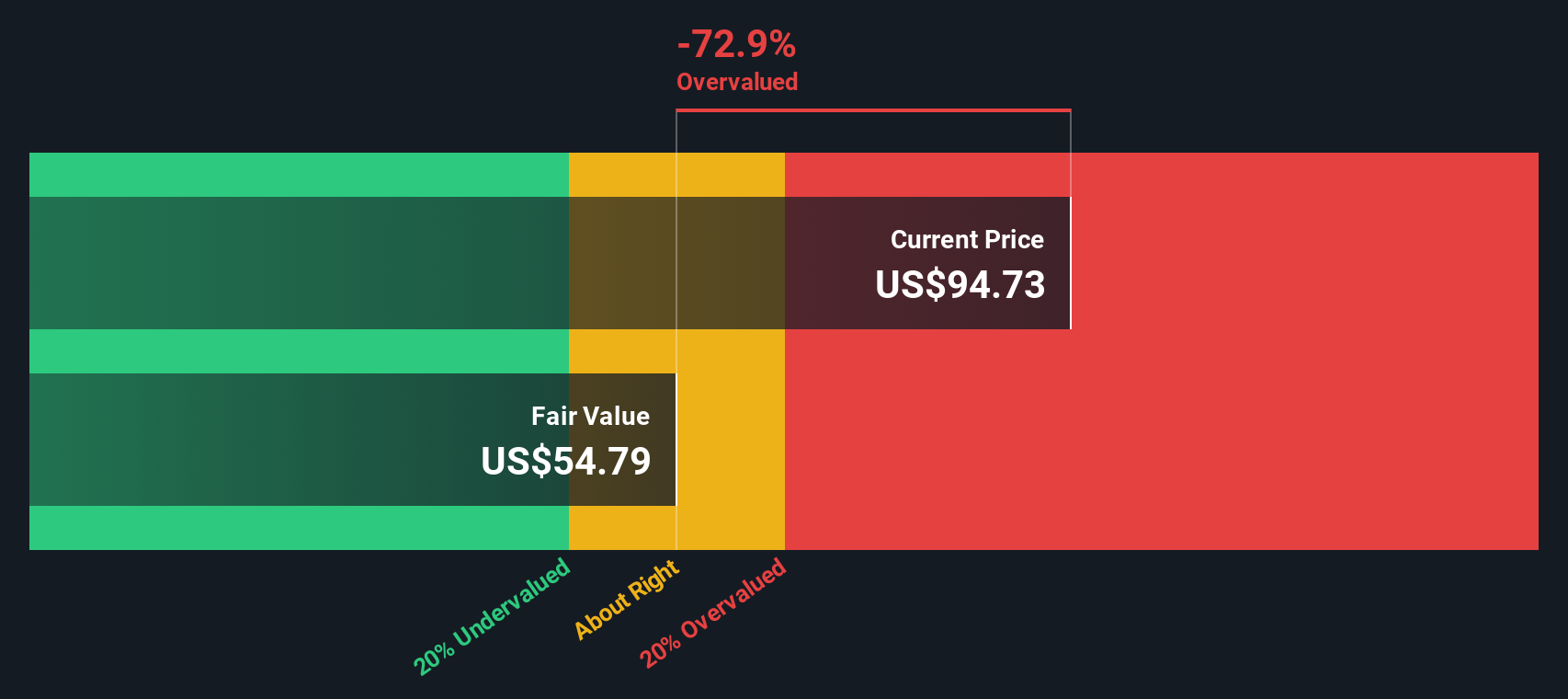

Another View: Discounted Cash Flow Model Sends a Different Signal

While analyst price targets suggest BJ's is undervalued, our SWS DCF model tells a contrasting story. According to the model, BJ's recent share price actually trades above its underlying fair value estimate. This perspective raises the stakes: are analysts pricing in too much optimism for near-term growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BJ's Wholesale Club Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own version on BJ's in just a few minutes, your way with Do it your way.

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. The next market winner could be just a click away. Fuel your portfolio with high-potential ideas now.

- Uncover market underdogs poised for a turnaround when you check out these 868 undervalued stocks based on cash flows and see which companies may be trading below their intrinsic worth.

- Tap into the AI revolution with these 24 AI penny stocks, connecting you to businesses shaping tomorrow through cutting-edge machine learning, automation, and smart technologies.

- Lock in reliable income and growth as you pursue these 20 dividend stocks with yields > 3%, focusing on companies offering attractive yields and consistent dividend payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives