- United States

- /

- Food and Staples Retail

- /

- NYSE:ACI

Albertsons’ New AI Shopping Assistant Could Be A Game Changer For Albertsons Companies (ACI)

Reviewed by Sasha Jovanovic

- In early December 2025, Albertsons Companies launched its Albertsons AI shopping assistant across all banner websites, using OpenAI-powered, multi-agent technology to help customers plan meals, restock essentials, convert recipes and lists into carts, and complete end-to-end online grocery shopping in minutes.

- This move signals Albertsons’ push into agentic commerce, laying groundwork for future capabilities like budget optimization, in-store product guidance, and voice-driven shopping that could reshape how its customers interact with digital grocery services.

- Next, we’ll assess how this AI-powered, agentic shopping assistant could influence Albertsons’ investment narrative around digital engagement and margin efficiency.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Albertsons Companies Investment Narrative Recap

To own Albertsons, you need to believe its mix of traditional grocery, pharmacy, and digital initiatives can translate into steadier earnings despite thin margins and high debt. The AI shopping assistant launch could matter near term if it accelerates e-commerce engagement and improves unit economics, but its financial impact is uncertain and the biggest current risk around labor costs and union negotiations remains largely unchanged.

The new AI assistant sits squarely within Albertsons’ broader push to modernize through technology, including prior deployments like the Ask AI experience and in-store digital media. Together, these tools tie into a key catalyst: using automation, personalization, and retail media to lift digital conversion, support higher-margin own brands, and gradually ease pressure on gross margins and SG&A.

Yet, against these promising digital efforts, investors should also be aware of the mounting labor cost and union negotiation risk, where...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies’ narrative projects $86.1 billion revenue and $1.1 billion earnings by 2028. This requires 2.1% yearly revenue growth and an earnings increase of about $145.7 million from $954.3 million today.

Uncover how Albertsons Companies' forecasts yield a $23.62 fair value, a 34% upside to its current price.

Exploring Other Perspectives

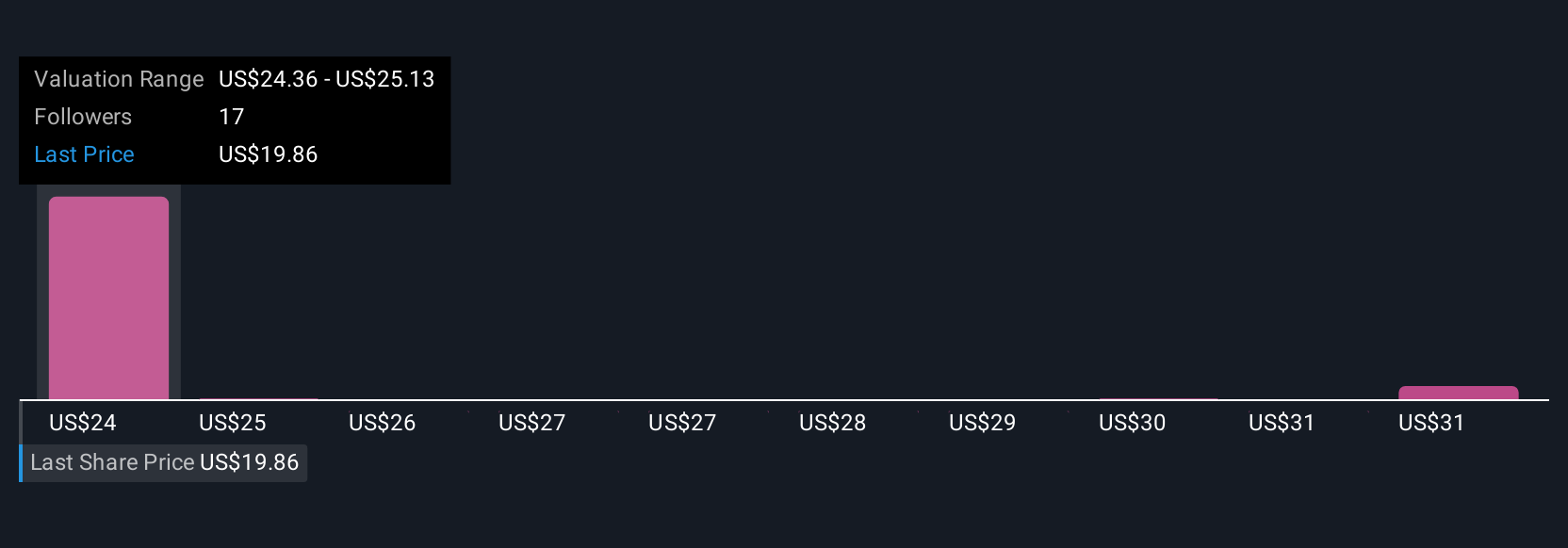

Six members of the Simply Wall St Community currently value Albertsons between US$19.34 and US$41.27 per share, reflecting wide disagreement on upside. You should weigh these views against the central catalyst that technology and AI investments could incrementally support digital growth and margin efficiency over time.

Explore 6 other fair value estimates on Albertsons Companies - why the stock might be worth just $19.34!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACI

Albertsons Companies

Through its subsidiaries, operates in the food and drug retail industry in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026