- United States

- /

- Food and Staples Retail

- /

- NasdaqGM:YI

US Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a hiccup in its rally, with technology shares leading the decline, investors are closely watching economic indicators for clues about future trends. Amidst this backdrop, penny stocks remain an intriguing option for those looking to explore smaller or newer companies that might offer unique opportunities. Despite their somewhat outdated name, penny stocks can still present significant growth potential when backed by strong financials and sound business models.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.802475 | $5.67M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $167.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.72 | $143.18M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.22 | $8.3M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.90 | $702.04M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $51.81M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.952 | $85.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $424.98M | ★★★★☆☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Telos (NasdaqGM:TLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telos Corporation, along with its subsidiaries, offers cyber, cloud, and enterprise security solutions globally and has a market cap of approximately $234.51 million.

Operations: The company's revenue is divided into two segments: Secure Networks, generating $47.47 million, and Security Solutions, contributing $75.49 million.

Market Cap: $234.51M

Telos Corporation, with a market cap of US$234.51 million, is navigating challenges typical of penny stocks, such as unprofitability and shareholder dilution. Despite being debt-free and having short-term assets exceeding liabilities, Telos reported significant impairment charges and widened net losses for Q3 2024. Revenue declined to US$23.78 million from US$36.19 million year-over-year, though the company forecasts modest revenue growth in the next quarter. Telos continues expanding its TSA PreCheck enrollment centers across the U.S., potentially enhancing future revenue streams while facing ongoing profitability struggles and competitive industry pressures in cybersecurity solutions.

- Navigate through the intricacies of Telos with our comprehensive balance sheet health report here.

- Explore Telos' analyst forecasts in our growth report.

111 (NasdaqGM:YI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 111, Inc., along with its subsidiaries, operates an integrated online and offline healthcare platform in the People's Republic of China, with a market cap of $52.69 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: $52.69M

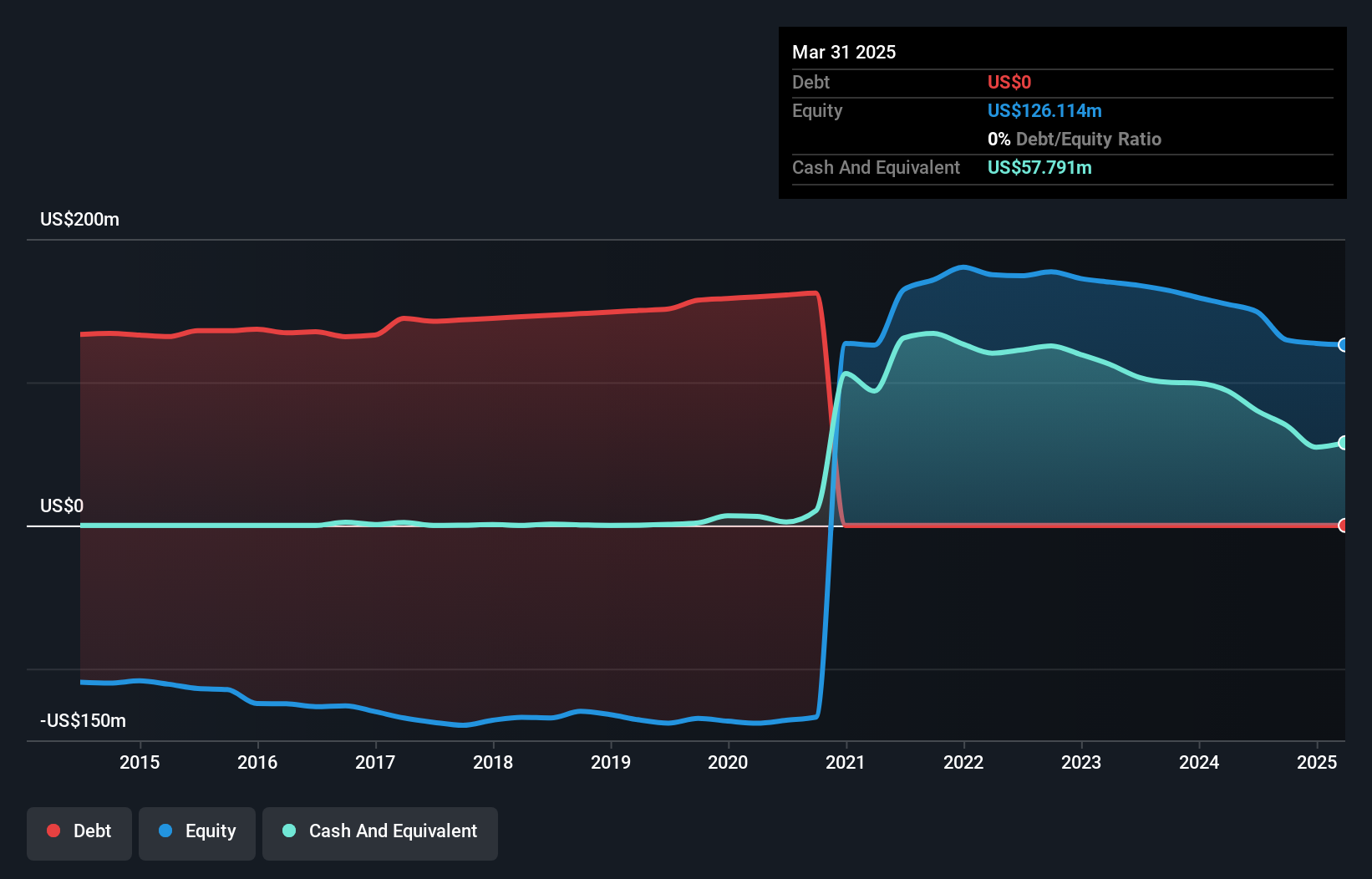

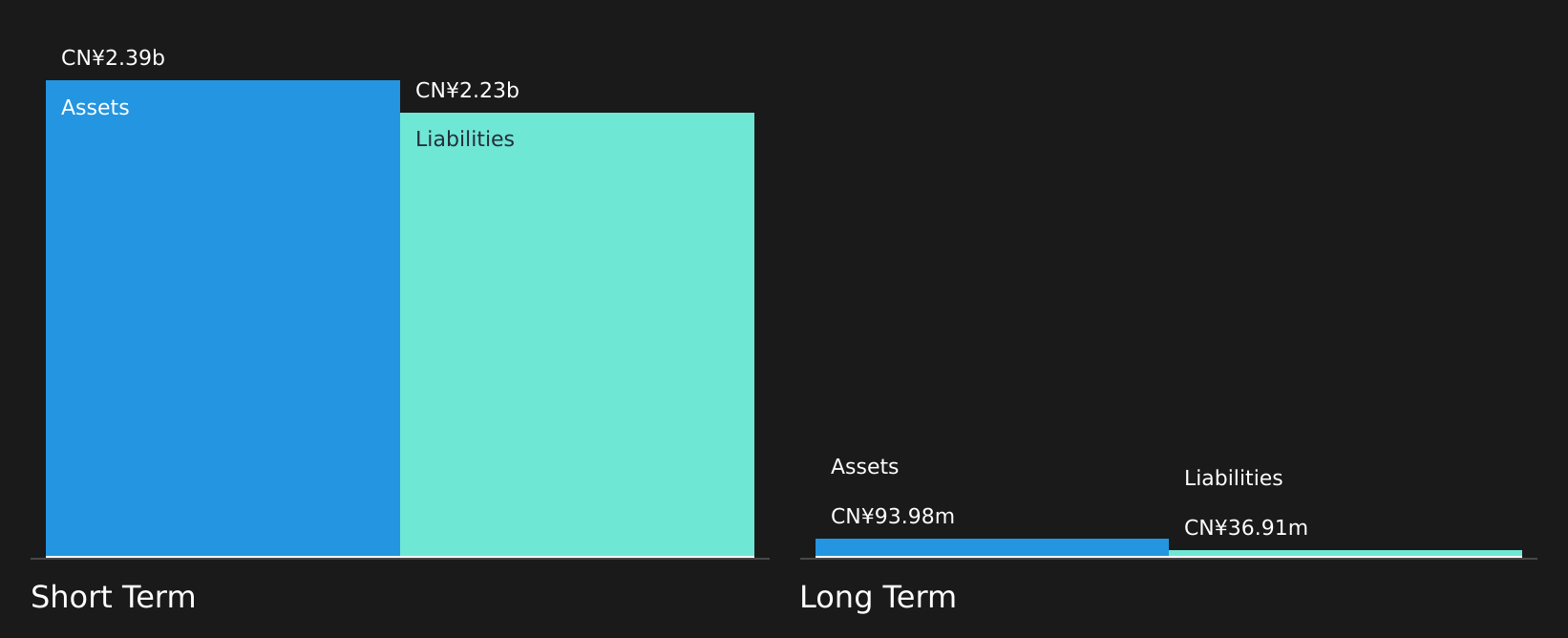

111, Inc., with a market cap of US$52.69 million, is addressing challenges common to penny stocks, such as Nasdaq delisting risks due to its low share price. Despite these hurdles, the company has made strides in reducing net losses and expanding its logistics network across China with new fulfillment centers. These expansions aim to enhance efficiency and speed in delivery operations while cutting costs significantly. The seasoned management team oversees a robust cash position that exceeds total debt, providing financial stability despite ongoing unprofitability and volatility in share price performance over recent months.

- Dive into the specifics of 111 here with our thorough balance sheet health report.

- Examine 111's earnings growth report to understand how analysts expect it to perform.

Expensify (NasdaqGS:EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Expensify, Inc. offers a cloud-based expense management software platform catering to individuals, corporations, small and midsized businesses, and enterprises globally, with a market cap of approximately $297.14 million.

Operations: The company's revenue is derived entirely from its Internet Software & Services segment, totaling $137.44 million.

Market Cap: $297.14M

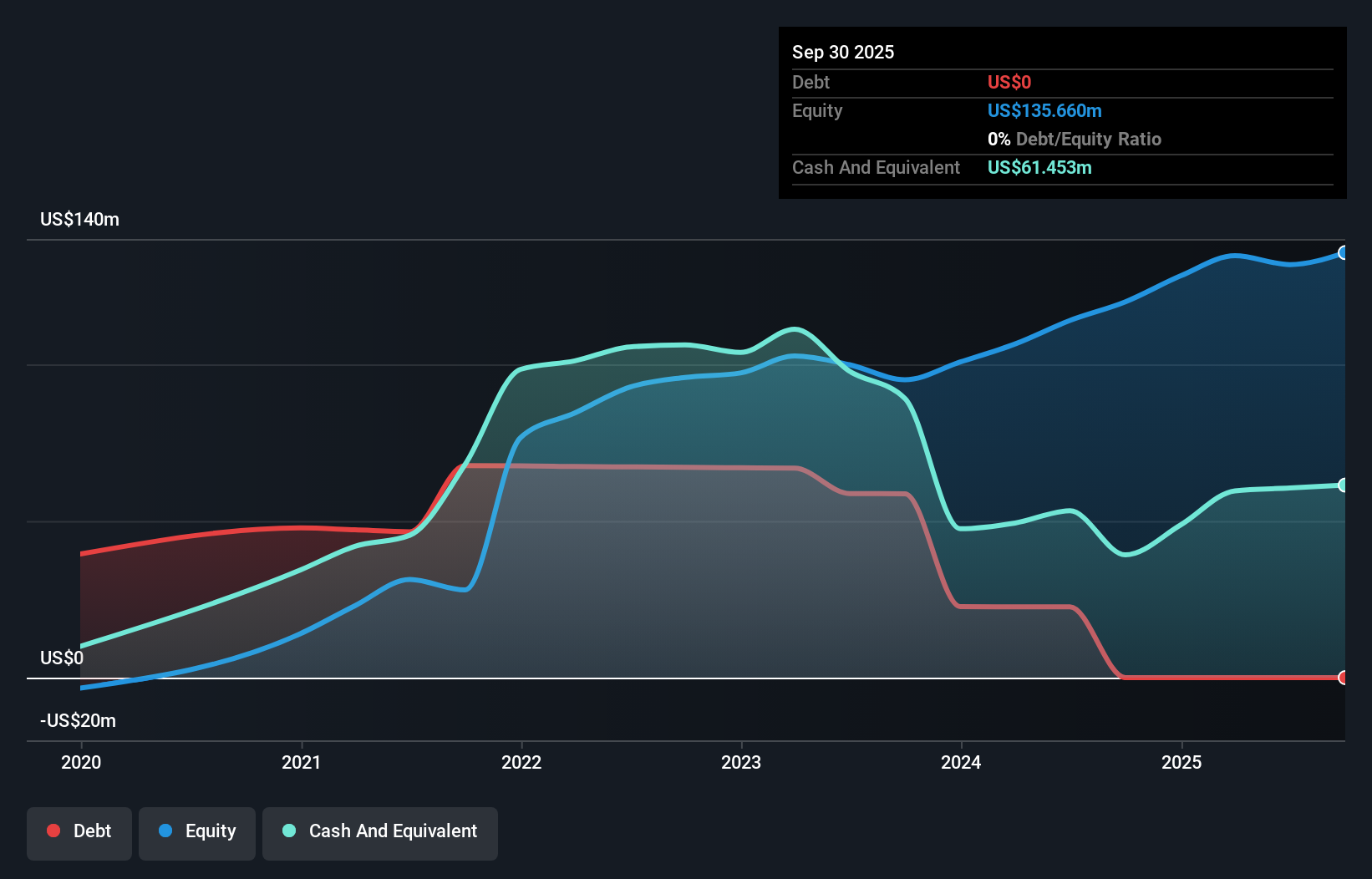

Expensify, Inc., with a market cap of US$297.14 million, faces typical penny stock challenges like high volatility and recent insider selling. Despite being unprofitable, the company has no debt and maintains a cash runway exceeding three years. Recent earnings show a narrowed net loss of US$2.2 million for Q3 2024 compared to US$17 million the previous year, indicating some operational improvement despite declining sales. However, shareholder dilution has occurred over the past year with shares outstanding growing by 6.2%. The experienced management team continues to navigate these financial complexities amidst fluctuating share prices.

- Click here and access our complete financial health analysis report to understand the dynamics of Expensify.

- Gain insights into Expensify's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Reveal the 713 hidden gems among our US Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:YI

111

Operates an integrated online and offline platform in the healthcare market in the People's Republic of China.

Undervalued with excellent balance sheet.