- United States

- /

- Food and Staples Retail

- /

- NasdaqGM:YI

111 (NASDAQ:YI) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that 111, Inc. (NASDAQ:YI) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for 111

What Is 111's Net Debt?

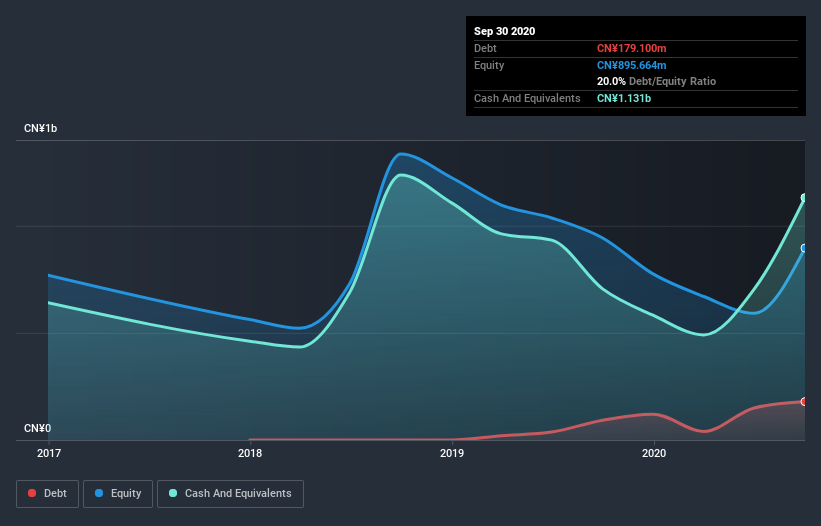

You can click the graphic below for the historical numbers, but it shows that as of September 2020 111 had CN¥148.0m of debt, an increase on CN¥92.6m, over one year. But it also has CN¥1.13b in cash to offset that, meaning it has CN¥982.9m net cash.

How Healthy Is 111's Balance Sheet?

According to the last reported balance sheet, 111 had liabilities of CN¥1.77b due within 12 months, and liabilities of CN¥56.2m due beyond 12 months. On the other hand, it had cash of CN¥1.13b and CN¥163.0m worth of receivables due within a year. So it has liabilities totalling CN¥531.5m more than its cash and near-term receivables, combined.

Given 111 has a market capitalization of CN¥3.73b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, 111 also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if 111 can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year 111 wasn't profitable at an EBIT level, but managed to grow its revenue by 118%, to CN¥6.9b. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is 111?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that 111 had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CN¥57m of cash and made a loss of CN¥484m. Given it only has net cash of CN¥982.9m, the company may need to raise more capital if it doesn't reach break-even soon. Importantly, 111's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - 111 has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading 111 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:YI

111

Operates an integrated online and offline platform in the healthcare market in the People's Republic of China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success