- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:WBA

Walgreens Boots Alliance Dividend is Solid, but it Might Not be Enough

- Trading at very low valuations, WBA presents a compelling candidate in the Pharma sector

- Long-term profitability remains trending down since growth is not scaling well

- Management might be overlooking the current issues

With persisting inflation, spiking interest rates, and overall gloom predictions regarding financial markets' short-term future, many companies are trading at steep discounts. Yet, not all of them present an equally good opportunity.

Trading at a favorable P/E ratio, with strong dividends and improving profit margins, Walgreens Boots Alliance, Inc. ( NASDAQ: WBA ) is an interesting prospect in the pharmaceutical sector.

View our latest analysis for Walgreens Boots Alliance

WBA Latest Earnings Results

Walgreens Boots Alliance announced earnings results on 13th October

- EPS: US$5.02 (up from US$2.31 in FY 2021).

- Revenue: US$132.7b (flat on FY 2021).

- Net income: US$4.34b (up 118% from FY 2021).

- Profit margin: 3.3% (up from 1.5% in FY 2021).

EPS missed analyst estimates by 15%, although the profit margin increased. The earnings per share have increased by 35% per year over the last 3 years, but the stock price has fallen by 16% - thus, it is significantly lagging behind the earnings.

WBA Fiscal 2023 Outlook

- Adjusted EPS: US$4.46-4.65 vs. US$4.49 consensus

- U.S. Healthcare fiscal year 2025 sales target: US$11b-12b (from US$9b-10b)

Positive adjusted EBITDA is expected to be achieved in 2024 (Currently, it was negative due to non-cash impairment charges related to intangible assets in Boots UK and higher costs of the Transformational Cost Management Program).

What Catches an Eye About WBA?

- Valuation

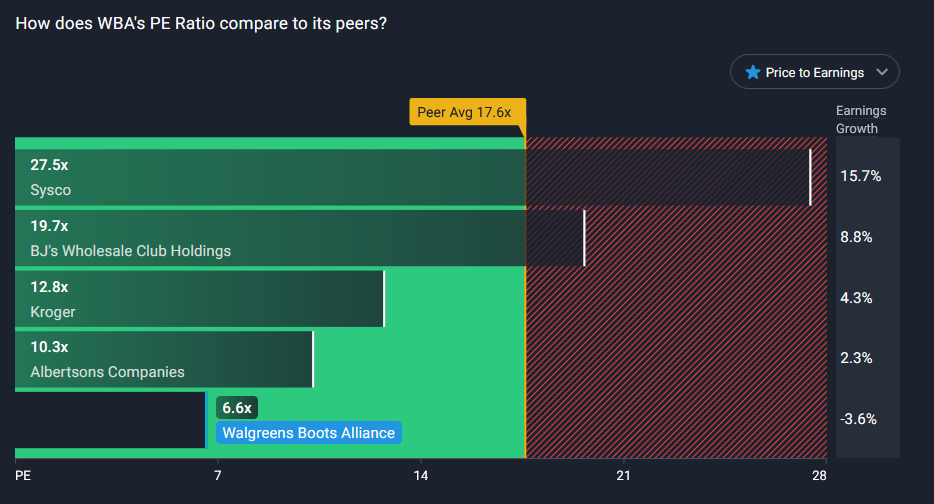

Trading at 6.6x the earnings, WBA stock is well below the sector's average . In fact, it is likely the lowest in the industry – even if accounting for the forward-looking P/E, which sits at 9.3%

Trading at 6.6x the earnings, WBA stock is well below the sector's average . It is likely the lowest in the industry – even if accounting for the forward-looking P/E, which sits at 9.3%. According to our consensus price target , an average 1y price sits at US$40.17, representing a 20.8% upside.

- Dividend

WBA is on the pace to become a " dividend king " as it has increased its dividends for 46 years. With that kind of track record and a yield of 5.8%, it is natural that the company attracts interest from yield-seekers, especially as it pays way above the average for this industry.

As a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Looking Beyond the Surface – Not An Opportunity for Risk Averse

Despite being undervalued on the surface, looking at the longer-term chart showing the price to free cash flow indicates a persistent downtrend.

To an extent, this is a result of the restructuring that has been going on for years following the Boots Alliance merger in 2015 and various asset sales and acquisitions. While this brought an explosive growth of revenue which almost doubled in the last 10 years, the cost of revenues followed, nullifying them – showing that the company is yet failing to achieve sustainable growth .

Finally, the management seems to be looking forward too much, dismissing the known short-term facts in favor of the favorable projections for fiscal years 2023 and 2024. That behavior is questionable given the ongoing macroeconomic environment and market turbulences that might lie ahead. For instance, we've identified 1 warning sign for Walgreens Boots Alliance that you should be aware of.

Of course, you might also be able to find a better stock than Walgreens Boots Alliance. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Walgreens Boots Alliance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:WBA

Walgreens Boots Alliance

Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion