- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:WBA

Investors Still Waiting For A Pull Back In Walgreens Boots Alliance, Inc. (NASDAQ:WBA)

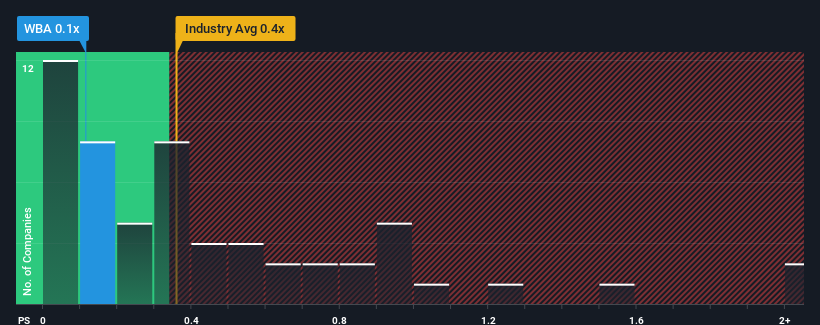

There wouldn't be many who think Walgreens Boots Alliance, Inc.'s (NASDAQ:WBA) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Consumer Retailing industry in the United States is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Walgreens Boots Alliance

What Does Walgreens Boots Alliance's Recent Performance Look Like?

Recent times have been advantageous for Walgreens Boots Alliance as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Walgreens Boots Alliance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Walgreens Boots Alliance's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 8.5%. The solid recent performance means it was also able to grow revenue by 16% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.6% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 4.7% per year growth forecast for the broader industry.

With this information, we can see why Walgreens Boots Alliance is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Walgreens Boots Alliance's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Walgreens Boots Alliance maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Walgreens Boots Alliance, and understanding them should be part of your investment process.

If you're unsure about the strength of Walgreens Boots Alliance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Walgreens Boots Alliance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WBA

Walgreens Boots Alliance

Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives