- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Farmers Market (SFM): Assessing Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Sprouts Farmers Market.

Sprouts Farmers Market has seen notable volatility, with its share price dropping 9.6% over the past month and a steep 34.3% decline in the last quarter. Despite these recent losses, the longer-term performance paints a different picture. Total shareholder returns still show substantial gains over the past three and five years, which suggests that earlier momentum is now cooling. This prompts fresh questions about the company’s valuation relative to its peers.

If questions about Sprouts’ next chapter have you weighing options, it could be the ideal moment to see what else the market offers and discover fast growing stocks with high insider ownership

The real question now is whether Sprouts Farmers Market’s recent pullback signals an undervalued opportunity, or if the current share price already reflects realistic expectations for future growth. Could this be a genuine entry point for investors?

Most Popular Narrative: 39.5% Undervalued

Sprouts Farmers Market’s most widely followed narrative points to significant upside, as its fair value estimate sits well above the current share price of $108.10. The company is pursuing robust growth strategies and expansion plans, raising eyebrows among investors tracking these projections.

Expansion into underpenetrated regions, particularly the Midwest, Mid-Atlantic, and Northeast, combined with the pipeline of 130+ new locations and robust new store performance, is expected to meaningfully increase Sprouts' addressable market and overall revenue base over the next several years.

Is store expansion the only factor behind this bullish outlook? The reality is more complex. The current narrative is driven by a multi-faceted growth forecast rooted in key profit improvements and an expectation of a higher future earnings multiple. For a detailed look at the specifics fueling this valuation, the key numbers and the factors behind them are available with just one click.

Result: Fair Value of $178.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and rising labor costs could challenge Sprouts Farmers Market’s growth. These factors could potentially limit margin expansion and dampen its bullish outlook.

Find out about the key risks to this Sprouts Farmers Market narrative.

Another View: Valuation by Market Multiples

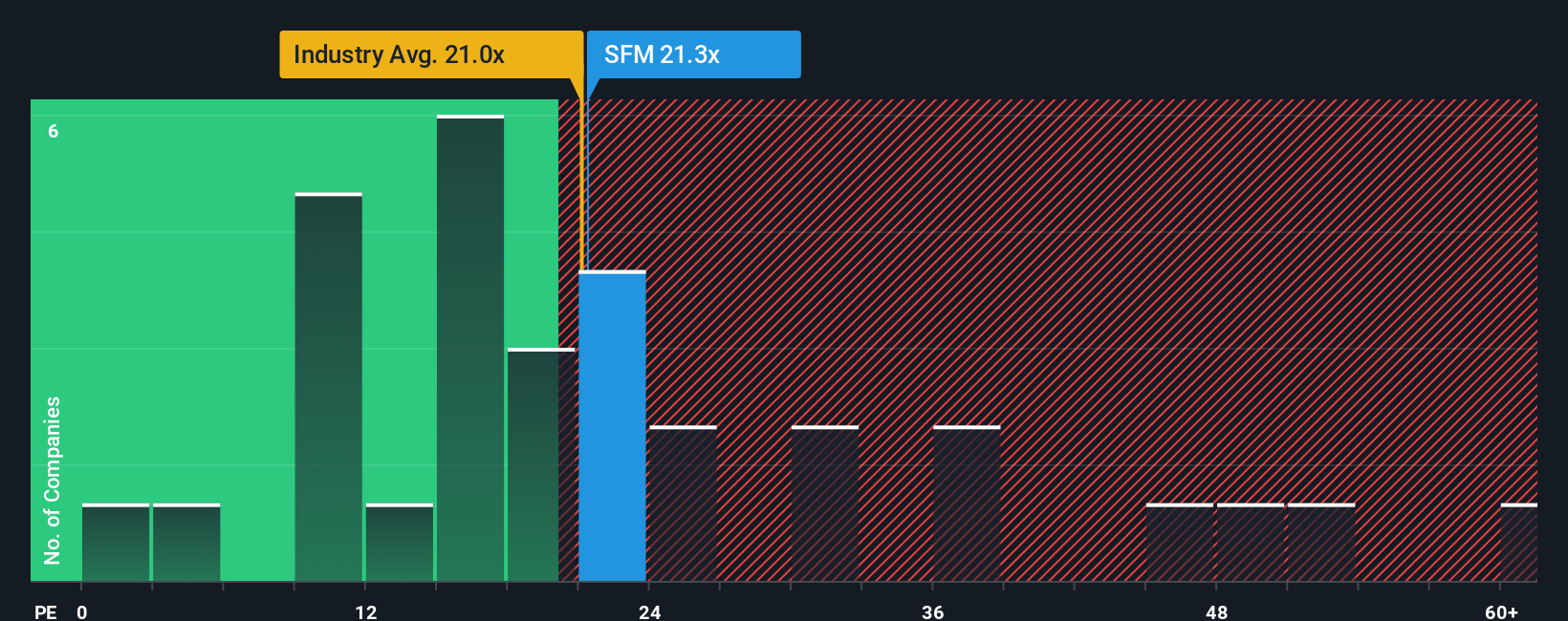

While the narrative builds a case for upside, looking at Sprouts Farmers Market through its price-to-earnings ratio presents a more cautious perspective. At 22.2x earnings, the company trades above both peers (21x) and the fair ratio of 20.9x, which may indicate a potential valuation premium. Does this mean today's price represents more risk than opportunity, even if analysts see strong growth ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sprouts Farmers Market Narrative

If you feel the story is incomplete or want to examine the numbers for yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Sprouts Farmers Market research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your next big opportunity. Use the Simply Wall Street Screener to uncover investments with advantages others might overlook and get ahead of market trends.

- Seize the chance for steady income by finding these 17 dividend stocks with yields > 3% that offer attractive yields above 3% and set the stage for reliable cash flow.

- Uncover potential in digital transformation by starting with these 25 AI penny stocks, focusing on groundbreaking innovations in artificial intelligence and automation.

- Spot tomorrow’s leaders with these 3574 penny stocks with strong financials that combine strong financials and impressive growth stories waiting for wider recognition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives