- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Assessing Sprouts Stock After Share Price Surge and Recent Strong Cash Flow Projections

Reviewed by Bailey Pemberton

So, you are wondering what to do with Sprouts Farmers Market stock. You are definitely not alone, especially considering how much action there has been in the share price lately. On one hand, the stock bounced 7.2% just over the past week, a move that’s caught the attention of everyone who felt uneasy after last month’s 11.1% slide. Year to date, Sprouts is still down 16.1%, and even the one-year return sits at a slight loss of 4.4%. But take a step back and the bigger story emerges: over the past three years, shares have soared a staggering 323.2%, and over five years, a massive 435.0% gain speaks volumes about the company’s long-term growth trajectory.

Some of these swings can be chalked up to ongoing market shifts in how investors perceive the future of grocery retail, especially in the natural and organic niche where Sprouts operates. Elevated volatility can sometimes hint at underlying opportunity, or, for more cautious investors, signal that risks are being repriced. That’s where looking at valuation comes into play. Are you getting value for the price you pay, or are you reaching for growth that’s already priced in?

By our numbers, Sprouts Farmers Market lands a value score of 3 out of 6, which tells us the company is undervalued on half of the valuation metrics we track. But what do those metrics actually reveal, and is there a better way to measure value? Let’s break down the major valuation approaches, with a twist at the end that might change the way you look at this stock altogether.

Why Sprouts Farmers Market is lagging behind its peers

Approach 1: Sprouts Farmers Market Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model takes the company’s likely future cash flows, projects them out over time, and discounts each year’s value back to today. This gives investors a sense of what the business is fundamentally worth, regardless of current market sentiment.

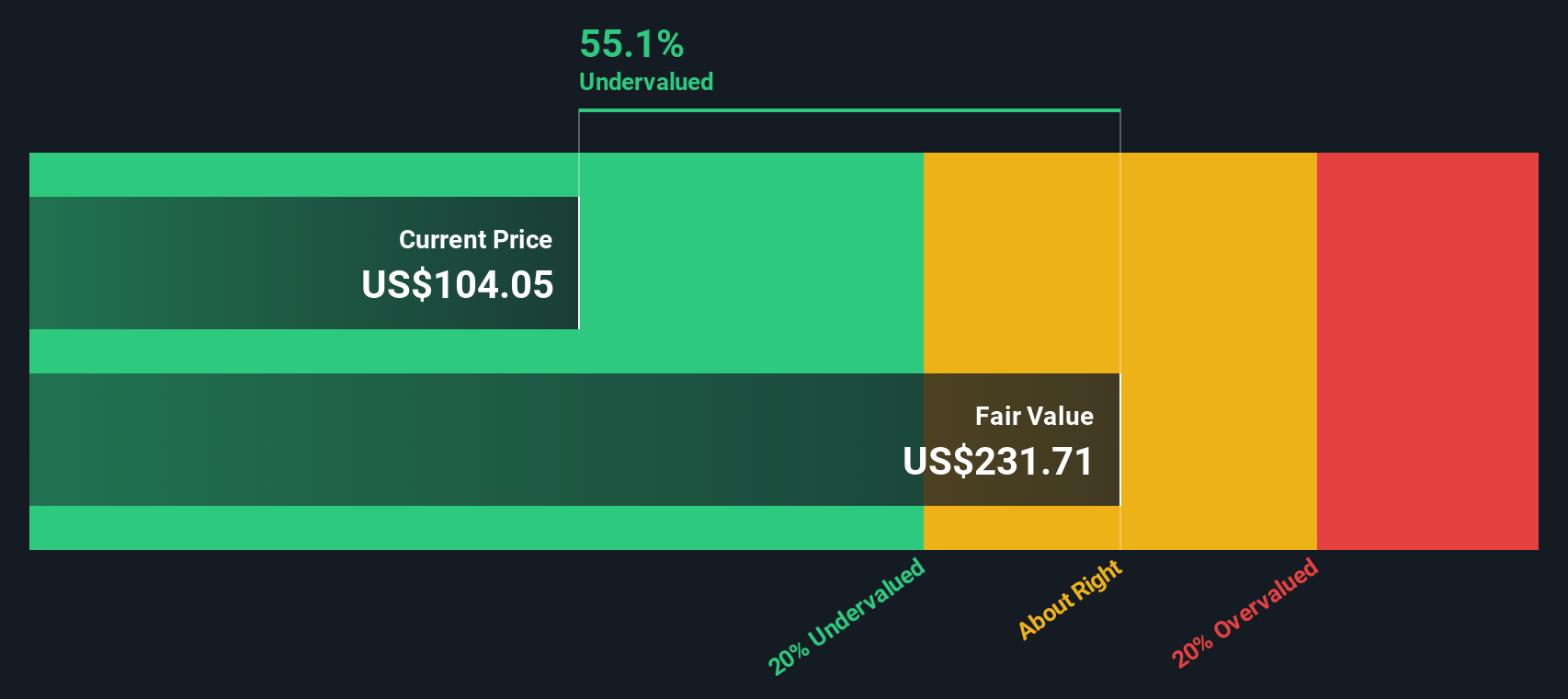

For Sprouts Farmers Market, the numbers show that its latest twelve-month Free Cash Flow stands at $499.6 million. Analysts estimate this will continue to rise, with projections reaching $596.9 million by 2026, $717.7 million by 2027, and $922.0 million by 2029. Beyond the five-year analyst horizon, further growth in Free Cash Flow is extrapolated, ultimately approaching estimates close to $1.2 billion by 2035, according to Simply Wall St.

When all future cash flows are discounted to the present, the intrinsic value of Sprouts Farmers Market stock comes out at $232.85 per share. This represents a 52.1% discount from the current trading price, indicating that the market may be underestimating the company’s future earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sprouts Farmers Market is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sprouts Farmers Market Price vs Earnings

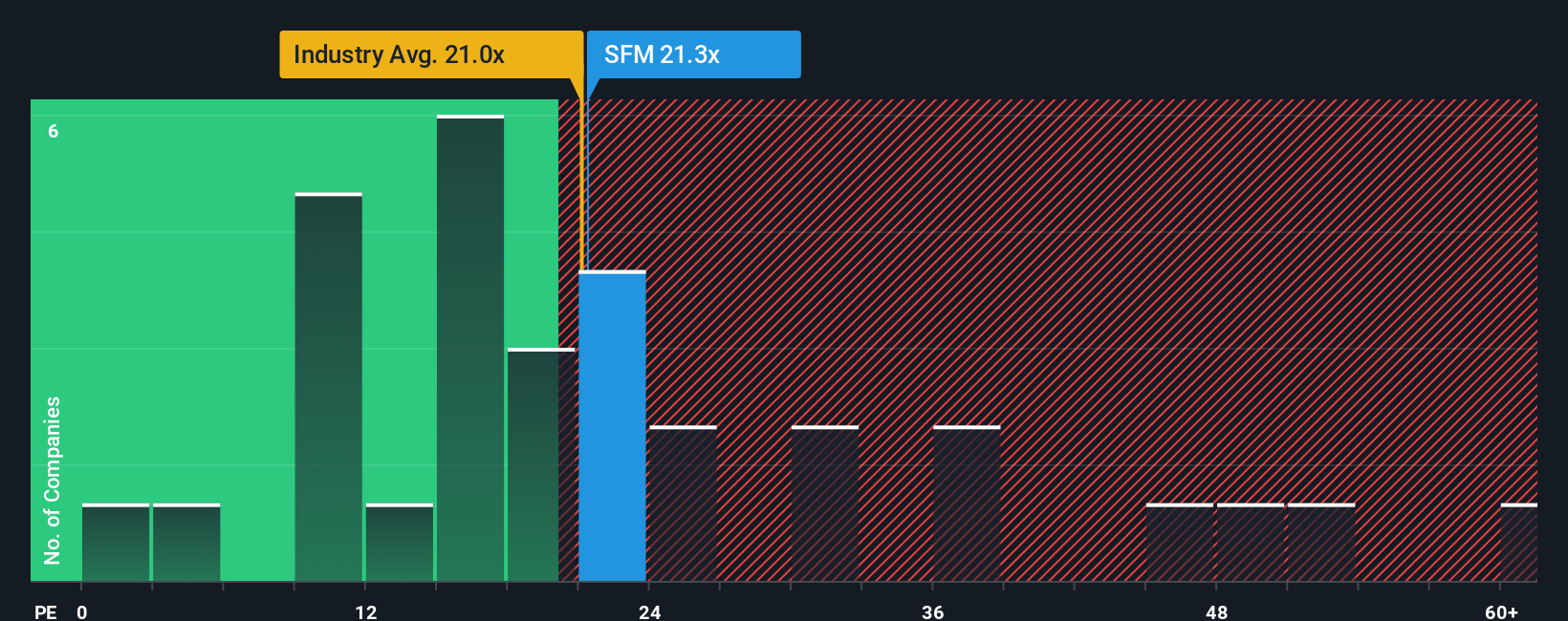

The Price-to-Earnings (PE) ratio is a common and effective valuation tool for profitable companies like Sprouts Farmers Market, because it shows how much investors are willing to pay for each dollar of earnings. The right PE for a stock depends on its expected earnings growth, perceived risks, and overall market conditions. Higher growth and lower risk usually command a higher PE, while companies facing challenges tend to trade with lower multiples.

Sprouts currently trades at a PE ratio of 22.5x. For context, this sits slightly above the average of peers at 21.3x and the broader Consumer Retailing industry average of 20.9x. However, comparing PE ratios alone can be misleading, since no two companies are exactly alike and simple averages overlook things like future growth, profit margins, and unique risks.

To address this, Simply Wall St’s proprietary “Fair Ratio” incorporates not just industry averages and peers, but also Sprouts’ specific earnings prospects, risk levels, margins, and market cap. For Sprouts, the Fair Ratio is calculated at 21.0x, which closely matches where the stock currently trades. This suggests the market has priced in Sprouts’ key strengths and risks appropriately, rather than overestimating or underestimating its true valuation based on earnings potential.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sprouts Farmers Market Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective behind the numbers, blending what you believe about a company’s future, such as its revenue, earnings, and margins, with your own fair value estimate.

Narratives go beyond just ratios, as they connect your view of Sprouts Farmers Market’s business potential and risks directly to a financial forecast and a calculated fair value.

Simply Wall St makes this approach easy and accessible, with millions of investors sharing their Narratives on the Community page. This helps you map out different scenarios, compare your assumptions, and see visually how your view could translate into a buy, hold, or sell decision.

With Narratives, you are empowered to judge whether Sprouts Farmers Market is trading above or below what you think it is truly worth. Because Narratives are updated automatically when new results, forecasts, or news are released, your insights stay relevant.

For Sprouts Farmers Market, one investor might have a bullish Narrative, forecasting strong future market share thanks to expansion and innovation and estimating a fair value as high as $209 per share. Another, more cautious investor could see intensifying competition and margin risks, resulting in a fair value closer to $155 per share.

Do you think there's more to the story for Sprouts Farmers Market? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives